The Hinge Research Institute is releasing a special technology and software services industry version of its breakthrough study of professional services buyers and the firms that they hire. It’s called Inside the Buyer’s Brain: Technology and Software Services Edition.

Why This Study is Needed

Buyers of technology and software services have a well-established reputation of being fickle on price. To a degree, they come by it honestly. Technology itself has allowed providers to enter the market en masse with feature-rich yet low-cost solutions. With so many firms looking like they do the same thing as the next guy on the block, competing on price shouldn’t be a surprise.

Add the current pandemic to the mix, and it almost feels like anyone’s guess when it comes to what it will take to win new business.

Fortunately, though, there is a path forward for providers of technology and software solutions for competing less on price and more on criteria such as expertise and innovation. The key is understanding what buyers think today, and what trends will impact how they learn and make decisions in the future.

About the Study

The original study was published in 2013 and provided the first comprehensive look at the differing perspectives of buyers and sellers throughout the entire professional services buyers’ journey.

A second version of the study was published in 2018. This study revealed a rapidly evolving landscape that presented new challenges and opportunities.

The pace and scope of change was so profound that we decided to follow-up with the current study just two years later in 2020. This study also saw the addition of industry specific versions of the report, such as this one.

The timing could not have been better. It allowed us to capture the first real indication of the emerging buyer concerns and preferences.

Purchase the Inside the Buyer’s Brain, Third Edition: Technology & Software Edition

Focused on Technology and Software Services

In this breakout report, we explore the challenges technology and software services clients are facing and the role they see their provider play. We also explore the new client journey from their first exploration of a business challenge to the final selection of the firm they choose to work with.

We then look at the client experience and how it does or doesn’t translate into an ongoing relationship and referrals. To put the findings in perspective we compare key T&S results to other professional services verticals such as Consulting, AEC, and Accounting & Financial services.

Sampled Both Buyers and Sellers

Using phone interviews and online surveys, we researched 191 buyers and 60 sellers of technology and software services. Because the buyers bought services from the sellers, we were able to study both sides of the relationship and how they see each other and identify disconnects that can derail a professional relationship.

Cross Industry Comparisons Included

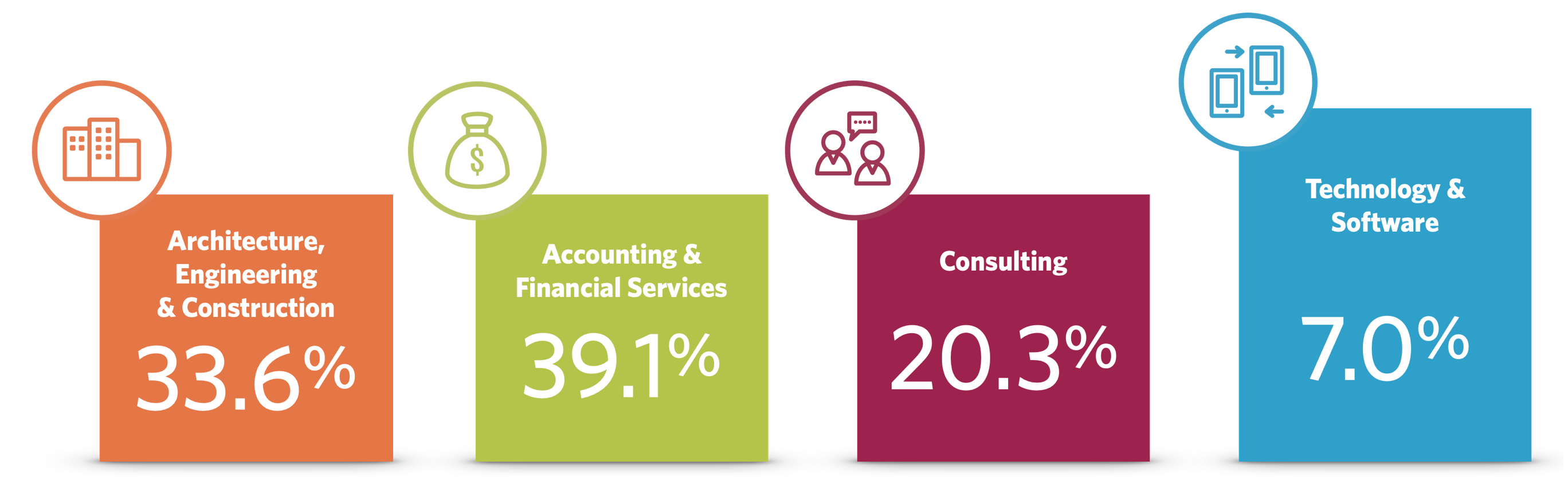

In addition to reporting on the industry data, we also looked at the findings from other angles. This report examines the responses from Technology & Software Services firms and puts them in the context of three other major professional services groups:

Key Findings

The results of the study are organized around four questions that capture the most impactful steps in a Technology & Software buyer’s journey.

