A recession is typically determined as the economy having two consecutive down quarters. However, it isn’t as cut and dried as that because everything regarding economic information is looked at in arrears. This makes it so often a recession is not declared until months after the recession has occurred. This declaration comes from the National Bureau of Economic Research, and they look at many different data points, not just stock market movements. Many investors feel we are in a recession, or at least a significant stock market downturn. How are investors responding to this market decline with regard to their relationship with their financial advisor?

Eighty-nine percent of investors have not had any change to their relationship with their financial advisor as a result of the recession, according to recent research with Spectrem Group. This means that the majority of investors have not hired or fired an advisor due to the recession. A small percentage, six percent, of investors have consolidated assets and decreased their number of advisors, while an even smaller percentage have hired a new advisor as a result of the recession. Investors at higher levels of net worth are more likely to have made changes to their advisory relationships as a result of the recession. Fourteen percent of investors with a net worth between $10-$25 million have consolidated their assets and decreased the number of advisors they use, while eight percent have hired a new advisor or advisors.

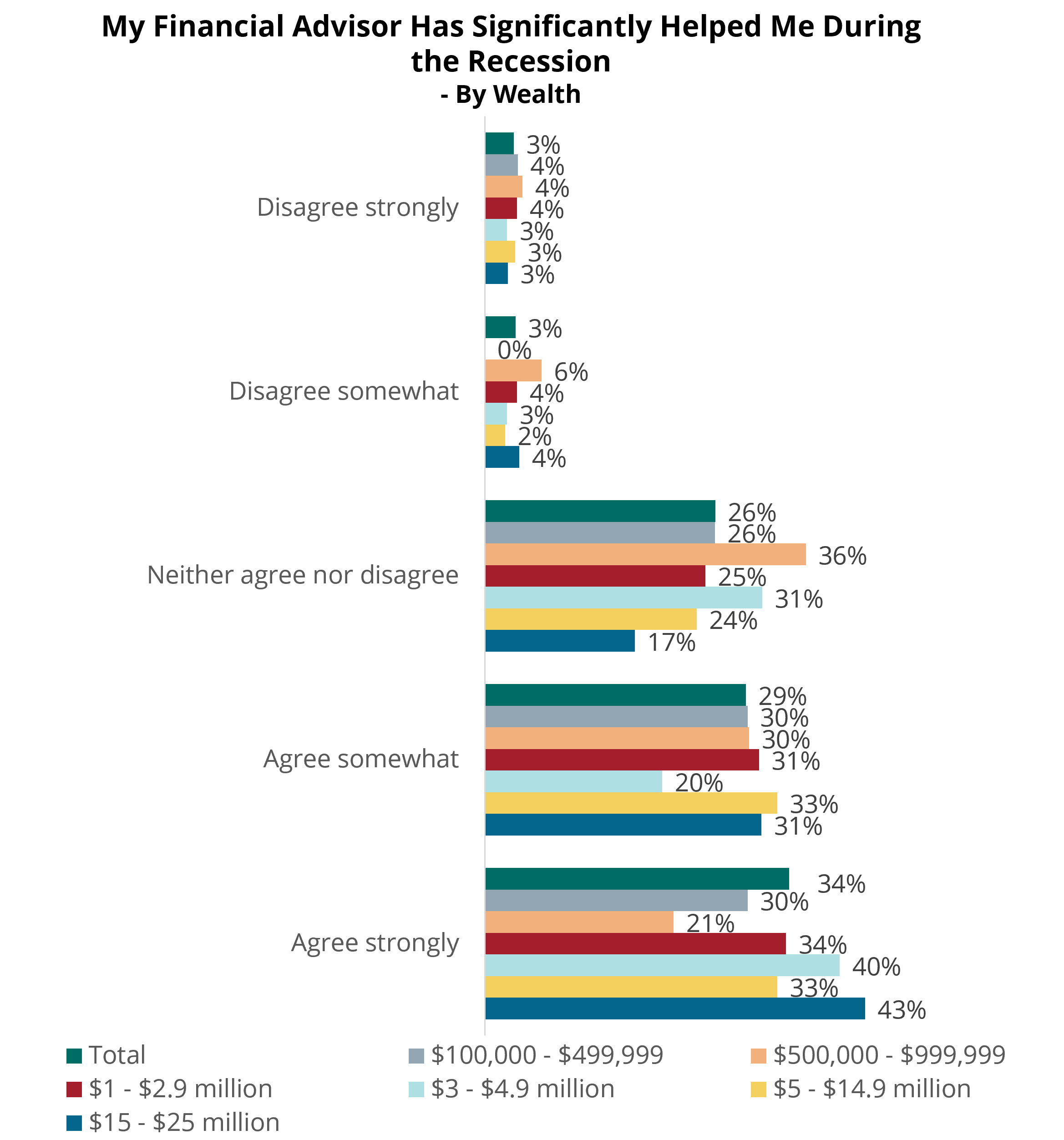

Given that the majority of investors haven’t made any changes to their advisory relationships as a result of the recession, it is important to understand how investors feel about their advisor during this time. Sixty-three percent of investors feel that their financial advisor has helped them significantly during the recession. Over a quarter of investors feel indifferent to whether their financial advisor has helped them during the recession, and only six percent feel their advisor has not helped them during the current recession. Investors at higher levels of net worth are even more likely to feel their advisor has significantly helped them, with 74 percent of investors with a net worth of $10-$25 million in net worth feeling that way about their advisor.

