Discussions regarding end-of-life and asset distributions are challenging for most investors. Facing one’s own mortality is difficult, yet a necessary part of proper estate planning. Estate distributions are notorious for causing conflict among family members, and without proper planning can result in a significant loss of estate value. Families play a significant role in estate planning and distributions.

Nearly two-thirds of investors feel there would not be any disputes among their beneficiaries, according to recent Spectrem Group research. Investors with at least $5 million in net worth are less likely to have that rosy outlook on how their asset distribution will be handled. Investors that are dependent upon their advisor are the most confident in a smooth estate distribution. This may be because they have created a solid estate plan with the help of their advisor.

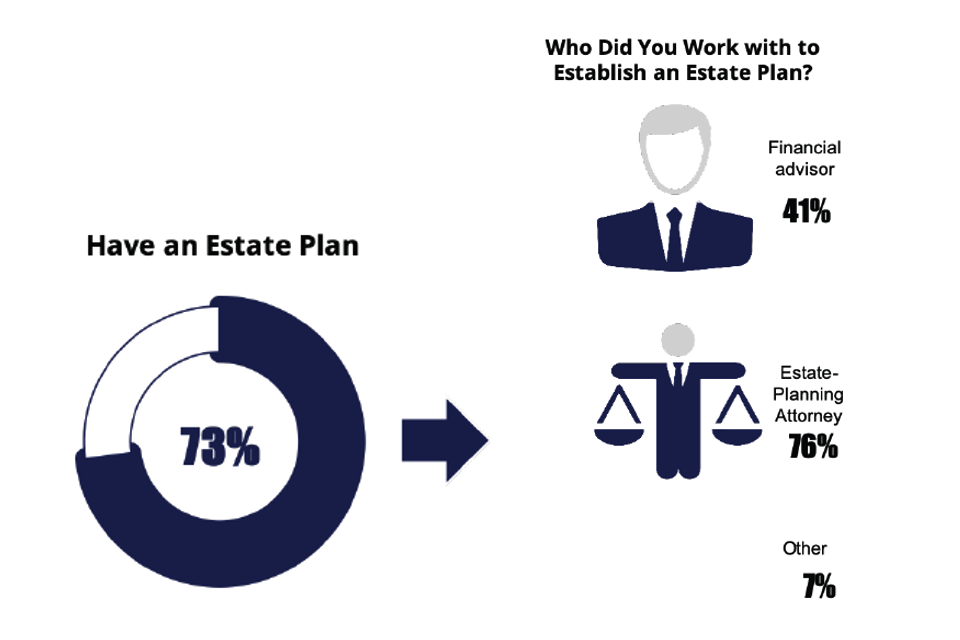

Seventy-three percent of investors have an estate plan, and that percentage increases among those at the highest levels of net worth, and male investors. The majority of investors, 76 percent, worked with an estate planning attorney to establish their estate plan, while 41 percent worked with a financial advisor to develop an estate plan. Financial advisors can work collaboratively with estate planning attorneys to ensure all components of an investor’s financial life is included in the plan.

Over half of investors have also created a trust to help with the inheritance process. Trusts are an important tool in the estate planning process and can effectively minimize some of the more challenging, and financially draining, aspects of estate distributions. As advisor dependency increases, so does the likelihood of having a trust to help with the inheritance process. This is likely one of the reasons why investors that are Advisor-Dependent are more confident in a smooth estate distribution.

It is not just the wealthy investor that needs to take steps for the estate planning process. Beneficiaries of an estate often take steps of their own prior to receiving an inheritance. Forty-two percent of investors meet with their own financial advisor prior to receiving an inheritance to discuss what needs to be done with assets, while 19 percent of investors meet with the advisor of the person from whom they are receiving the inheritance. Prior to inheritance 79 percent of investors indicate that their advisor knows their beneficiaries, yet only 38 percent of investors maintain a relationship with the advisor who administered the inheritance.

Investors don’t particularly mind if their beneficiaries use the same advisor as themselves after their death. Just over a third of investors would at least somewhat like for their beneficiaries to use the same advisor, while 61 percent don’t care if they use the same advisor or not.

Inheritors need to make an important decision when inheriting assets if they want to continue working with the grantor’s advisor, or if they want to move all the assets to their advisor. Family plays an important role in estate planning, making it critical for investors to include their loved ones in the estate planning process.