Written by: Emma Wall | Hargreaves Lansdown

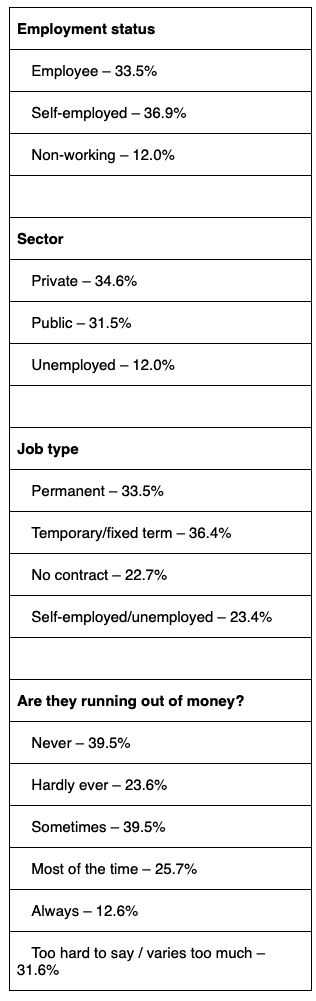

- More self-employed people invest than those employed at companies

- Private sector employees more like to invest than those in the public sector

- Even those running out of money are managing to invest for the future

Figures from the HL Savings & Resilience Barometer, produced with Oxford Economics in July 2022.

The self-employed have been hit hard in recent years. Service sector jobs most impacted by lockdown restrictions included hairdressing, shopkeepers and taxi drivers – typically self-employed people. Huge swathes of the creative sector are self-employed too, which slowed to a stop during the pandemic. Slow to get a furlough equivalent, it was also not universal, and left many self-employed without income for the best part of two years. So, it comes as a heartening surprise to learn from our Savings and Resilience Barometer data that the self-employed are the most likely to invest, especially those that work part-time or on a contract basis.

While markets may be in turmoil right now, investing is the best way to secure your long-term financial goals, such as an income in retirement. Over a multi-decade timeframe, the stock market will far outperform cash savings. The self-employed are less likely to qualify for a state pension – unless they opt to contribute National Insurance – so securing their own financial futures is imperative.

The Barometer data also revealed that even those individuals who regularly run out of money every month are managing to put something aside for the future, a difficult statistic to digest, but it their future selves will thank them. How long this lasts however, with the cost-of-living rising every month, is tricky to say.