Owning a home is a financial milestone, one that is often the largest purchase an investor will make in their entire lives. Home ownership also provides for tax deductions and appreciation, among many other benefits. Millionaire investors, those investors with a net worth between $1MM-$5MM, not including their primary residence, are very likely to own a primary residence, but there are many other types of real estate investments that are available to investors.

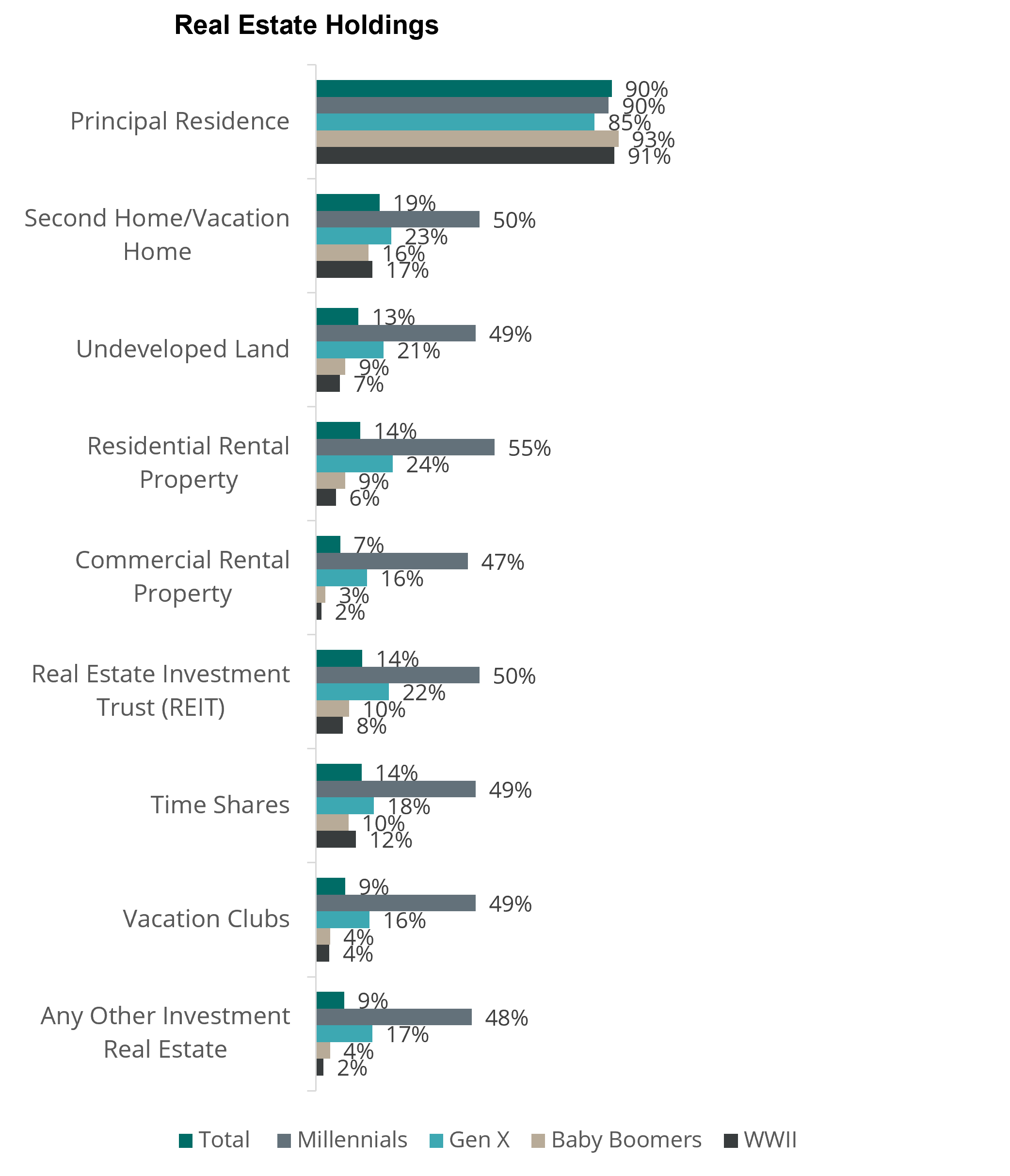

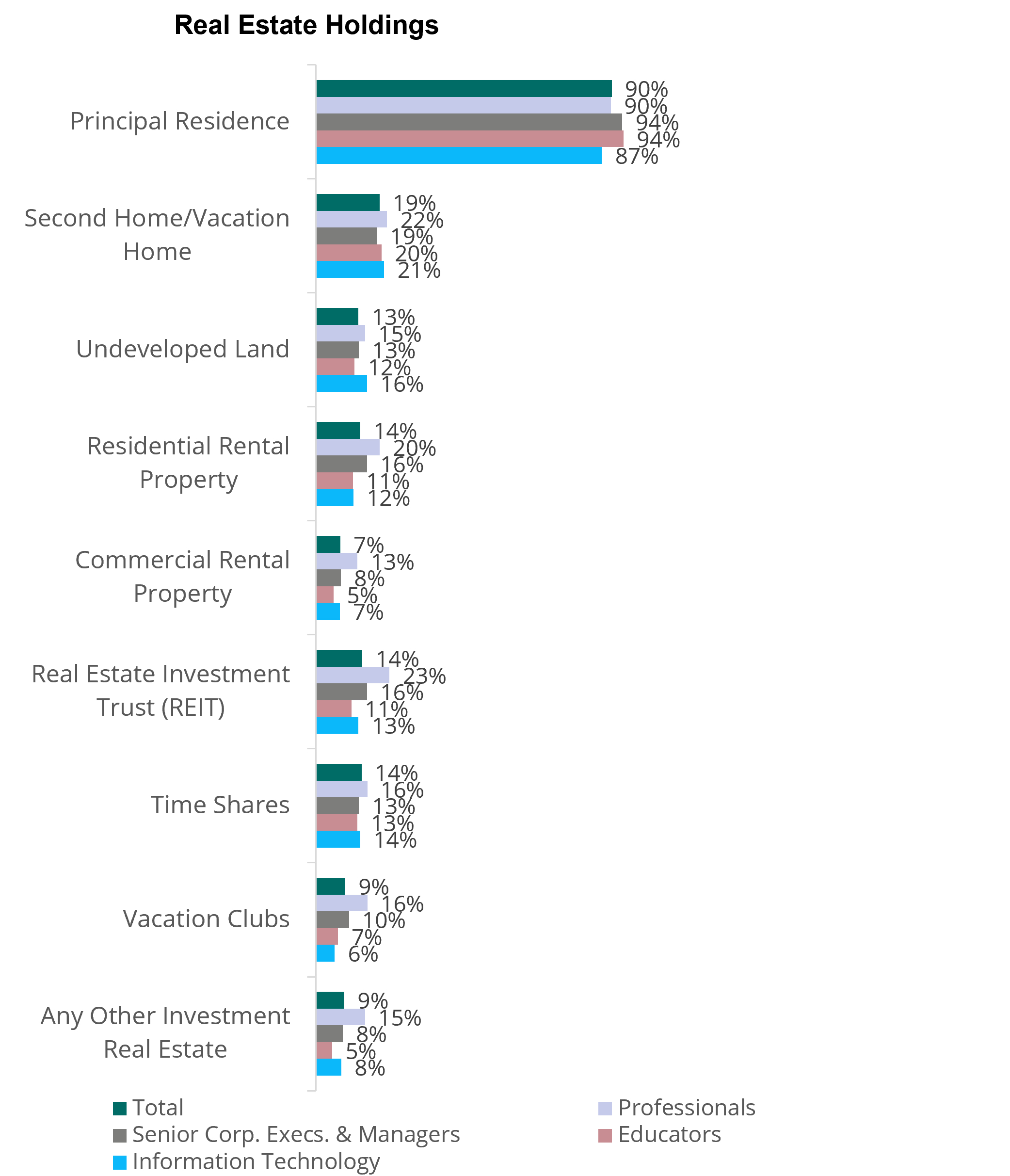

Starting with a primary residence, 90 percent of Millionaires own a primary residence, according to recent research Spectrem Group conducted with Millionaire investors. Baby Boomers are the most likely to own a home at 93 percent, while Gen X are the least likely, even though 85 percent own a primary residence. Educators and Senior Corporate Executives & Managers are more likely to own a principal residence as well.

