Written By: Hannah Shaw Grove and Russ Alan Prince

Philanthropy is much more than making donations – it’s an effective way of sharing values across generations and illustrating personal and family interests, passions, and creativity. And, of course, when charitable clients have the tools to align their philanthropic, wealth management, and legacy-planning objectives, it can enhance their giving while helping forge the multigenerational connections needed to ensure dynastic wealth.

Our research and close work with family offices and financially successful families over the past two decades has uncovered some meaningful trends that (1) collectively provide historical context for the issues facing today’s philanthropic families and (2) present several opportunities for advisors to better serve and engage with their most valuable clients.

Our Early Findings (2004-2014)

In our 2004 book, Inside the Family Office: Managing the Fortunes of the Exceptionally Wealthy, we saw that many families had adopted an increasingly holistic approach to managing their affairs, creating numerous points of intersection among the various parts of their portfolio as they sought to achieve a range of investment, risk management, tax mitigation, and philanthropic goals. However, many family offices felt there was room for improvement in the way philanthropy was conducted, as it did not fully reflect the personal interests and intent of the underlying family members.

The Family Office: Advising the Financial Elite, which we published six years later in 2010, revealed that as the leadership of the family moved from one generation to the next, they were likely to use the transition as an opportunity to tighten the focus of operations and streamline expenses within their family offices. Most commonly, this meant retaining investment management and related services in-house while outsourcing non-core services, such as philanthropic advisory and charitable planning. In many cases, the families still wanted and needed support for the outsourced activities but expected to rely on a carefully curated network of specialists rather than building that infrastructure within the family office.

Russ’s 2014 book, Taking the Reins: Insights into the World of Ultra-Wealthy Inheritors, explained that rising generations (those who were not yet controlling wealth but actively assuming larger and more influential roles within their family) were keen to use their resources to tackle key social and environmental issues but readily acknowledged some gaps in their own skills and experience. As such, there was high interest in learning more, meeting like-minded people, and, especially, getting more involved to improve philanthropic activities and outcomes.

Our New Discoveries (2019-2020)

Six years on, we have new research from two generations of family members with family offices that illustrates a natural evolution of the above-mentioned trends and shows that philanthropy remains an important but potentially undermanaged component of the family agenda due in part to diverging generational views.

In contrast to the founding generation, who are typically focused on wealth creation, inheritors are proportionately more involved in philanthropic endeavors and expect to have even greater involvement in the future (Exhibits 1 and 2).

Exhibit 1: Very or Extremely Involved in Philanthropy

Founders 40.4%

Inheritors 66.7%

Weighted Average 50.6%

N=239

Exhibit 2: Greater Involvement in Philanthropy in the Future

Founders 45.2%

Inheritors 79.6%

Weighted Average 58.6%

N=239

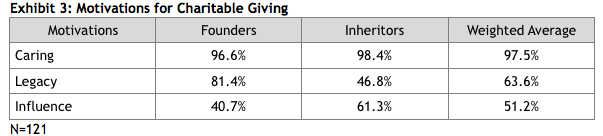

For all generations in a family office, the core motivation is helping others, but founders are more likely to see philanthropy as a means to building a personal legacy while inheritors see it as a mechanism for benefitting society (Exhibit 3).

Exhibit 3: Motivations for Charitable Giving

And, lastly, relatively few members of either generation have worked with outside experts like philanthropic advisors or private client attorneys to help formulate and execute their charitable agenda. This last point demonstrates that there is still room to enhance and possibly institutionalize the structure and process of their philanthropic activities (Exhibit 4).

Exhibit 4: Have Engaged Philanthropic Advisors

Founders 21.2%

Inheritors 6.5%

Weighted Average 15.5%

N=239

Being charitable is an important consideration for many wealth creators and inheritors, but in many family offices, the support mechanisms for philanthropy are no longer part of the core operating infrastructure. And, as younger family members assume more prominent roles setting the direction for the family’s wealth management, there is wider acknowledgment that they need professional guidance and a peer network to synchronize the overarching priorities of the family and its charitable activities and ensure that philanthropic assets are deployed in ways that will deliver maximum impact.

Opportunities for Advisors

Our findings translate into several opportunities for advisors to better support their charitably inclined clients:

- Expand the client discovery process to include a discussion of charitable goals, which can help uncover unspoken aspirations and interests.

- Address philanthropy as part of the financial plan (and investment policy, as appropriate), which can lead to multi-dimensional relationships and new pools of assets.

- Help clients evaluate charitable vehicles based on their giving style and long-term objectives

- Create client connections within your practice, and more broadly within your community, that will bring like-minded people together to learn and collaborate.

- Source technical expertise that will help your clients advance their philanthropic missions and provide a complementary perspective to yours, delivering a more complete service experience.

- Check in periodically with clients to diversify your conversations, evolve your relationship, and demonstrate the link between their financial plans and the realization of personal passions.

Related: The Generational Transfer of Assets is Now

Hannah Shaw Grove is the chief marketing officer for Foundation Source, the nation’s largest provider of support services to private foundations.

Russ Alan Prince is a Visiting Scholar at the Forbes School of Business and Technology and one of the leading authorities in the private wealth industry.