Think about the last time you paid for groceries or your coffee? Did the chip reader work? Did you use cash? Or your phone?

We are clearly in a time of transition when it comes to payments.

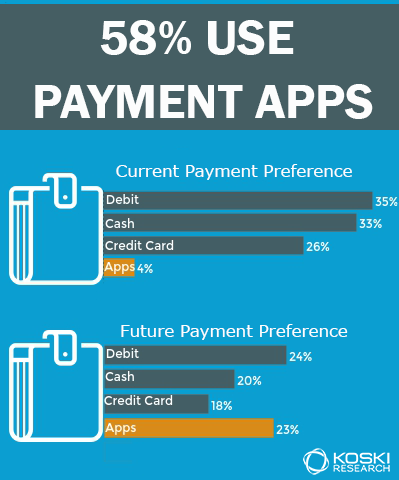

We surveyed the general population and a majority, 58%, currently report using some type of payment app on their phone. Although usage is quite high, preference is currently low but expected to grow. Only 4% of the general population ranked digital payment apps as their preferred payment method today. When asked to rank preferred payment methods 5 years from now, that 4% jumps to 23% for digital payment apps.

Although it looks like payment apps are the way of the future and traditional accounts will take a back seat, bank accounts are still critical to the inner workings of more modern payment methods. Checking and debit accounts will remain important to keeping digital transactions moving.

Technology is already changing how people spend money, and our research shows it will shift dramatically in the next five years. As money and spending become more digital, how are you engaging your customers?