Investors seem to be increasing their interest in social and ESG investing, however, their actual understanding of these types of investments is relatively weak. Social investments started many decades ago and focused on excluding investments that supported “sinful” activities such as tobacco, alcohol and gambling. Since that time social investing has expanded and now focuses more on investing in companies that have strong environmental focuses as well as including social issues. To go even further, impact investing involves specifically investing in businesses that will benefit specific local communities.

While the language regarding these various types of social investments is thrown around the industry regularly, the reality is that most investors really don’t understand the various types of social investing. Spectrem recently completed research with investors with $100,000 to $25 million of net worth and found that most investors cannot properly define various types of social investing and familiarity with various types of social and ESG investing remains low.

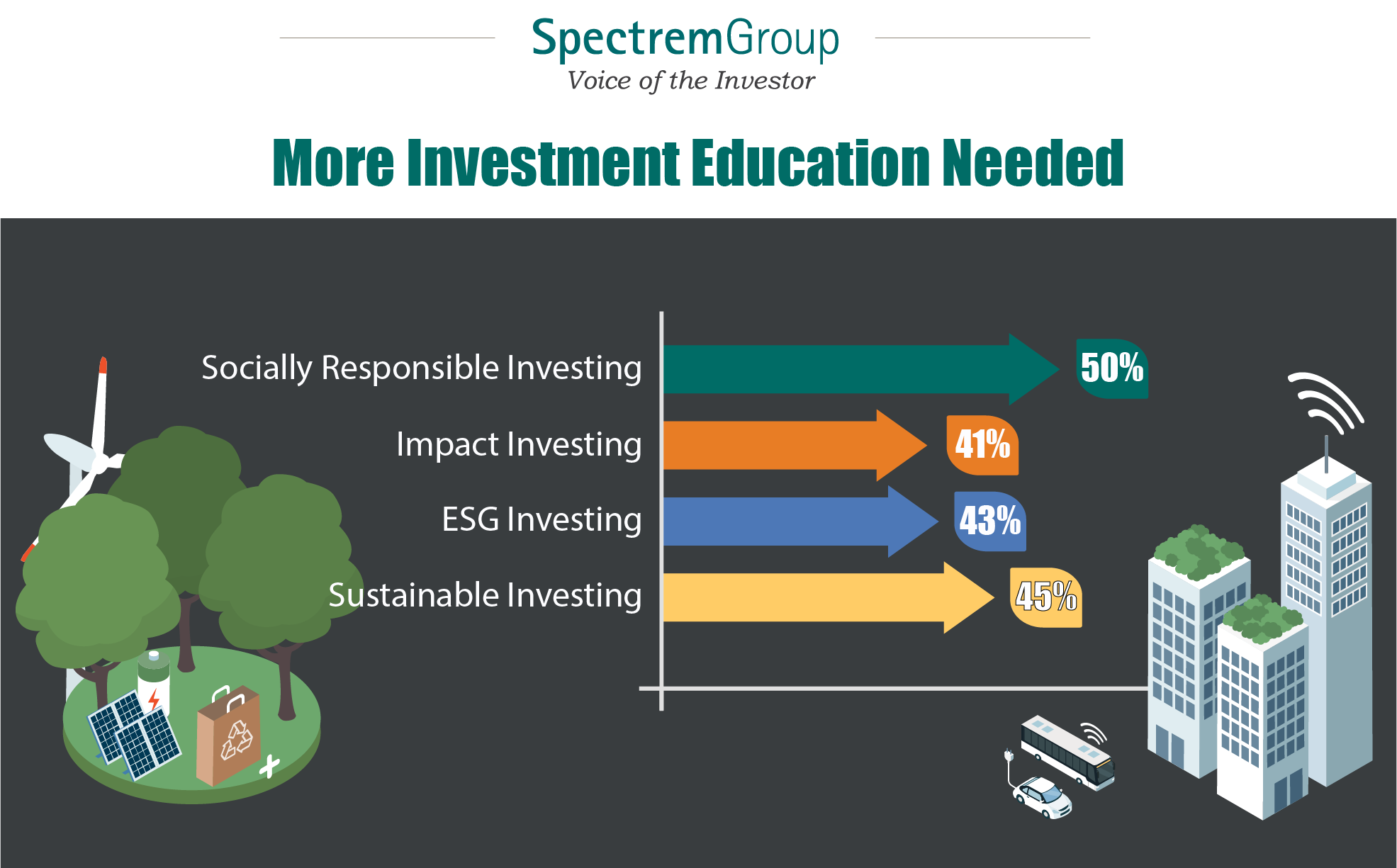

Fifty percent of investors were able to define socially responsible investing while other types of social investing were only defined by approximately 40% of investors. Additionally, when asked how familiar they were with specific types of social investments, the largest percentages were not familiar with the various types of social investments.

Regardless of familiarity of current investors, financial advisors need to become familiar with social investing. Younger investors, along with wealthier investors, are very interested in these types of investments and may be more likely to expect their advisor to be able to offer various social options in the future.

Related: Is Investor Behavior Impacted By A Corporations Politics?