The stock market and economy has been a roller coaster ride throughout 2022. The stock market has had huge ups and downs, and investors are experiencing increased inflation, increased fuel costs, and a struggling economy. Logic would think that this would be enough to make investors pessimistic about their financial future, yet many investors are not.

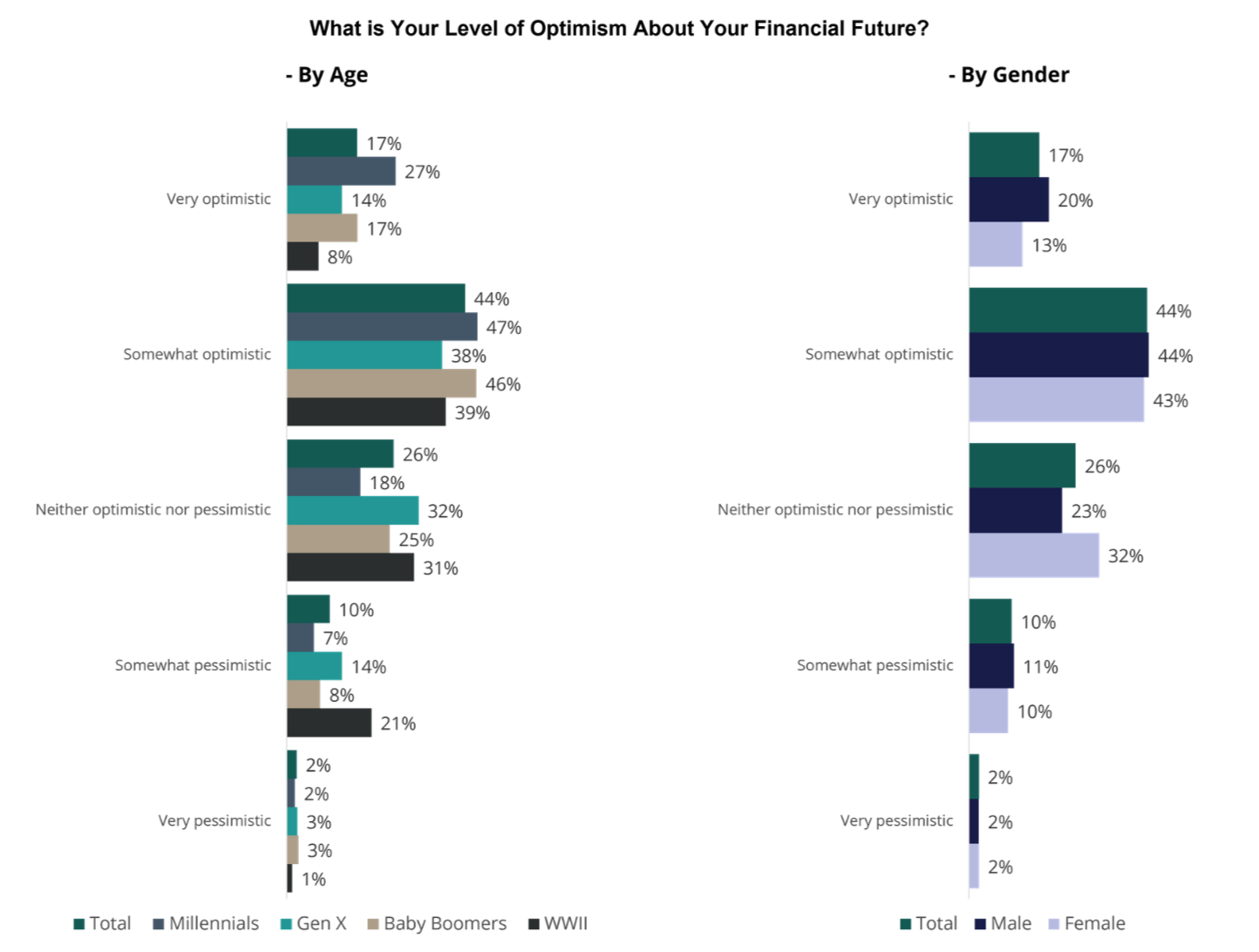

Over 60 percent of investors are at least somewhat optimistic about their financial future, while less than 15 percent are pessimistic about the future. Men are slightly more optimistic than women, 64 percent versus 56 percent respectively. Millennials are the most optimistic, with 73 percent of Millennials feeling at least somewhat optimistic. WWII investors and Gen X investors are the most pessimistic, with 17 percent of Gen X investors feeling pessimistic, and 22 percent of WWII investors feeling pessimistic. Investors at higher levels of wealth are more optimistic about the future as well.

