Written by: Ken Haman

Financial advisors sometimes turn to personality tests for insights into what makes people tick. Three of the most common tests are DISC, Kolbe and Myers-Briggs. But one of the challenges of these assessments is that they require an advisor to learn a great deal before they’re useful. For example, the Myers-Briggs model describes 16 distinct personality types. That’s a lot to remember!

Fortunately, you don’t need a graduate degree in psychology to improve your effectiveness with clients. Use this simple model to navigate relationships with the four basic personality types.

It’s About Control

Everyone falls somewhere on a spectrum that we describe as having control of events, people and life in general. Most people are somewhere in the middle, but there are two extremes. On the far right are people who need a lot of control over what happens in their world. This is an expression of dominance and personal efficacy that leads to feeling like “I have full control!” A few of your clients will want to feel this way. On the far left of the spectrum are people who feel that they have no control over events in their lives. This is an expression of submissiveness and learned helplessness.

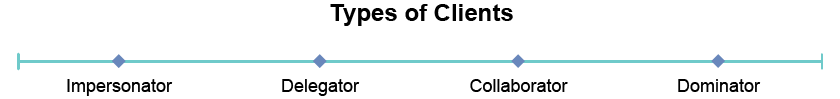

Applying the Model: Four Types of Clients

Now let’s consider the types of clients you encounter based on this spectrum.

Dominators, at the far right of the spectrum, need to control everything. Most often they apply a do-it-yourself approach when it comes to investments, but sometimes they hire an advisor to offer them insights and access to information or to handle unpleasant, complicated tasks. Dominators are difficult to work with, as they want to control every decision and all aspects of the relationship.

Dominators find it easy to fire an advisor for the smallest reason. Typically, they want complete control over every decision until a decision goes wrong, and then they blame the advisor for the failure. Relationships with Dominators are fragile because they need to preserve their sense of command over the world at all costs.

If you have a client who is a Dominator, always defer to him when making a proposal: “You need to be the final decision-maker, but you might want to consider…” Take extensive notes at every interaction, as a client with this personality type often punishes his advisor if he feels that the advisor has failed.

Collaborators, who are more in the middle of the spectrum, want some control. They are less likely than Dominators to want to tackle their investments on their own and often hire an advisor; however, Collaborators aren’t willing to release the investment process completely. Instead, they want to be involved in every decision and need to understand proposals before agreeing to a process.

A client with this personality type isn’t comfortable giving discretion to her advisor; she requires frequent conversations about decisions and wants to understand market dynamics. Advisors who think of themselves as teachers or consultants often enjoy working with these clients.

When you onboard a Collaborator, pay attention to how much detail she requires to feel adequately informed, as some will require extensive specifics while others will be satisfied with less information. Make sure you can meet those needs before you begin a relationship.

Delegators are the ideal clients for many advisors. Once a Delegator decides to hire an advisor and has developed a basic level of trust, he’s comfortable relinquishing most of the decision-making. This is the client who says, “I trust you; just do what you think is right!” But don’t be lulled into complacency. These clients still need to be informed about decisions.

Delegators don’t need a lot of control but are still disappointed by unexpected events and respond intensely if they feel betrayed or mistreated. Therefore, it’s important to build and maintain trust by delivering consistent experiences of goodwill and professional competency. For details on how to do this, see the AllianceBernstein Advisor Institute’s white paper Inside the Mind of the Uniquely Successful Investor.

Impersonators feel as if they have no control over the events in their lives and frequently need significant support. Common characteristics include helplessness and feeling overwhelmed by the complexities of life and wealth management. Impersonators rarely create wealth; typically, they inherit family money.

I created the label of Impersonator because these clients aren’t authentically representing themselves as adult decision-makers. They experience life very much like children looking for a grown-up to take care of them. And, like children, they resist their advisor’s guidance and resent the constraint that an investment process requires.

Importantly, like a Dominator, an Impersonator will get angry if she feels let down or disappointed. The prudent advisor anticipates temper tantrums and a very fragile relationship even though the relationship typically begins with the client asking for help. As with Dominators, you should maintain fastidious documentation with Impersonators, as you are likely to be blamed for some injustice, inconvenience or insensitivity.

Every advisor works well with and attracts one personality type but finds another type very challenging. Think about your practice. Do you see a pattern? Have there been unpleasant experiences with one particular type of client? Which type do you work best with? Pay attention to your answers as you navigate the early stages of a relationship. Protect yourself from the types that don’t match your style, and refer them to another advisor who is better suited to their needs.

I am indebted to Mary Ann Best, Managing Director of Bernstein Global Wealth Management in Washington, DC, for her insights into the Collaborator and Delegator types.

Related: The Most Dangerous Question Advisors Have to Answer