Inflation is over eight percent right now, the highest levels since the early 1980s. This is impacting pricing and expenses for investors all over the country, and at every level of wealth. Investors are all contemplating how long the current rate of inflation will last, what the causes are, and what actions, if any, they need to take because of these high levels of inflation.

Millionaire investors are just as concerned about current inflation rates as other investors. In fact inflation is the biggest concern among Millionaire investors, with 82 percent indicating they are concerned about it, according to recent Spectrem Group research. More Millionaires are concerned about inflation than they are concerned with the current political environment, global relations, tensions with Russia or China.

Millionaire investors are split regarding how long inflation will remain this high. Thirty percent of Millionaire investors feel that the current rate of inflation will last for six months to a year. The largest percentage of Millionaires, 39 percent, feel that current inflation rates will last one to two years. Twenty percent of investors feel that inflation will remain at these levels for two to four years.

Investors are just as split regarding the causes of inflation rates being high. A quarter of Millionaire investors feel that the primary reason for inflation rates is due to the problems with the supply chain. Supply chain issues have been plaguing the country for the past two years. Twenty-two percent of Millionaires feel that the primary reason for inflation is current government policies and practices. Seventeen percent blame government spending as the primary reason for inflation rates. Rising wages, shortage of employees, and foreign oil dependence are all identified by less than five percent of investors as the primary cause of inflation.

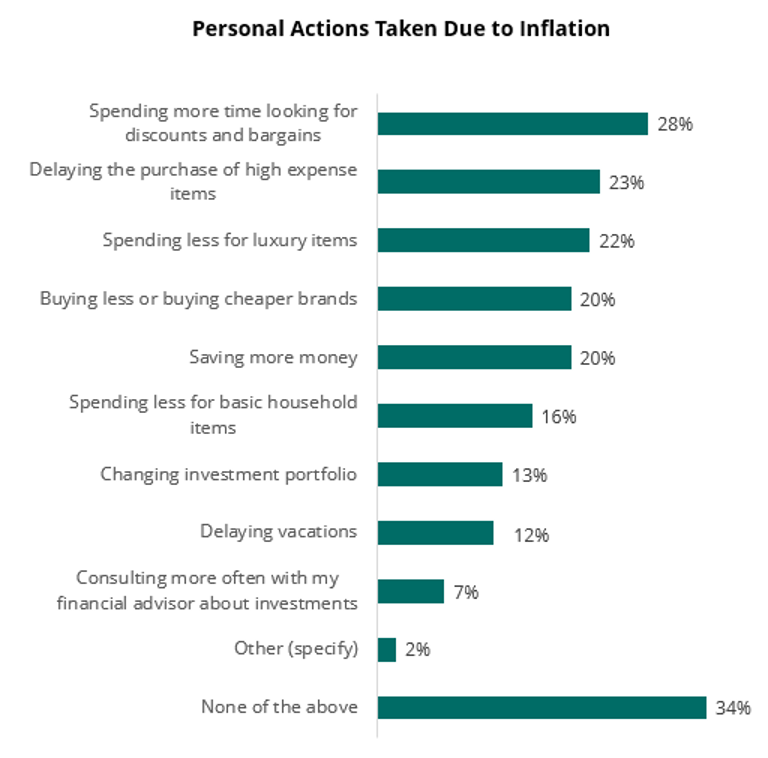

Regardless of how long inflation will last, or the cause, investors are still faced with deciding if they need to take action in their lives as a result of current inflation rates. Twenty-eight percent of Millionaire investors are spending more time looking for discounts and bargains due to inflation, while 23 percent are delaying the purchase of high expense items. Twenty-two percent of Millionaires are spending less for luxury items, and 20 percent are buying less/cheaper brands or saving more money.

Inflation will be an issue for months to come, without a clear cause, so investors will need to continue to determine what actions they need to take in order to combat inflation in their lives.