With many social and sporting events cancelled, wealthy investors are more likely now than ever to read articles online. Financial providers are also increasing their communication with clients through email and hard copy newsletters and articles. There are countless articles about the coronavirus and the economy, but is that what investors always want to read about?

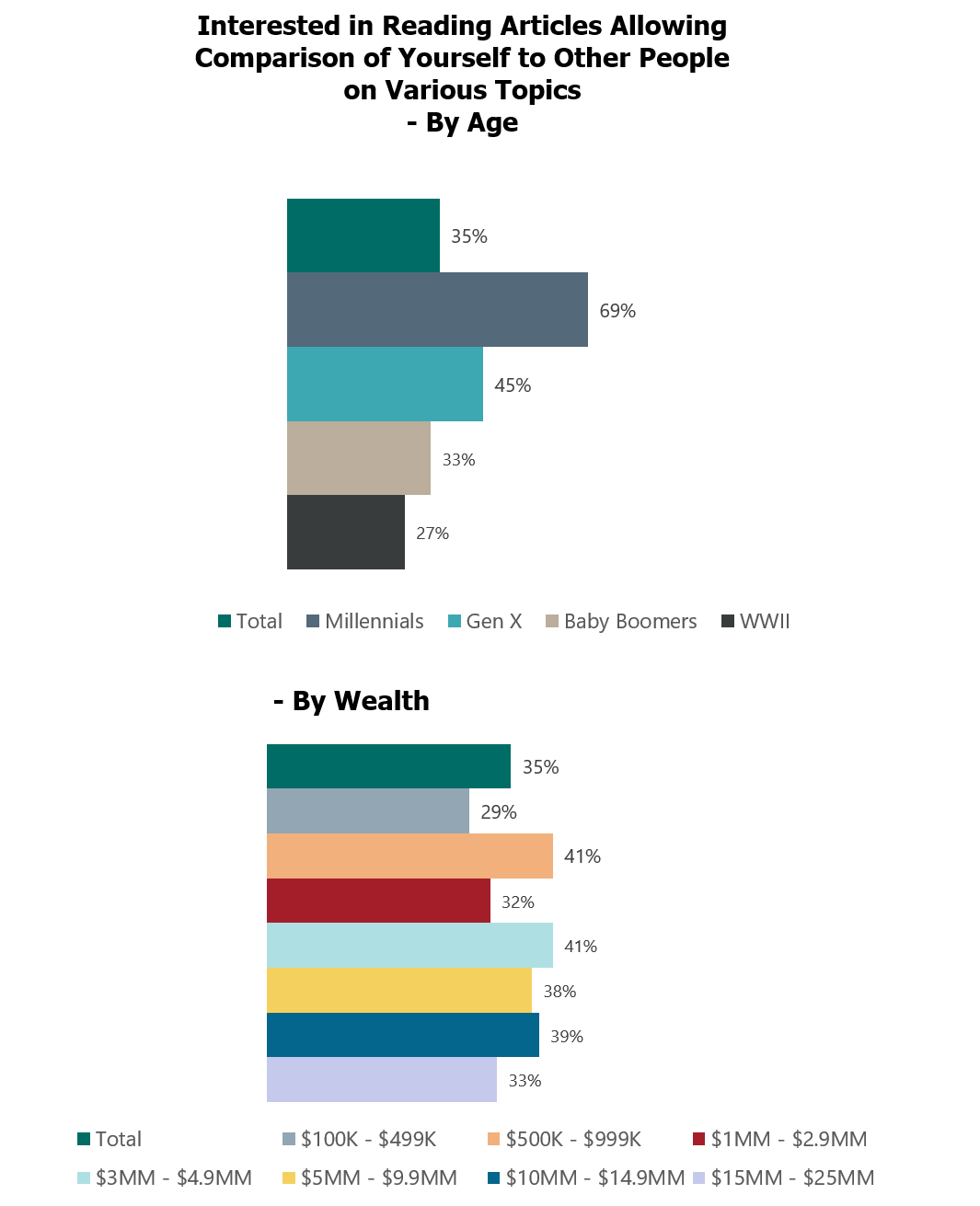

When investors are asked what types of articles they would like to read about, 35 percent of investors would like to read articles that allow them to compare themselves to other people on a variety of financial topics, according to Spectrem Group research. That number increases with higher levels of wealth. Age plays a significant role in how interested investors are in reading articles that allow comparison to other people. Sixty-nine percent of Millennials are interested in reading those types of articles, which is in stark comparison to only 27 percent of WWII investors that share that interest.

There is similar interest among investors regarding having their financial advisor provide them with articles about how other investors are approaching various financial topics. In fact, nearly half (48 percent) of investors with a net worth over $5 million are interested in having their financial advisors provide them with articles about how other investors are dealing with financial issues. Over two-thirds of Millennials would like their financial advisor to provide them with articles on how other investors approach financial issues.