That significant amount of help has translated to an increase of trust for many investors. Forty-four percent of investors feel that their trust for their advisor has increased since the start of the recession. Eleven percent do not feel their trust levels with their advisor have increased since the recession. Advisors who have provided guidance and support that helps their clients during turbulent times are likely to have increased loyalty and trust.

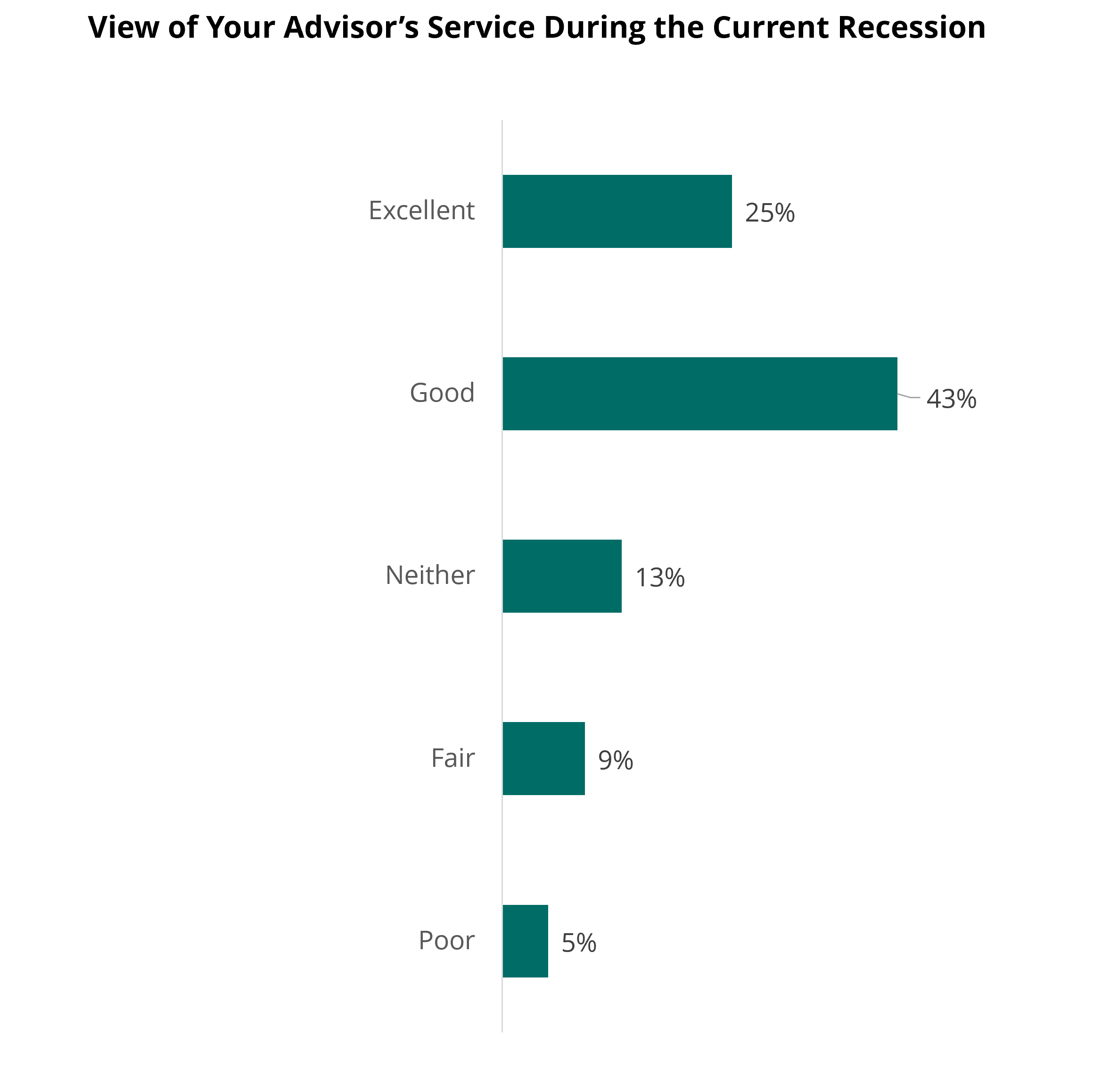

Providing significant help for clients is often accomplished through exceptional service, yet only a quarter of investors would consider the service they have received from their financial advisor during the recession to be excellent. Forty-three percent of investors would consider their advisor’s service to be good. It is important for investors to not settle for fair or poor service levels and communicate to their advisor what they need to have exceptional service.

The recession is creating a sense of uncertainty among many investors and is causing some individuals to reassess their financial goals or financial plans. Working with an advisor that provides value while also delivering excellent service is the best method of mitigating that uncertainty during this time. Investors who do not currently use an advisor may consider using an advisor to support them during down markets.