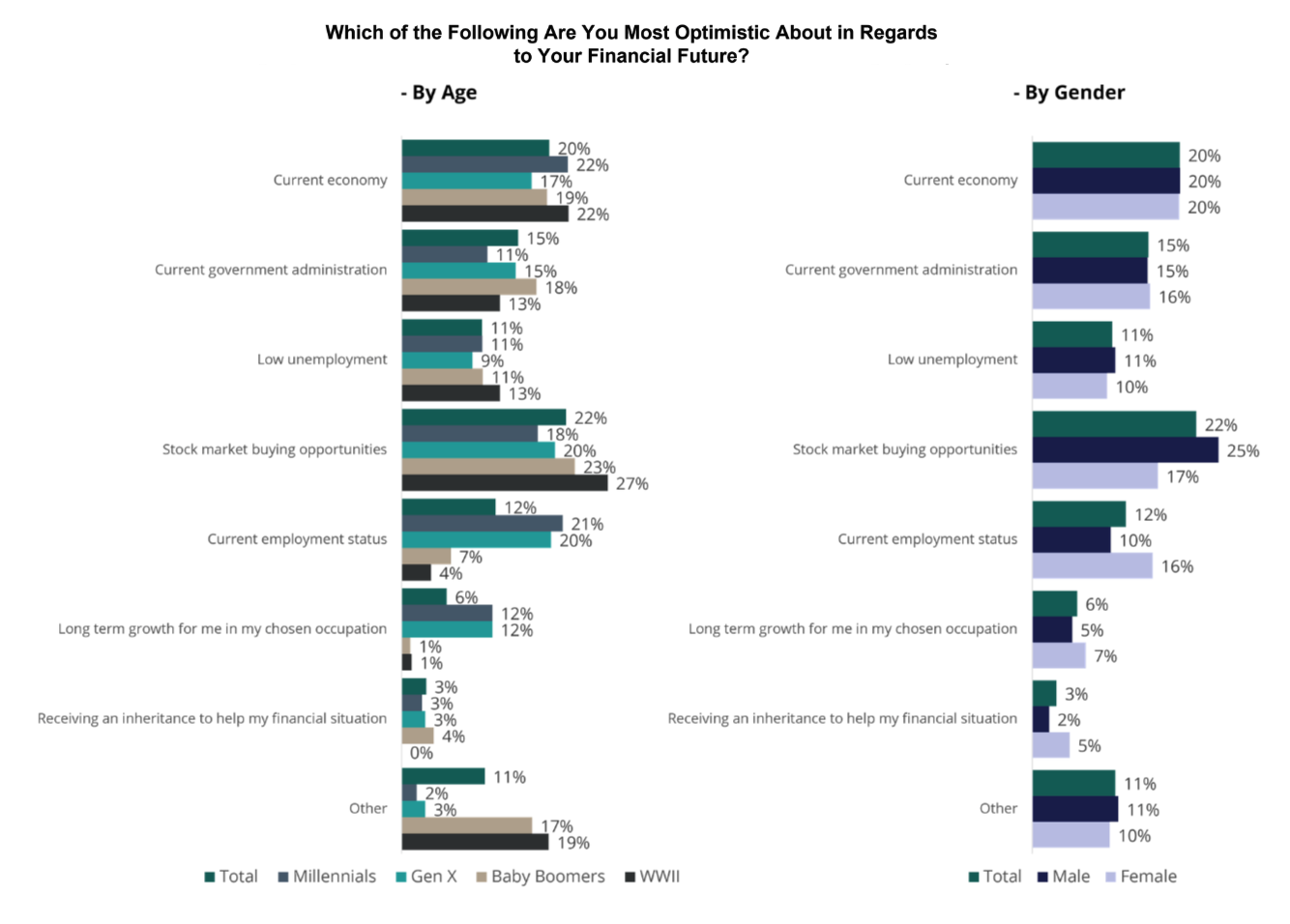

The reasons for the optimism vary, with 22 percent of investors being optimistic primarily due to the stock market buying opportunities. The stock market has had significant market swings, which presents some exceptional buying opportunities for investors who are willing to take that step. Twenty percent of investors are optimistic for their financial future because of the current economy, while 15 percent are optimistic primarily because of the current government administration. Older investors are more likely to be optimistic for the stock market buying opportunities, as are men. Investors at higher levels of wealth are more likely to be optimistic due to the investment buying opportunities, while those at lower levels of wealth are more likely to feel optimistic as a result of the current employment status or the current economy.

Investors who are not optimistic about their financial future should work with their financial advisors to gain a greater understanding of their own financial situation. Advisors can provide a great deal of information and context for investors so they are able to gain confidence in their financial future, or help investors make changes that would be necessary in order to be optimistic about their financial future.

Related: Why Investors Fire Advisors