What Are the Buyers’ Business Challenges?

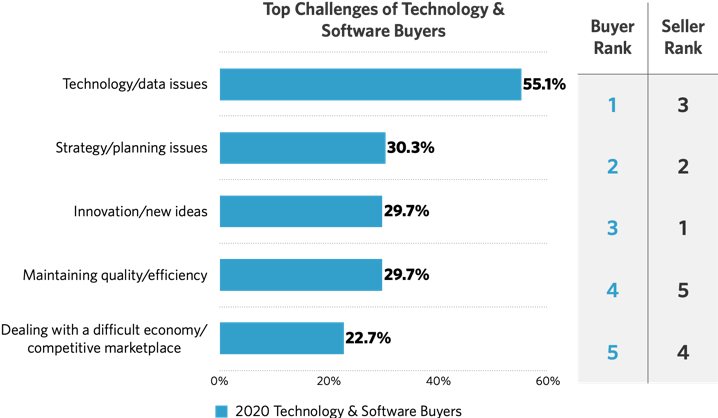

Most professionals believe they understand the challenges their potential clients face. And while this doesn’t hold true in most industries, the data validates that belief for technology and software services firms.

Unlike the other professional services industries, technology & software providers are well attuned to the issues their clients are facing—lending providers a potential edge when it comes to messaging the value of their services.

The key of course is to understanding the many different nuances of the buyers’ stated concerns so that your message stands above the noise of other providers saying they can solve the same problem you can solve.

Purchase the Inside the Buyer’s Brain, Third Edition: Technology & Software Edition

How Do Clients Feel About Their Service Providers?

Most T&S buyers (56.6%) would gladly recommend their current provider to a friend or colleague. But fewer and fewer friends and colleagues are bothering to ask. It’s quicker and easier to do a web search or check on social media. Even more troubling is the erosion of client’s willingness to recommend, down by an alarming 23% in just two years – the highest across all industries sampled in the study.

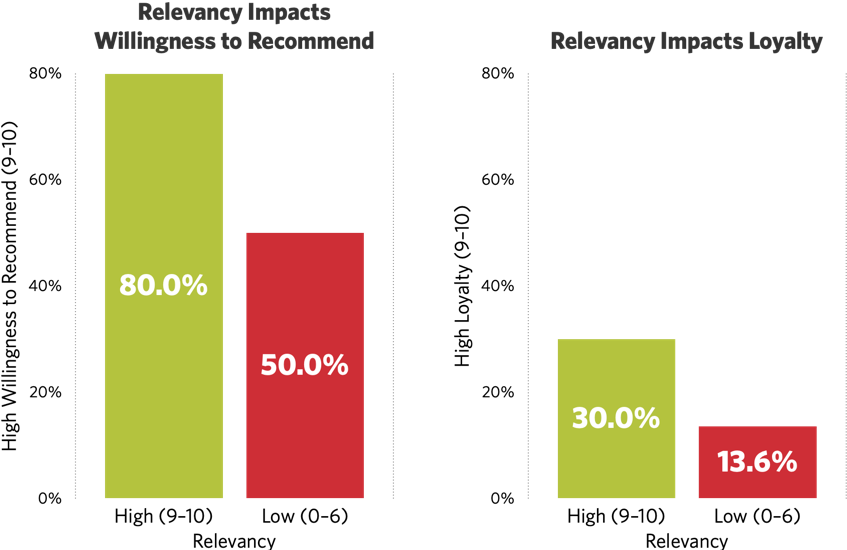

There is another means of measuring how clients feel about their providers: relevance. Fortunately for T&S providers, 42% of buyers rate providers as “highly relevant” to their top organizational challenges – and this has improved 30% over the last 2 years. This finding is significant since relevance impacts both willingness to recommend and client loyalty.

High-level relevance to the prospects’ key issues not only wins new clients, it also helps you keep them. Firms that are viewed as highly relevant to clients’ current issues are 80% more likely to be highly recommended by their existing clients. High relevancy ratings are also associated with a 30% higher likelihood of having highly loyal clients.

