Many financial industry professionals and critics feel that investors do not understand what fees they pay to their financial advisor. There have been several rules and regulations created in order to increase the level of transparency regarding fees. Just how well do investors understand the fees they are paying? What types of fees do investors prefer to be charged? What types of services do wealthy investors expect to receive for the fee they are paying?

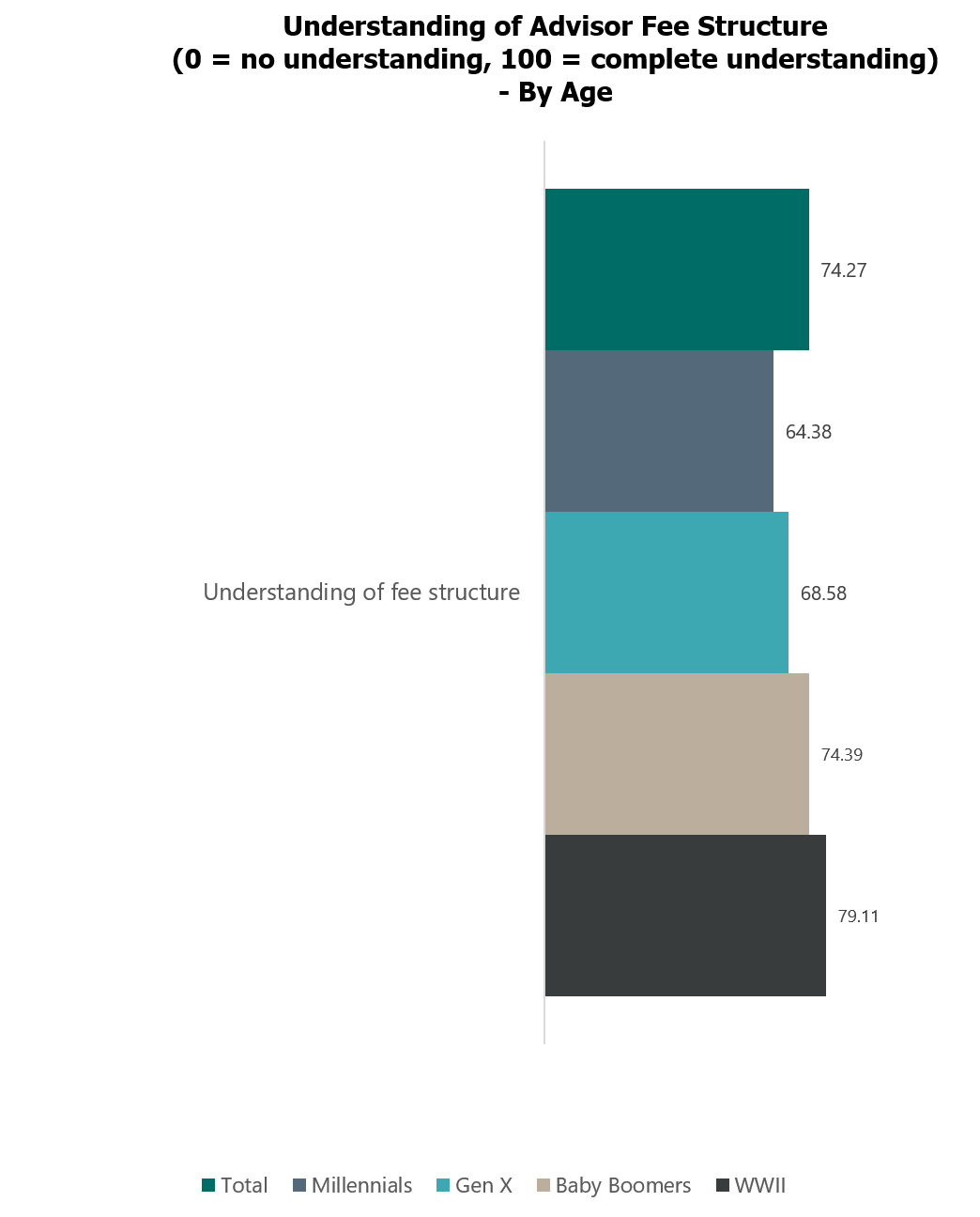

When Spectrem Group asked investors to rate their understanding of the fees they are charged on a scale from 0-100, with 0 being no understanding and 100 being complete understanding the average score is a 74.27. As age increases, so does level of understanding of the fees being charged. The same is true for wealth, as wealth increase so does understanding of fees that are charged. Understanding the fee is one thing, feeling the fee is reasonable is a different story.

Something being reasonable means that it is not excessive. Determining what is reasonable is in the eye of the beholder, with each investor determining what reasonable means to them as an individual. Among those investors who use a financial advisor less than half feel the services of a financial advisor is expensive. Over half of investors are very comfortable with the fees that they pay to their financial advisor. Younger investors are more likely to feel that the services of a financial advisor are expensive. Investors at lower levels of wealth are also more likely to feel a financial advisor’s services are expensive. Regardless if the fees are reasonable or not, investors are quite specific as to what types of fees they prefer.

Forty-one percent of investors prefer a fee structure with a financial advisor to be one that is to investment performance, according to recent Spectrem Group research. This percentage jumps to 50 percent among Millennials. The next most popular type of fee structure is one where the investor pays a fixed fee for the services received from a financial advisor, which is preferred by 18 percent of investors. Seventeen percent of investors prefer for the cost of services be connected to the percentage of assets the investor has with the financial advisor.

The level of understanding of fees, preferences around how to charge the fee, and the value received for the fee are all key components in the relationship between financial advisor and client. Gaining a greater understanding of that knowledge and preferences will serve to improve relationships between an advisor and their client, as well as increase the possibility of working with new clients.

Related: What Makes a Millionaire More Likely To Create a Trust?