With interest rates being at or near zero for the past nearly two decades investors have had to get creative on how to generate income from their investment portfolio. Generating income within an investment portfolio can be a critical part of a retirement income plan, a method to reinvest and add to the investment portfolio or used for another purpose. Regardless of the reasons for seeking income from investments, investors have several options to choose from when looking for income from investments.

Interest rates will impact the rate of return that investors can expect to receive within a savings account, CD, or other types of fixed income. These interest rates are primarily derived from the Fed Funds rate. The Fed Funds rate is the interest rate that banks with reserves charge other banks that need overnight loans. This rate is maintained by the federal reserve through purchasing and selling U.S. Treasuries. Bonds that have been issued within the last 15 to 18 years likely have a coupon payment that reflects this low rate that the Fed Funds rate has been at for so long.

With bonds, CDs, and savings accounts all being so influenced by the low rates, are investors looking elsewhere when they want to generate income from investments? According to recent research from Spectrem Group, twenty-three percent of investors have moved money from fixed income due to low interest rates. Among those who have moved money, 71 percent have moved to equities, 10 percent moved to real estate, and 11 percent have moved it to alternative investments. The investor’s financial advisor was the most helpful resource with those investment changes for 47 percent of investors.

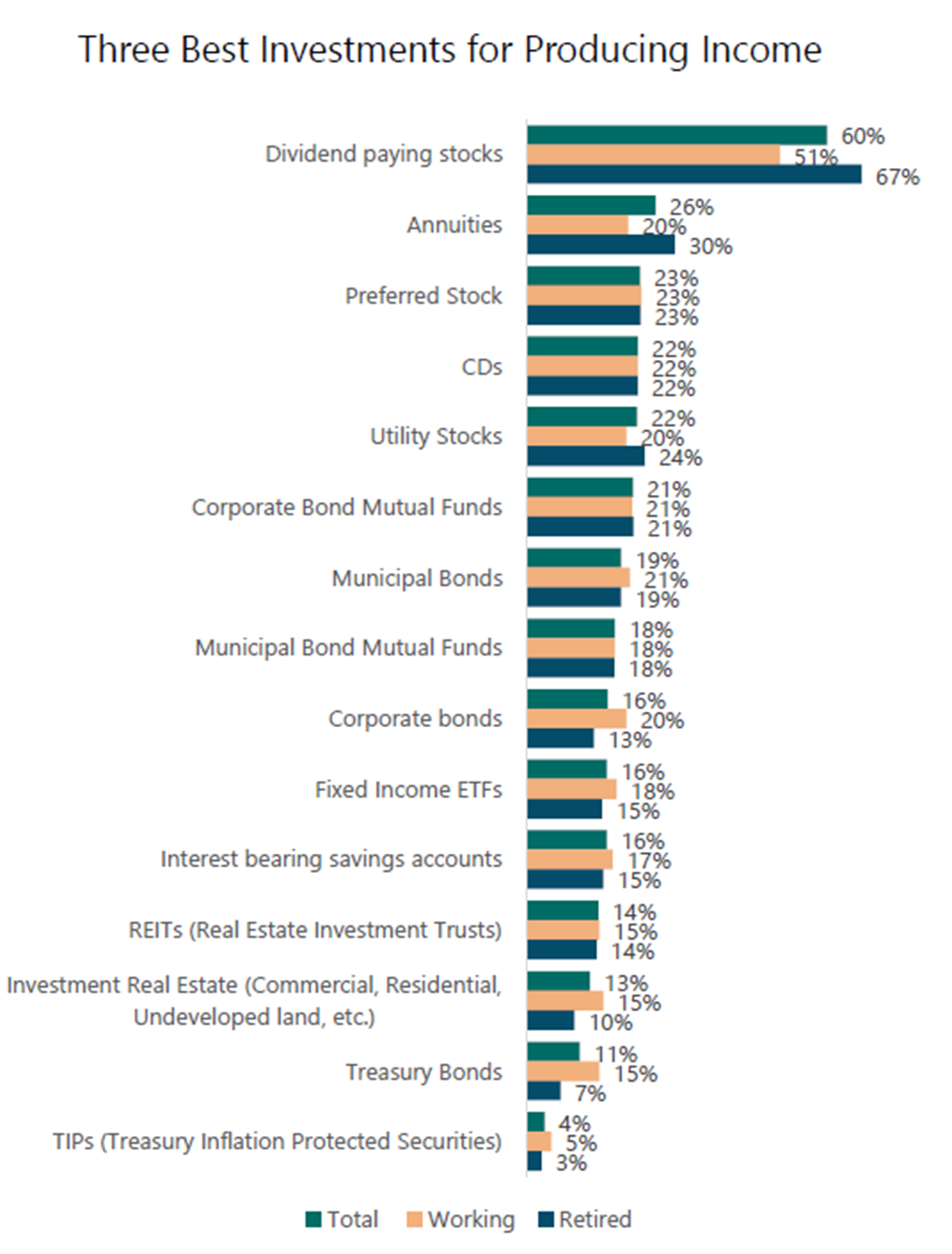

However, when investors were asked what the three best investments are for producing income, bonds, savings accounts, and treasury bonds are not in the top investment choices. Dividend paying stocks are among the top three investments for producing income for 60 percent of investors. Annuities are in the top three choices for 26 percent, and preferred stocks are third at 23 percent of investors feeling that they are among the top three choices for an income producing investment.

Retirees are even more likely to feel that dividend paying stocks and annuities are among the best investments for producing income. Retirees are more likely to feel that utility stocks are a good choice for income, while working investors feel bonds, investment real estate, and treasury bonds are good options for income producing investments.

Investors would benefit from speaking with their advisor regarding income generation from investments. Many investors would like to speak with their advisor about various income generation investments but have not yet. The top three topics regarding income generation that investors want to speak with their advisor about but have not are: dividend paying stocks, preferred stocks, and fixed income ETFs. Working with a financial professional can help investors understand ways to generate income in our low interest rate environment that is likely to continue for some time.

Related: What the Wealthiest Americans Aren't Helping Their Kids With