The decision to hire a financial advisor is one that shouldn’t be entered into lightly. Many factors should be considered, and the most important traits are dependent upon each investor. Weighing various factors when considering hiring an advisor is critical to ensure that investors hire the right advisor. Many of the most important factors are the same regardless of investor segment, however there are some important distinctions among investors in what variables are the most important when choosing and retaining a financial advisor.

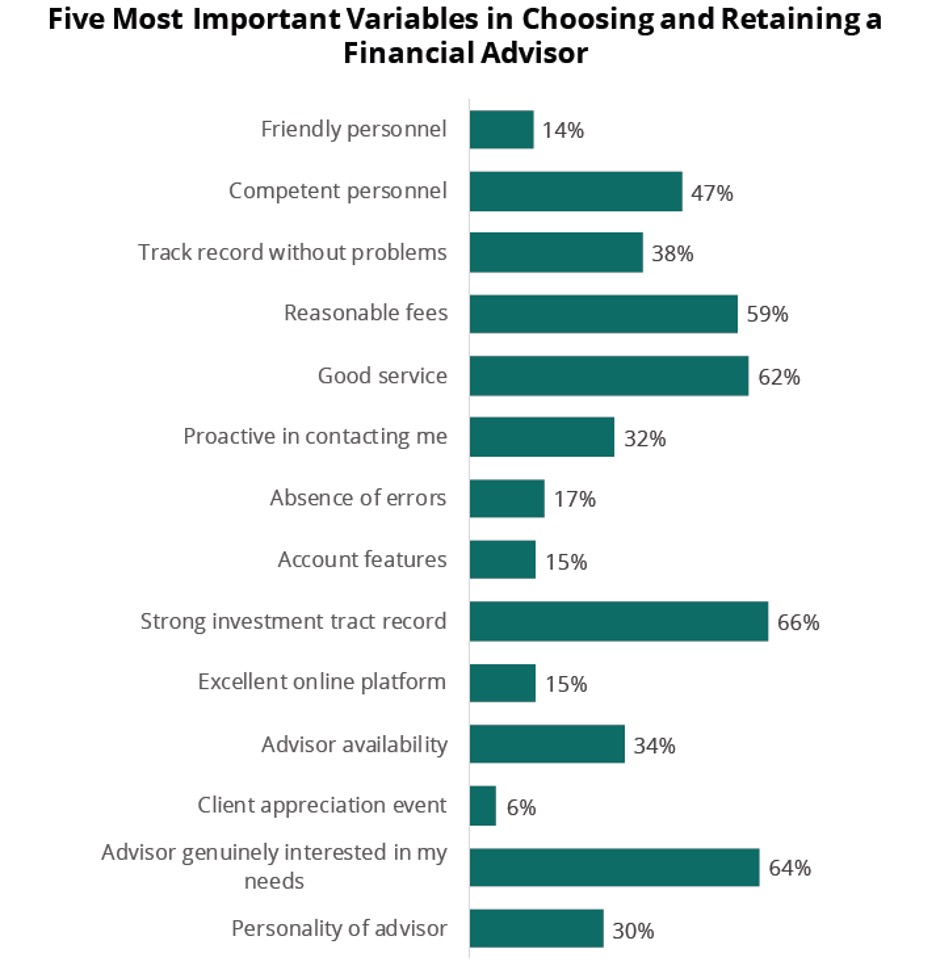

According to recent Spectrem Group research, the most important variables when choosing and retaining a financial advisor are a strong investment track record, and that the advisor is genuinely interested in their needs. Good service and reasonable fees are also of top importance to the majority of investors. Similarly, 47 percent feel that having competent personnel is one of the most important variables when choosing and retaining a financial advisor. Equally important to note are the variables that are not a high priority for investors. Less than 20 percent of investors feel that account features, online platforms, friendly personnel, or an absence of errors are the most important variables when selecting an advisor. These priorities differ by gender and age, among other variables.

Women are more likely to feel that a strong investment track record is among the most important variables when choosing and keeping an advisor, with 73 percent indicating they feel that way versus 64 percent of men. Women are also more concerned about the financial advisor’s availability when considering hiring a new advisor. Men on the other hand are slightly more concerned with good service, a problem-free track record, and friendly personnel. These differences continue

Baby Boomers and WWII investors are more likely than younger investors to feel that good service, and the advisor being genuinely interested in their needs is among the most important variables in choosing and retaining a financial advisor. Younger investors are more concerned about the advisor’s availability, online platforms, and the advisor being proactive in contacting them.

When wealthy investors are asked what the most important factor is when choosing a new advisor, the advisor being honest and trustworthy is the most important. Closely behind being honest and trustworthy is the investment track record of the advisor. Eighteen percent of investors feel the most important factor when choosing a new advisor is that the advisor comes with a strong referral or recommendation from someone who is trusted. How much an advisor charges in fees or commissions is the most important factor for only 13 percent of investors. Women are more concerned about the advisor coming from a strong referral or recommendation, while men are concerned about the advisor being honest and trustworthy.

Regardless of what factors are of greatest importance to investors when selecting an advisor, the choice of what advisor to hire is a very personal one. Investors need to ensure they are weighing various factors in the selection process and make a decision in their best interest.

Related: Wealthy Women and Investing