Written by: George Walper, Jr.

More than a month after the initial market crash due to the Covid-19 pandemic, investors are contemplating whether advisors should have known about the potential financial implications of this pandemic and whether or not they should have acted differently. An overwhelming percentage of investors do not feel their advisor could have anticipated the impact of the surprise pandemic, however, one select group of investors feels differently…the wealthiest investors.

Spectrem’s recently fielded (this week!) report The Corona Crash: What Advisors Should be Saying to their Clients Now (Volume 2) indicates that most investors are happy with how their advisor has responded during the recent financial crisis. In fact, 39 percent of investors indicate that they are more impressed with their financial advisor because of his or her reactions to the crisis. More than half (54 percent) of investors believe that their primary advisor has been very proactive on how to handle investments during the Coronavirus crisis.

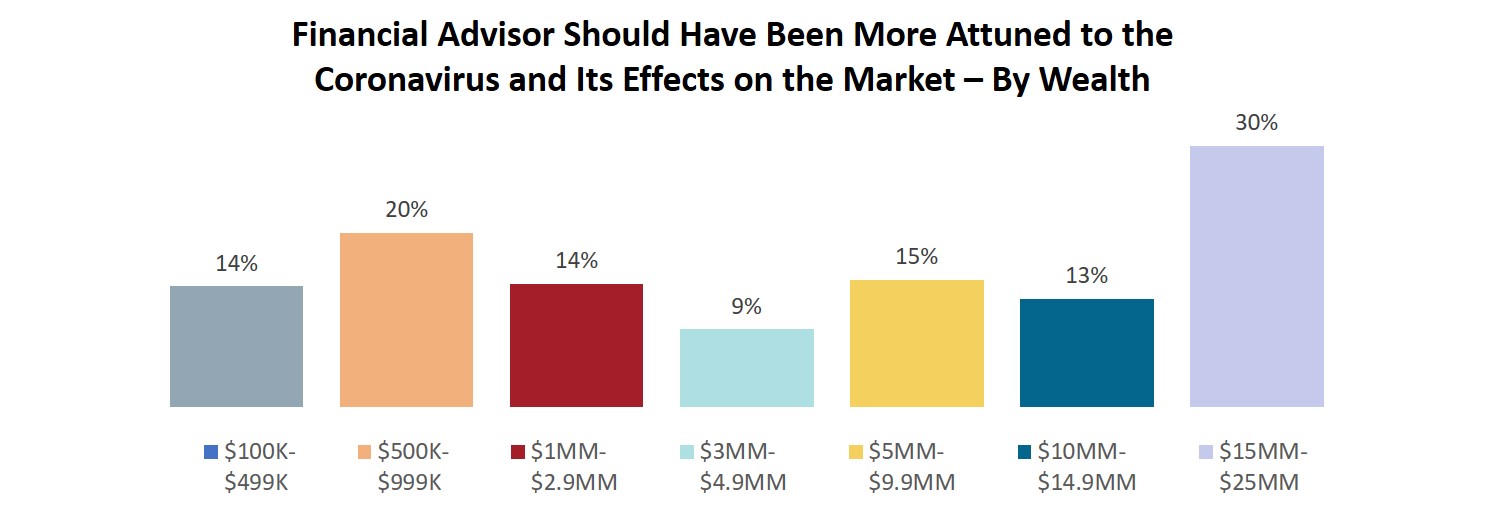

For the most part, investors understand that there was nothing advisors could have done to change what has happened to the markets and therefore the impact to their portfolios. In fact, only 15 percent of investors believe their advisor should have been more attuned to the Coronavirus and its effect on the market.

The wealthiest investors, however, feel somewhat differently. In fact, 30 percent of investors with $15 million to $25 million of net worth believe their advisor should have been more attuned to the impact of the Coronavirus on the financial markets.

These same investors have been the most active in the market in the last six weeks. Forty-eight percent of those with $15 million - $25 million net worth have sold equities in the last six weeks while 37 percent have purchased equities. This compares to 15 percent of total investors who have sold equities and 21 percent who have purchased equities.

Does this belief lead to a likelihood that the wealthier investors are more likely to replace their advisor in the future than others? Maybe. Twenty percent of investors with $15 million - $25 million of net worth indicated they “would be better served with another financial advisor” compared to other investors, in which only 10 percent agreed with that statement.

What is the message? While most of your clients are very satisfied, there are a few, sometimes the wealthiest clients, who may be looking elsewhere in the future.

Related: Investors are Seeking Advisors Now!