How Do Buyers Search for Service Providers?

When buyers of technology and software services need to find a solution to a problem they’re trying to solve, they are more likely to conduct a web search than any other strategy. This tendency underscores the critical role of both your website (where the solution can be displayed) and SEO (how your website gets found) in the buying process.

Similarly, webinars are now on a par with conferences and events as information sources.

LinkedIn is used by nearly 85% of buyers, making it the dominant social media platform.

Purchase the Inside the Buyer’s Brain, Third Edition: Technology & Software Edition

How Do Buyers Evaluate Service Providers?

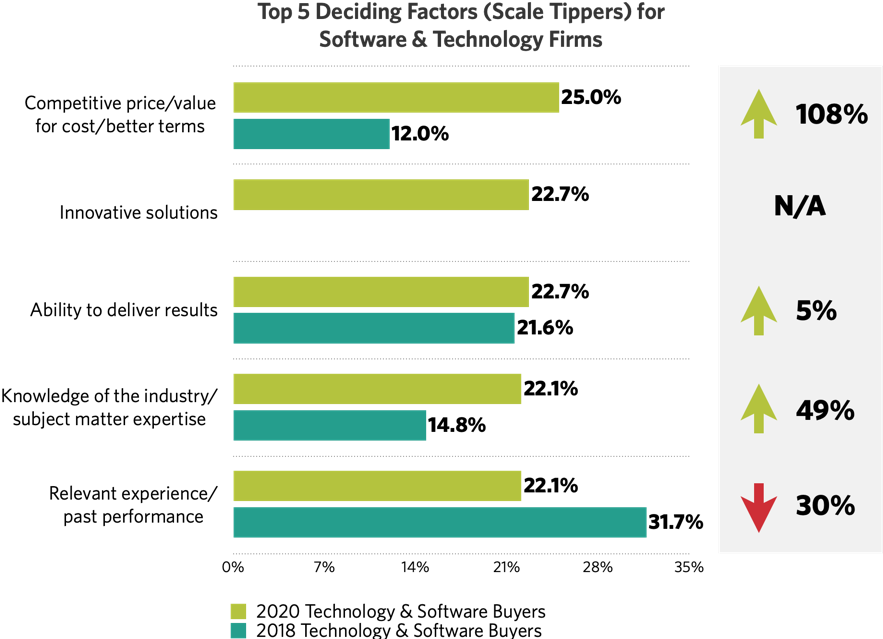

While T&S providers have long relied showcasing relevant past experience to help seal the deal, we are seeing the limits of this strategy. While still an important factor, its role in the final selection process has decreased by 30% over the last few years. Expertise on the other hand, rising by almost 50% as a top deciding factor, carries nearly the same weight as ability to deliver results and competitive pricing. Interestingly, innovation wasn’t even mentioned in previous studies as a top deciding factor – and it takes the number 2 slot this year.

What Does This Mean for Your Firm?

The T&S industry joins the rest of professional services in that the industry as a whole is undergoing a period of significant and rapid change. While no one can know for sure how this change will play out, some conclusions seem clear.

The pressure is on when it comes to understanding specific buyer challenges. Sellers seem to be aligned at a high level on clients and their challenges. However, when pricing figures so prominently in the final selection as it does in the T&S industry, differentiated and relevant messaging becomes the non-negotiable when it comes to standing out above the noise.

Focus on the relevance of your services. Making your expertise visible is important, but don’t forget to make it relevant to the buyer’s challenges as well. Don’t assume that your potential client understands what they need or how you can help them, even if it seems obvious to you.

Part of your job is connecting the dots between the buyer’s challenge and your solution. And don’t forget to reinforce that relevance on a regular basis. If not, you can easily get taken for granted over time.

It’s time to get serious about digital. Consumers and clients have been migrating to digital communications channels for many years. We have seen digital approach and overtake traditional marketing and delivery channels. And with the widespread “remote work” experience that so many have shared, the time has come to act. Buyers are free to search for the specific expertise they need, independent of geographic location. Don’t get left behind waiting for things to “get back to normal”.

Changes in buyer behavior are reducing the impact of traditional approaches. Buyers are changing their behavior at a fast clip. Many traditional business development strategies no longer work as well as they used to. Buyers learn in ways that are fast and easy. They search online rather that asking a friend for a referral. They are less loyal and more inclined to find a best fit solution, rather than fall back on existing relationships. Don’t make the assumption that what worked before will work again.

Related: The Five Keys to Building Better Business Relationships