The global pandemic has impacted every household in the country. Some changes have been small or temporary, such as quarantining for a period of time, or doing remote learning, while others have the potential for longer term impact, such as being laid off from work or having work hours or pay reduced. In the cases of unemployment or cut in wages, many Americans have resorted to other sources of income outside of their traditional career income or investment income.

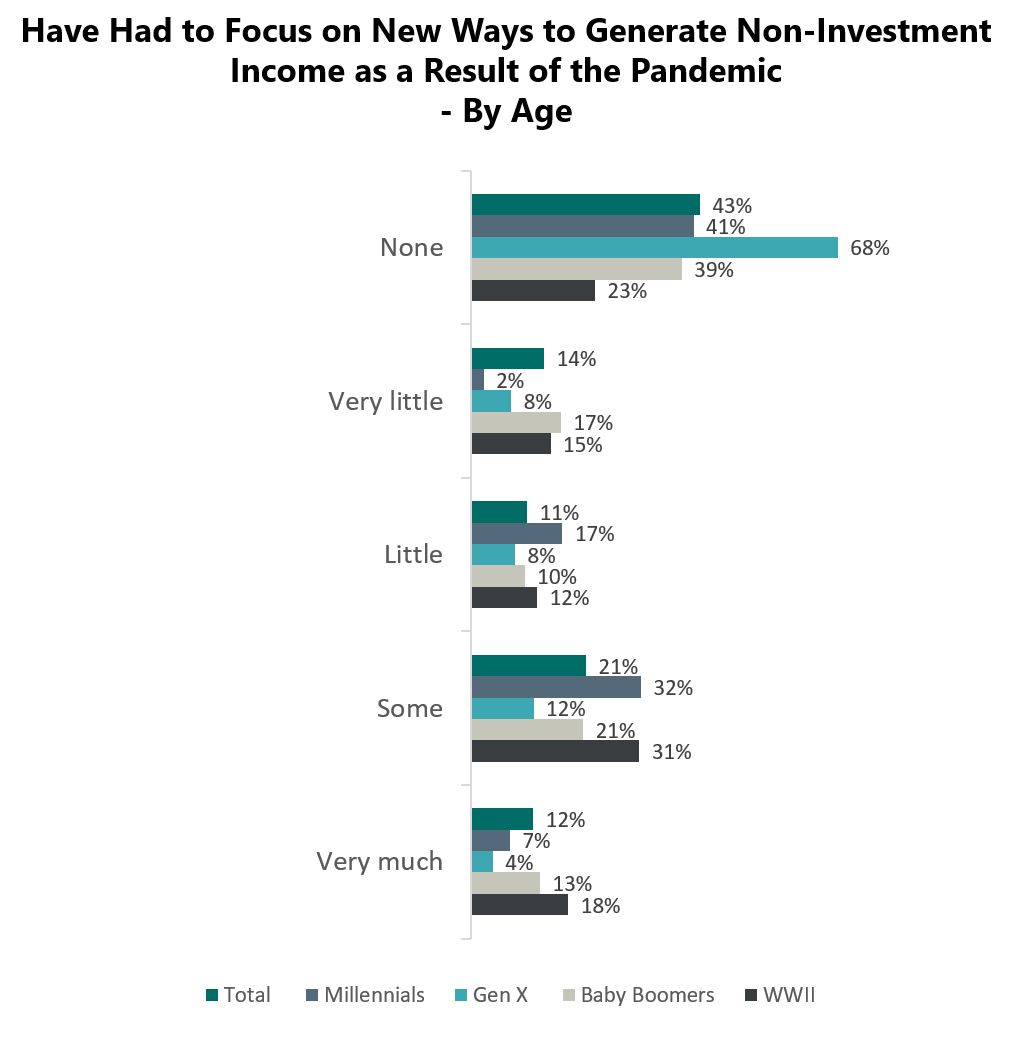

According to Spectrem Group research regarding income generation 21 percent of investors have had to focus on new ways to generate non-investment income due to the pandemic. Even 17 percent of investors with a net worth of $5 million to $9.9 million have had to find new ways to generate non-investment income. Just because someone had a higher level of net worth does not mean that they are immune to the financial hardships that this pandemic has caused. Young investors have been the hardest hit, with 44 percent of Millennials and 37 percent of Gen X investors indicating they have had to at least somewhat focus on new ways to generate income outside of their regular wages and investment income.

What types of non-traditional income producing activities are people utilizing? The most common type of non-traditional income activities is selling collectibles or personal creations. Platforms such as Etsy have seen unprecedented growth since the onset of the pandemic, with Etsy’s sales growing by 91 percent during the first six months of the year, according to their financial statements. This platform and others like it offer the seller the opportunity to sell their creations to make a profit. Many other investors have sold collectibles or even clothing as a way to make extra income during the pandemic. eBay is a common website for selling collectibles and also experienced a surge in usage during the pandemic with people selling their curated collectibles or clothing.

Another non-traditional income source is tutoring or educational assistance. Many college students found themselves with more time on their hands than they previously had, as well as industry experts in many fields were laid off due to the pandemic and they wanted to use their expertise to generate income for their household. For those investors that are fortunate enough to have a vacation or non-primary residence, there was an increase in listing those types of properties as an Air BNB to generate income. Driving for a ride-sharing company or providing delivery services are also among the top non-traditional income sources for investors. Just how are these investors finding the various opportunities for income?

Millennials and Gen X are likely to ask their primary financial advisor for help on ideas of how to generate non-traditional income, with over a quarter of Gen X and 60 percent of Millennials indicating they would reach out. This percentage drops to 10 percent or less for Baby Boomers and WWII investors. Older investors are far less likely to be needing to seek out non-traditional income likely because many of those investors are already retired and their income is not as subject to the changes that many working Americans have experienced during this pandemic.

Speaking with a financial professional is wise anytime there is a change to income or expenses, as that may also require a change to portfolio allocation or financial plans. An advisor can provide guidance on finding non-traditional income or reassure an investor if steps like that are not needed at this time. The effects of the pandemic are likely to continue for a long period of time, so it is important to maintain regular and consistent communication with your financial professional and conduct reviews of your financial plan.

Related: How Can Financial Advisors Assist Women in Confronting the Challenges of 2021?