Inflation, which defined the late 1970s, has once again reared its ugly head and is becoming a concern for Americans of all wealth levels. CNBC reported on October 29, 2021, that headline inflation, including food and energy, rose at a 4.4% annual rate in September, the fastest since 1991. Core inflation increased at 3.6% for the 12 months ending in September, also the fastest pace in 30 years.

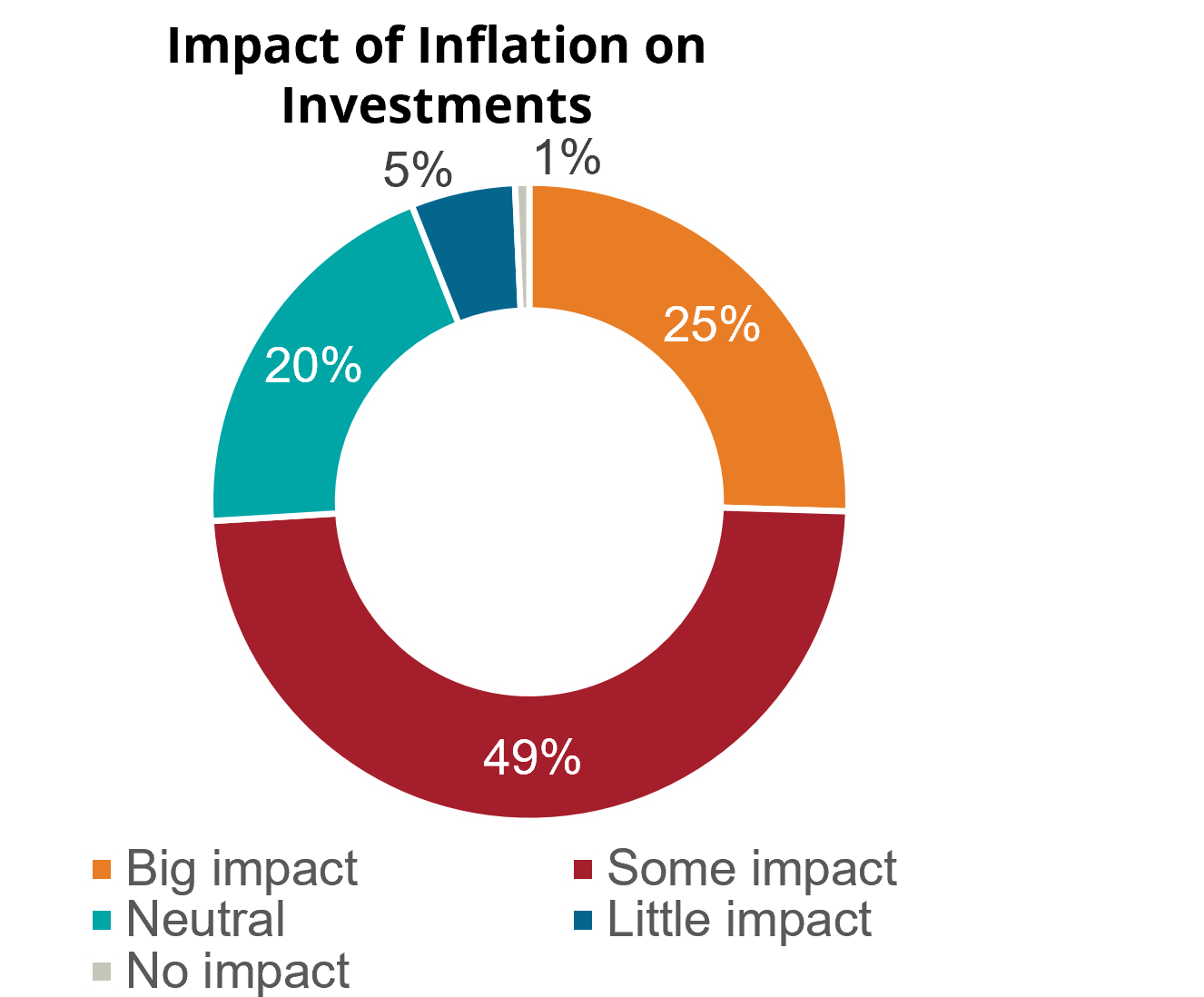

While many investors are too young to remember the times when inflation was high in the past, all investors are beginning to feel some of the ramifications of the current economic environment. When Spectrem Group asked investors in October 2021 regarding the impact of inflation on their investment returns, 25% indicated that it was having a big impact on their investments while 49% indicated it was having some impact. Twenty percent of investors remained neutral regarding whether or not inflation was impacting their investments and only 6% indicated that inflation was having little to no impact on their investments.