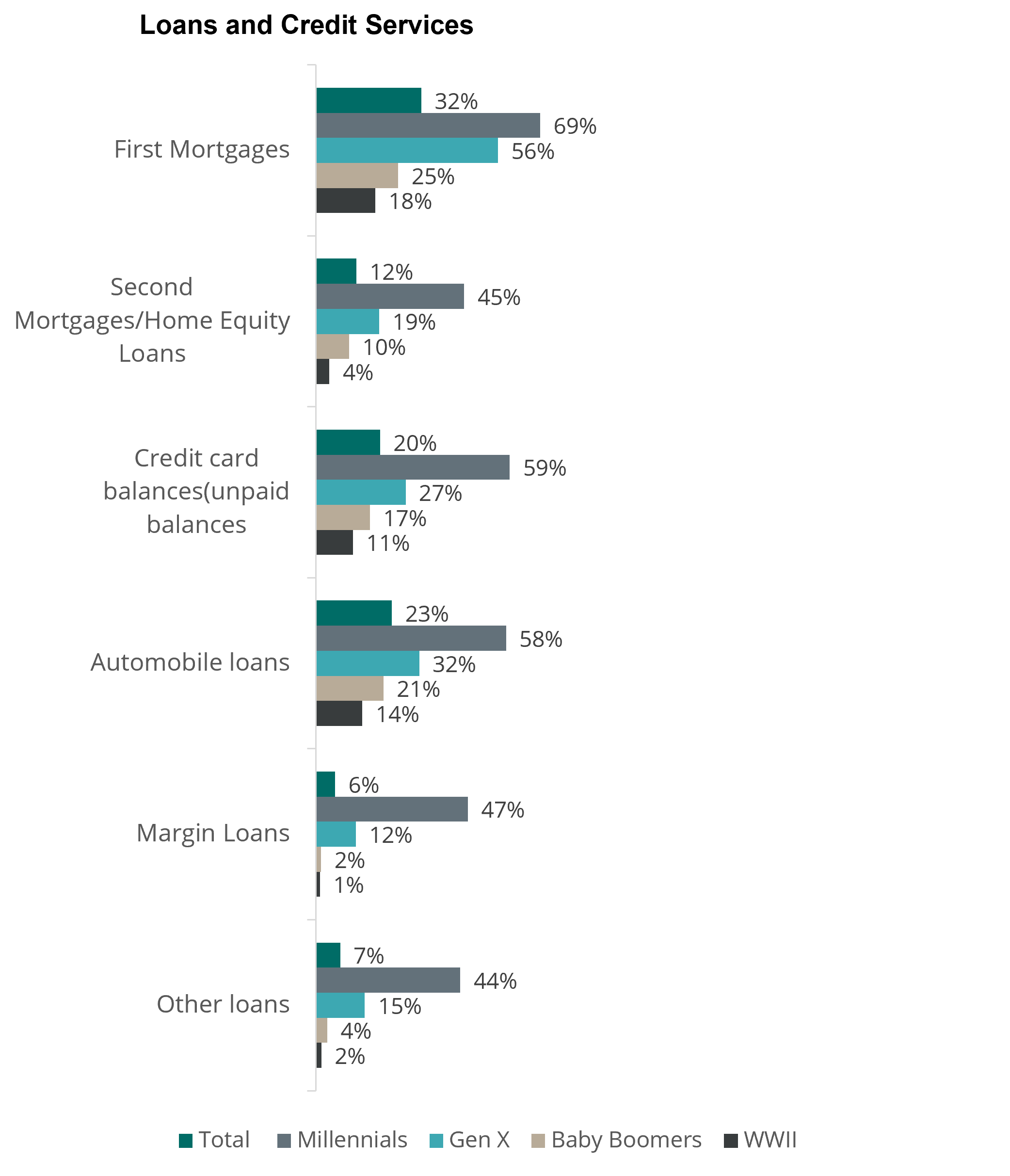

This financial investment also often comes with associated liability in the form of a mortgage. Nearly a third of Millionaires have a first mortgage, with an average loan balance of $155,000. Twelve percent of Millionaire investors also have a second mortgage or home equity loan, with an average loan balance of $62,000. Younger investors are far more likely to have a first and second mortgage. Sixty-nine percent of Millennial Millionaires, and 56 percent of Gen X Millionaires have a first mortgage, while 45 percent of Millennials have a second mortgage, with an average balance of $48,000. Senior Corporate Executives & Managers are the most likely to have a first mortgage, however Professionals are more likely to have a second mortgages.

As mentioned earlier, there are many other types of real estate investments that wealthy Millionaires can be invested in. Nineteen percent of Millionaire investors have a second home or vacation home. Younger investors are more likely to have a second home or a vacation home, with half of Millennials indicating they have a second home or vacation home. Millionaires with a net worth between $3MM-$4.9MM are slightly more likely to have a second home or a vacation home.

Rental property is another very common type of real estate investment that includes both residential and commercial property. This type of investment real estate is more commonly owned by Millionaires with a net worth between $3MM-$4.9MM, Millennials, and Professionals. Professionals are also more likely to own Vacation Clubs or timeshares.

Real Estate Investment Trusts (REITs) are another method of investing in the real estate industry. REITs are a way for investors to have exposure to investment property while having their investment be highly liquid, as REITs trade similar to an ETF or a stock. A REIT is a company that owns or provides financing for, income producing real estate properties. Most often REITs provide income from the real estate but are not usually looked at for appreciation. Fourteen percent of Millionaires own REITs, but that percentage increases among Professionals and Millennial Millionaires.

One of the benefits to investing in real estate is that the real estate industry does not move in the exact same way as the stock market. The stock market could experience losses while the real estate market has an increase, or vice versa. Investors should discuss any real estate holdings with their financial professional to ensure these assets are included in their financial plan and estate plan, while also ensuring the investor does not have an overallocation to any particular segment.