The Covid-19 pandemic has been around for over two years, wreaking havoc in many areas of life. This pandemic, masking, and shutdowns have been challenging for everyone, regardless of what personal beliefs one has regarding the topic. Some areas of the country have handled the situation very cautiously, while others began operating close to normally quite some time ago. Some individuals feel that we need to move on and get back to normal, leaving Covid-19 and the pandemic in our rear-view mirror, while others feel that the pandemic will be an ongoing issue for many years.

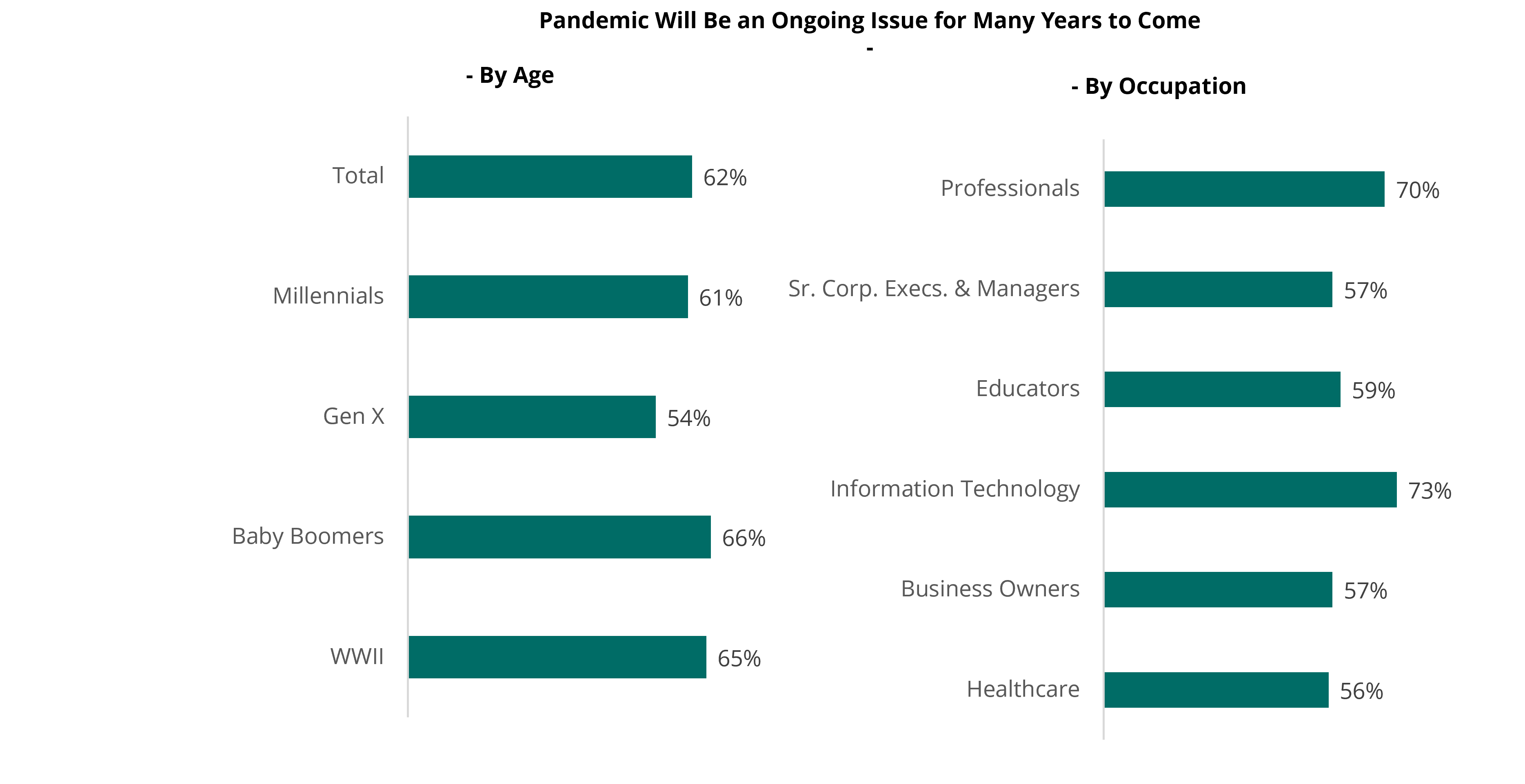

Nearly two-thirds of wealthy investors, 62 percent, agree with the thought that the pandemic will be an ongoing issue for many years to come, according to Spectrem Group research. Baby Boomers and WWII investors are slightly more likely to feel that way, while fewer Generation X investors feel that the pandemic will be an ongoing issue. Professionals and investors in Information Technology are the most likely to feel that that the pandemic is going to be an issue for many years to come, while Senior Corporate Executives are the least likely to feel that way.

One of the ways the pandemic has impacted investors in every aspect of their lives is not seeing or meeting with people face-to-face. The move to virtual visits, and video calls has allowed for many essential life tasks to continue to occur, however some things are better done in person. Nearly two-thirds of investors feel that they are more open to meeting with others face-to-face than they have in the past two years. Broad availability of vaccinations, along with isolation fatigue, has empowered many investors to feel more comfortable with conducting various types of meetings in person, whether that be with a financial advisor or a physician.

The approach companies have taken regarding Covid-19 and precautions implemented has varied significantly. Some companies have very stringent requirements regarding the spread of Covid-19, while others have taken a more relaxed approach. Investors are mostly neutral regarding how a company is approaching the spread of Covid-19. Just over a third, 36 percent, of investors indicate they are more likely to use a company that has stringent requirements regarding the spread of Covid-19, while 42 percent are neutral regarding how a company handles this topic. WWII investors are more likely to not use a company more if they have stringent Covid-19 requirements, with 35 percent indicating this. Investors with a net worth between $10MM-$25MM are the most likely to use a company that has stringent requirements regarding Covid-19.

Despite how investors feel regarding Covid-19, some of the fallout and complications resulting from the pandemic and economic shut down will remain for some time to come. Investors need to determine to what level the pandemic will continue to impact their own decision-making, and that is something that needs to be a very personal decision that no one should be influenced regarding.

Related: Which Investors Will Be Most Impacted by a Cryptocurrency Crash?