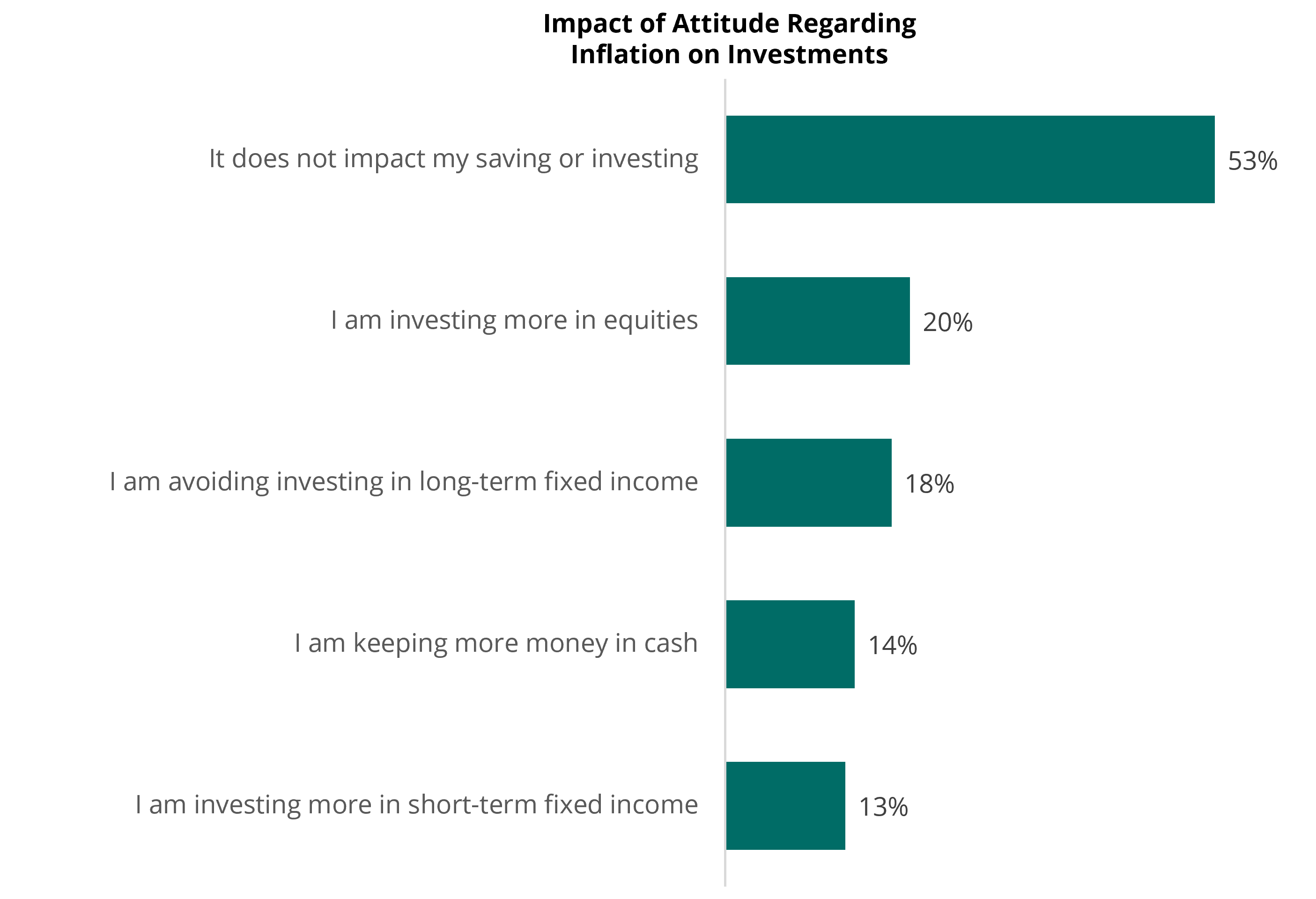

When asked how they might change their investment decisions, more than half of investors (53%) indicated that inflation will not impact their investing or saving. Twenty percent, however, indicate that they will be investing more in equities. This may be due to inflation concerns but may also be influenced by record market highs. Eighteen percent indicate that they will be avoiding investing in long-term fixed income investments. Only fourteen percent are keeping their investments in cash while thirteen percent are investing in short-term fixed income investments.

While it is unclear how long the threat of inflation will last, financial advisors and providers need to know that it is top of mind for investors as they think about financial decisions in 2021 and beyond.

Related: The Process Most Important for Advisors To Ensure Client Loyalty