The stock market has been extremely volatile in 2022, taking a rollercoaster ride of ups and downs resulting in losses over 15 percent. While in theory most investors understand that the stock market has ups and downs, it is challenging to keep that in mind during the “down” times. Do higher levels of wealth make an investor immune to the concerns of the volatile stock market? Are investors making any changes to their investments because of the volatility?

Spectrem Group research show that higher levels of wealth does not insulate someone from volatility concerns. Sixty-one percent of Millionaire investors, those investors with $1 million - $5 million in net worth (not including primary residence), are concerned about the stock market volatility. These concerns impact the outlook these investors have towards investment returns for the remainder of the year. Only 23 percent of Millionaire investors feel that the stock market returns will be better in 2022 than they were in 2021. Given all this concern, what are these wealthy investors doing about it?

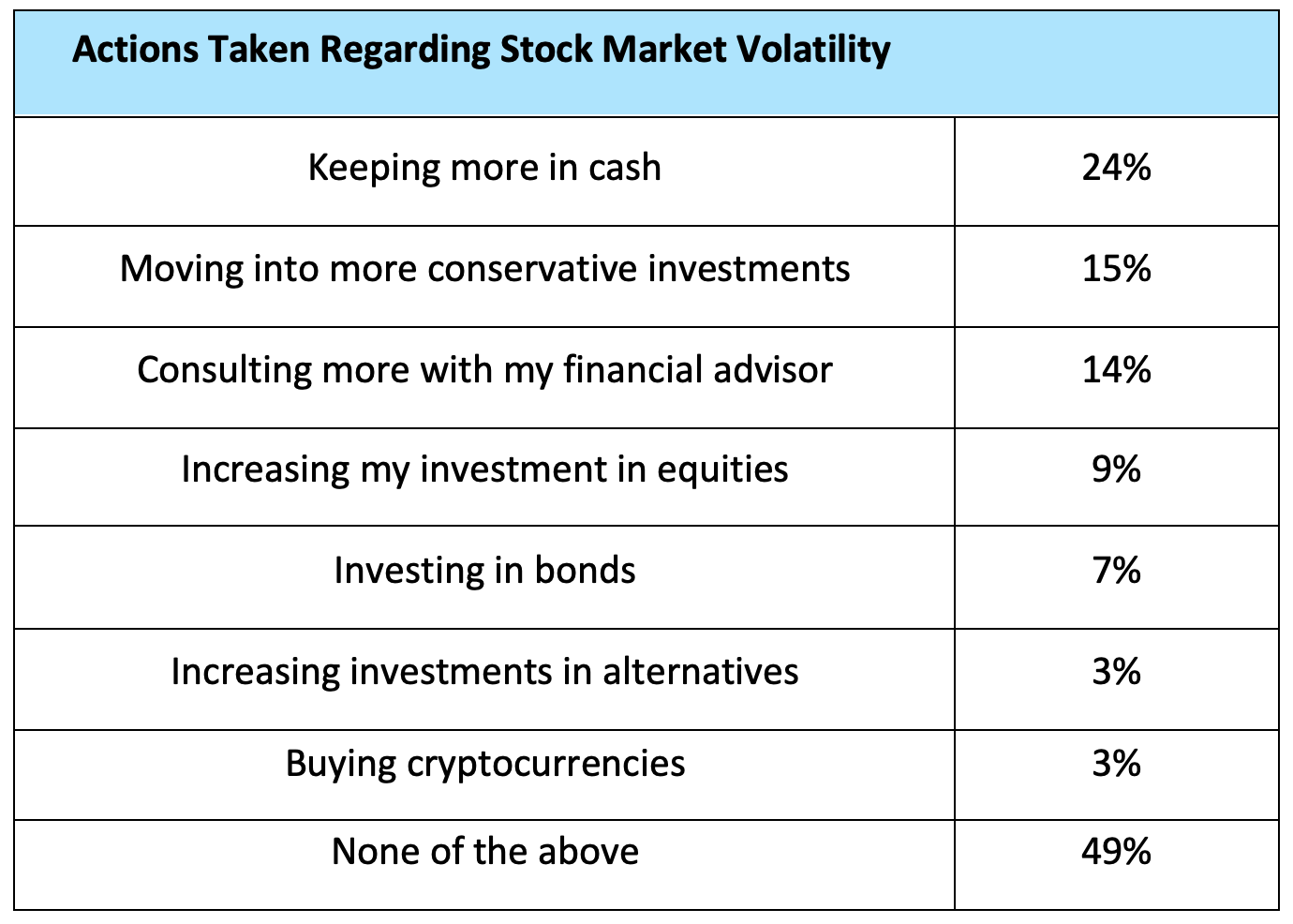

Nearly a quarter of Millionaires are keeping more of their assets in cash due to stock market volatility. This avoids the potential losses, however it also eliminates potential gains. Fifteen percent of Millionaires are moving assets into more conservative investments, which may not have as significant price movements during volatile times. Nine percent of Millionaire investors are increasing their investment in equities, utilizing this volatility as a buying opportunity. Half of Millionaire investors are not taking any action as a result of stock market volatility.

Fourteen percent of Millionaire investors are spending more time consulting with their advisor. This doesn’t mean that any changes are being made, this simply indicates that these investors are working with their advisor more during these tough times in the market.

Despite the concerns about how volatile the stock market is, these investors are fairly optimistic about their financial future. Nearly two-thirds, 63 percent, of Millionaire investors are at least somewhat optimistic about their financial future. A quarter of Millionaires are neutral regarding the future of their financial lives. The reasons for their optimism vary.

The most common reason for the optimistic financial outlook is the buying opportunities the stock market is providing right now, with 23 percent of Millionaires indicating that is their greatest reason for optimism. Twenty percent of Millionaire investors are optimistic due to the current economy, while 19 percent are optimistic because of the current government administration. Low unemployment, current employment status, and long term growth in current occupation are reasons for optimism for less than 10 percent of Millionaires.

Volatile stock market conditions does not always spell a recipe for disaster, in fact that volatility can provide for several opportunities for those investors who have the risk appetite to take those chances. Financial advisors can provide peace of mind during these times, offer suggestions on allocation changes if that becomes a necessary step to take, or simply remind investors to stay the course and not make emotional decisions in the market. Regardless of how Millionaire investors are handling these issues, it is likely that volatility will be an issue for quite some time.

Related: Who Is Investing in Crypto?