Written by: George Walper, Jr.

The year 2020 has brought significant change to how and where people work. Parents with school-age children find themselves balancing how to help kids adapt to school via Zoom while learning how to effectively pursue their own careers. No longer are children dropped off at school or put on the bus while parents then rush to their offices. All of these changes have caused a reassessment of what is important and how and when do we prioritize the various components of our lives. In the next few weeks Spectrem Group will be releasing new research with wealthy women entitled Wealthy Women and Market Volatility that explores how women are reacting to this new environment and how it impacts their financial and investment attitudes.

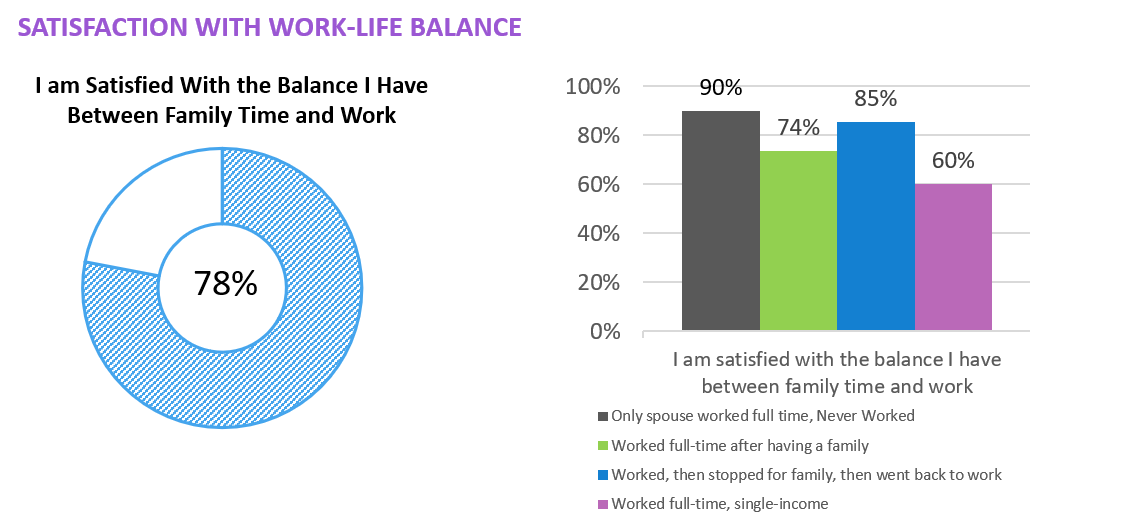

As we await the new research it is important to reflect on how women felt about work-life balance prior to the pandemic. In research with women with over $1 million of net worth Spectrem found that in 66% of the households both individuals worked. Twenty-two percent of the women surveyed indicated they never worked but their spouse did and 8% of the women worked while their spouse stayed at home. Four percent were the only source of support in the household. Overall, 78% of women were satisfied with their work-life balance but it varied significantly based upon their work status.

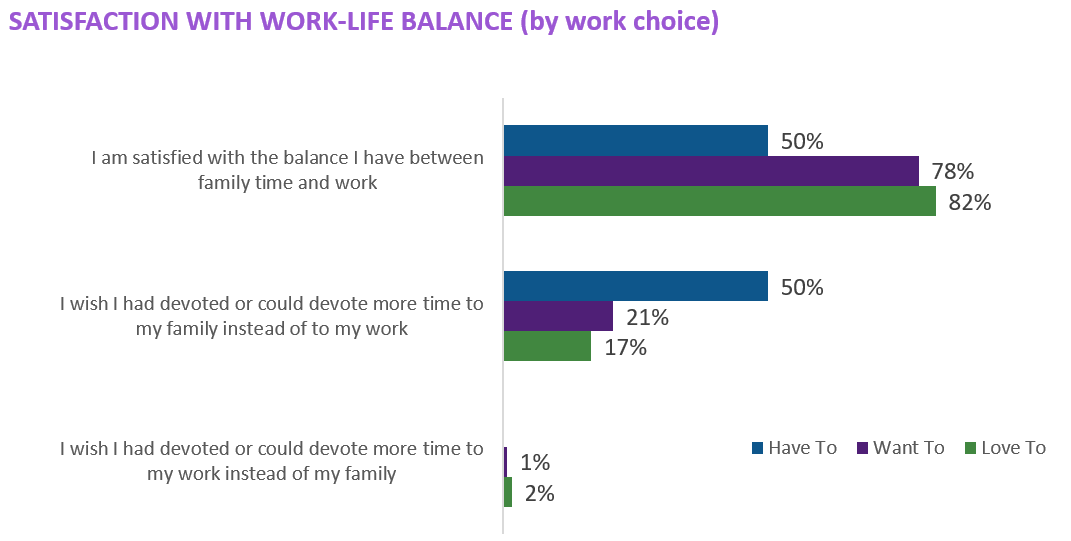

One of the biggest influences on how women felt about their work-life balance was directly linked to the question of “why” did they work. Some women had to work to support the family, others wanted to work to help with family finances and another group worked because they “loved” their job and career. The women who worked because they wanted to or loved to rather than because they had to were much more likely to be satisfied with their work-life balance. Those who had to work were more likely to indicate that they wish they were able to devote more time to their family instead of their work.

Why should financial advisors care about this?

It is important for financial advisors to understand the dynamics of their clients and what is driving their financial decisions. If both spouses are working and it is not necessary to meet their financial goals, advisors can suggest that one spouse could work fewer hours or retire early. If they find that their clients love their jobs, it is important to help them assess how to use that dedication to benefit them financially.

Financial advisors need to assist wealthy women in balancing their financial goals with their life. As you can see, few women wish they had dedicated more time to their careers and less to their families. If financial advisors can encourage female investors with tips on how to lighten their load and free up their time while still meeting their financial goals and feeling secure, then clients are likely to become more loyal and trusting of the overall relationship.

It will be interesting to investigate how women have balanced their work-life situations during the pandemic. We look forward to sharing that information with you in the future.