Interest rates have been extremely low for many years. Investors looking for investment income in this environment have few options or resources. Interest rates on savings accounts are essentially zero, with yields on CDs and bonds being not much higher. How exactly are investors finding investment income in these historically low interest rate times? Who are the wealthy investors looking to in order to help them find new ways to generate investment income?

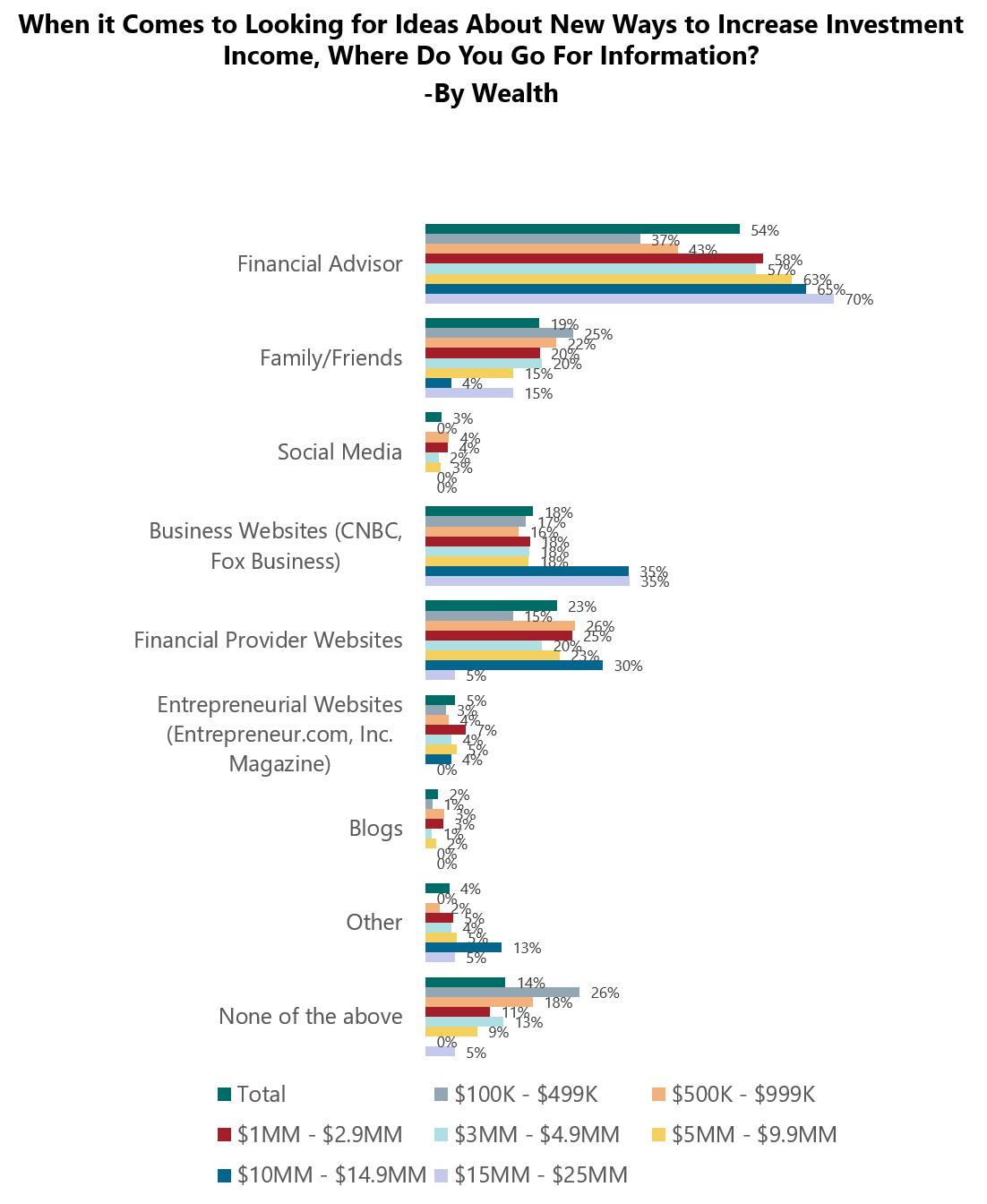

When it comes to generating income in this environment, over half of investors look to their financial advisor for ways to generate investment income, according to a recent study about investment income generation in low interest rate environments from Spectrem Group. Nearly a quarter of investors go to their financial advisor’s website to provide them guidance in generating investment income. Younger investors, Millennials and Gen X, are more likely to seek help in generating investment income from friends and family than older investors. Investors at higher levels of net worth are more likely to use their financial advisor to help them generate investment income. Over two-thirds of investors at the highest levels of wealth, over $10 million in net worth, reach out to their financial advisor for information on how to increase investment income.

Investors do have some ideas about what types of investments are best for producing income. When investors were asked about the types of investments that are best for income generation, dividend paying stocks, annuities, and preferred stocks are the three most commonly identified investment choices. Investors at the highest levels of wealth identify dividend paying stocks but also municipal bonds as the best investment for income generation.

Income generation from investments may not be essential to many investors. Sixty percent of investors have 15% or less of their annual income come from their investment portfolio. Even among retirees nearly half (45%) only have 15% or less of their annual income come from investments. World War II investors, those who are 74 years old or older, are the investor segment that utilizes income from their investment portfolio to the highest percentage.

Regardless of how much income an investor is taking from their investment portfolio, everyone wants to generate as much income as possible while taking the least amount of risk. Working with financial advisors and going on a financial advisor’s website to be more educated on various types of investments that can be income generating is an ideal way to start.

Related: How Well Do Investors Understand the Fees They Are Paying?