Many children are given piggy banks when they are young, in an effort to help them understand the value of saving and keeping assets in a safe location. Some kids take to the concept of saving incredibly well, amassing a large nest egg from holiday and birthday gifts over the years due to a lack of spending. Others take a more spendthrift approach, spending the money before it has the chance to collect any dust at the bottom of that piggy bank. What about some of the more advanced types of financial management, such as investing or planning? At what age is it appropriate to meet a financial advisor? The answer may surprise you.

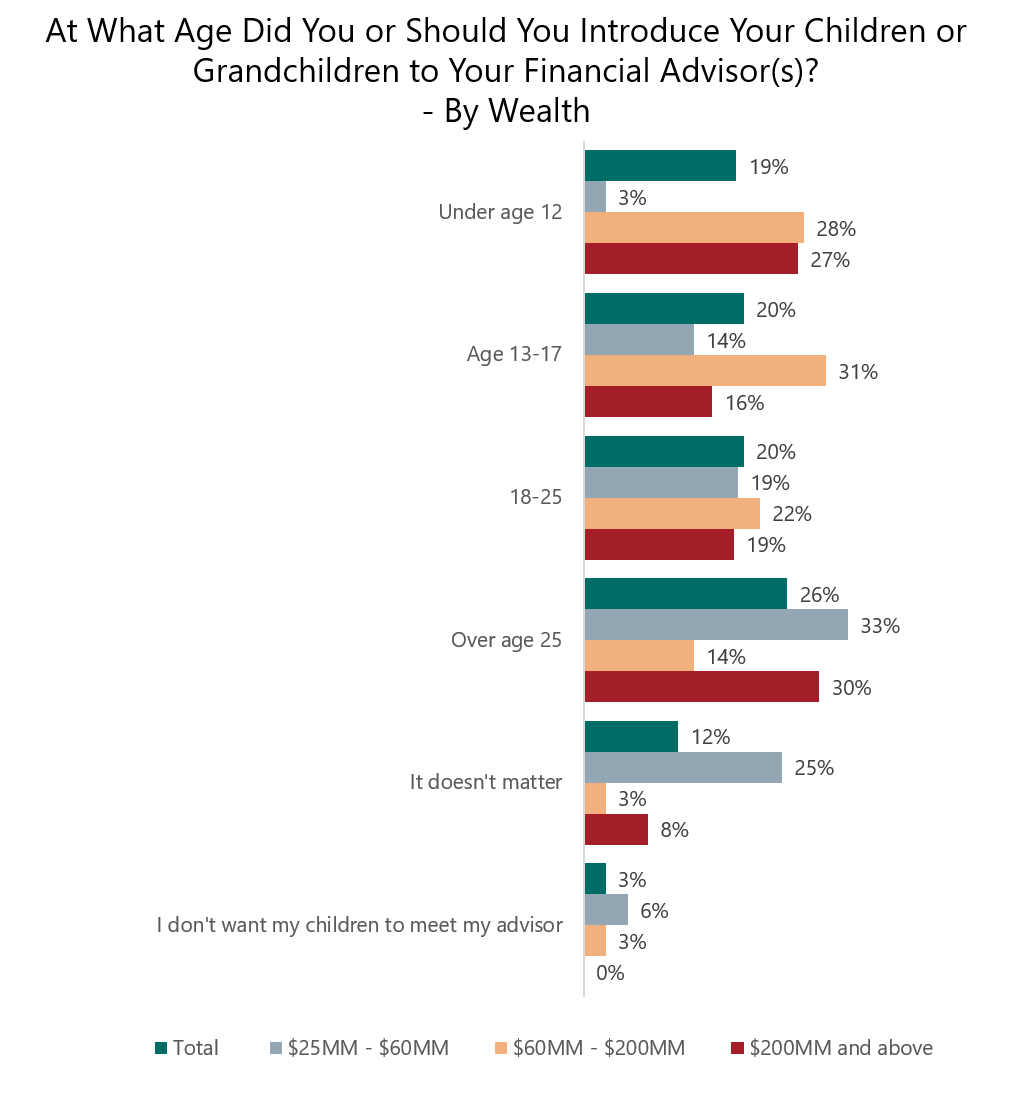

Among investors with over $25 million in net worth, they feel it is important for their children or grandchildren to be introduced to their financial advisor very young, according to recent Spectrem Group research. Over a third of $25+ million investors feel their children or grandchildren should be introduced before they are 18 years old. Another 20 percent would like their children or grandchildren to meet their financial advisor when they are between 18-25 years old. When looking at investors with over $200 million in net worth the desire for the advisor to meet children or grandchild when they are young is even more noticeable, with 27 percent wanting their children or grandchildren to be introduced to their financial advisor before they turn 13. That is a very different approach than many advisors take, as the approach is often to focus on the generation that currently holds the wealth, as opposed to focusing on the generation set to inherit the wealth. Only a quarter of these ultra-wealthy investors are willing to wait until their children or grandchildren are over 25 years old before making those introductions.

When talking with a young adult or child about their financial situation, what is the best approach? According to investors with over $25 million in net worth the best approach is to conduct one-on-one educational meetings with their client’s children, taking the time to educate them about their situation. Other popular approaches are creating a financial plan for them, providing them with materials to study and learn on their own, or simply meeting with them and determining how the financial advisor can best help them.

Now is it a forgone conclusion that because the introduction is made, the children or grandchildren will work with that financial advisor? Just over a quarter of investors with over $25 million in net worth have children or grandchildren that do not have established relationships with their financial advisor. That is not because of a lack of effort however, as 73 percent of these investors encourage their children or grandchildren to use the same financial services firms they currently use.

What about those investors with lower levels of wealth? It is still a wise idea to have a financial advisor work with children or grandchildren as early as possible. This can position them for an increased chance of financial success and planning if they are educated and prepared for the various potential financial pitfalls that can occur in early adulthood.

Related: The Opportunity for Financial Advisors in Retirement Accounts