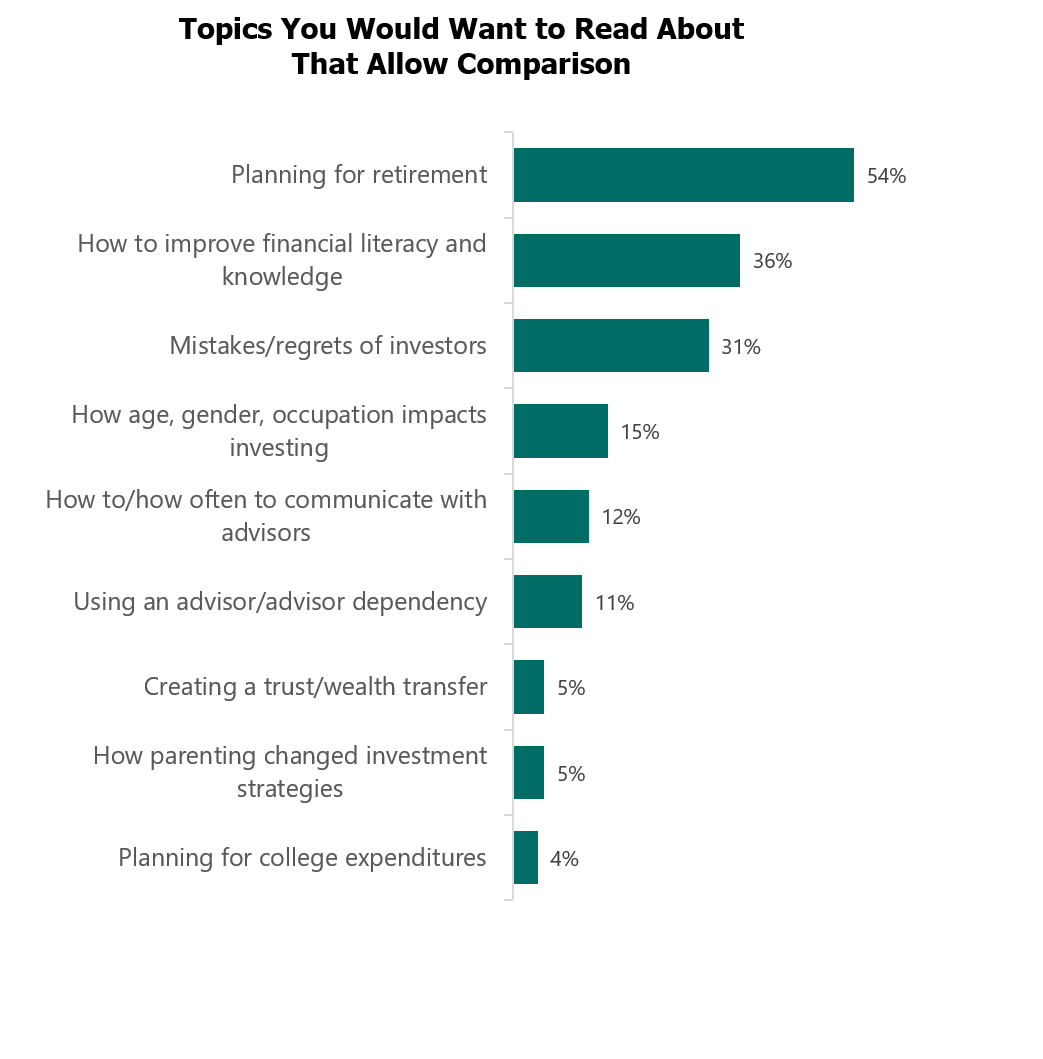

What specific types of topics would investors want to read about? Planning for retirement is the most common topic that investors seek information regarding. Investors at the highest wealth levels are also highly interested in articles regarding the creation of trusts or wealth transfer topics. Over a quarter of investors want to read about the mistakes and regrets of investors. Articles that improve financial literacy and knowledge is something that 41 percent of investors at the highest wealth levels would like to read about. Forty-two percent of WWII investors would also like articles about improving financial literacy and knowledge. Along with that educational topic, 28 percent of those ultra-wealthy investors would also like their financial provider to send them articles about how to educate children on financial issues.

Investors are far less likely to want articles about planning for college or how parenting impacted investment strategies. Articles about using an advisor or how often to communicate with an advisor are also topics that are not of great interest to investors. Not surprisingly, articles regarding planning for college costs or how parenting changes investment strategies is not of any interest to Baby Boomers or WWII investors.

Content providers would say that coming up with engaging topics that are of interest to a broad audience is challenging to say the least. Being able to compare oneself to other investors is intriguing to many individuals, if out of curiosity or out of a desire to see how they “measure up” compared to others. Have you ever wondered how your investment decisions compare to others?

Related: How Many Advisors Do You Need If You're Really Rich?