Written by: Emma Wall | Hargreaves Lansdown

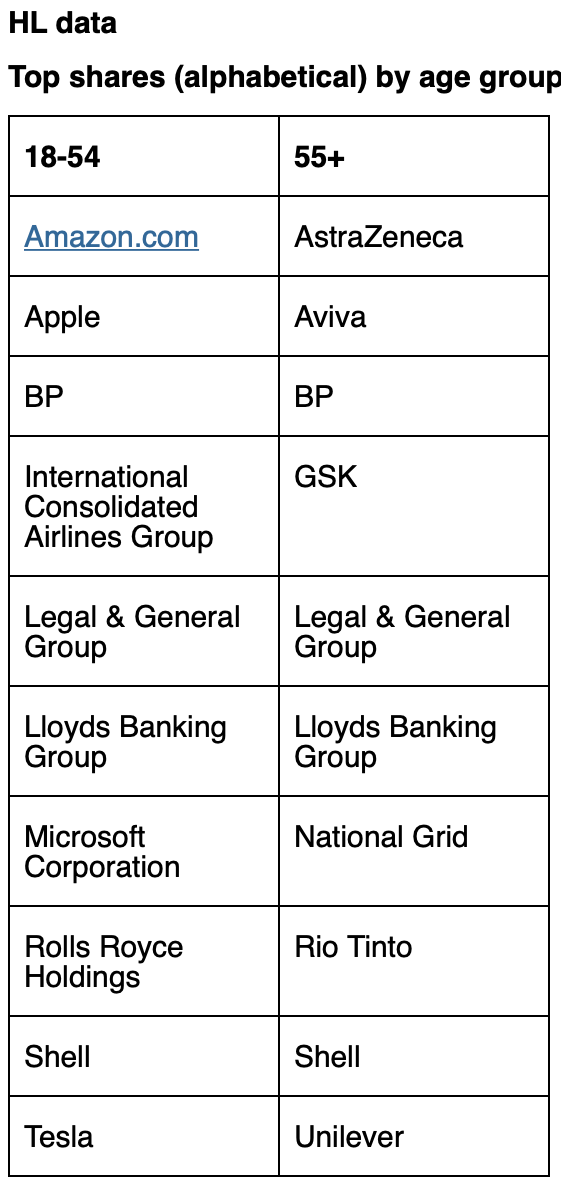

- Investors across the age groups hold oil majors and banks in their portfolios

- Younger investors are more likely to hold tech companies

- Older investors are more likely to hold pharmaceuticals

- People aged 65+ trade the least

- Those aged 55-64 trade more than any other age group

Older and younger investors have some striking differences when it comes to their portfolios, but an awful lot of it is driven by them tailoring their investments to their stage in life. When it comes to their overall approach, they have more that unites than divides them.

Both older and younger investors are looking for positive growth stories. Both age groups hold oil majors and banks – reflecting their history of producing strong dividends, and the profits oil companies have been making while the oil price is higher.

However, different generations of investors are seeing opportunity in different places. Younger people are more likely to have technology companies in the mix, taking advantage of the way tech is transforming economies around the world. Parents also favour these stocks for their JISA portfolios. Meanwhile, older investors see the potential in pharmaceuticals as the population ages.

How they approach trading also varies by age. Those aged 65 plus trade the least, followed by those aged 18-29, and investors aged 30-54. Those aged 55-64 trade much more than their nearest rival, but that may be because they are approaching retirement and need to position their portfolio differently for capital protection and income rather than growth.

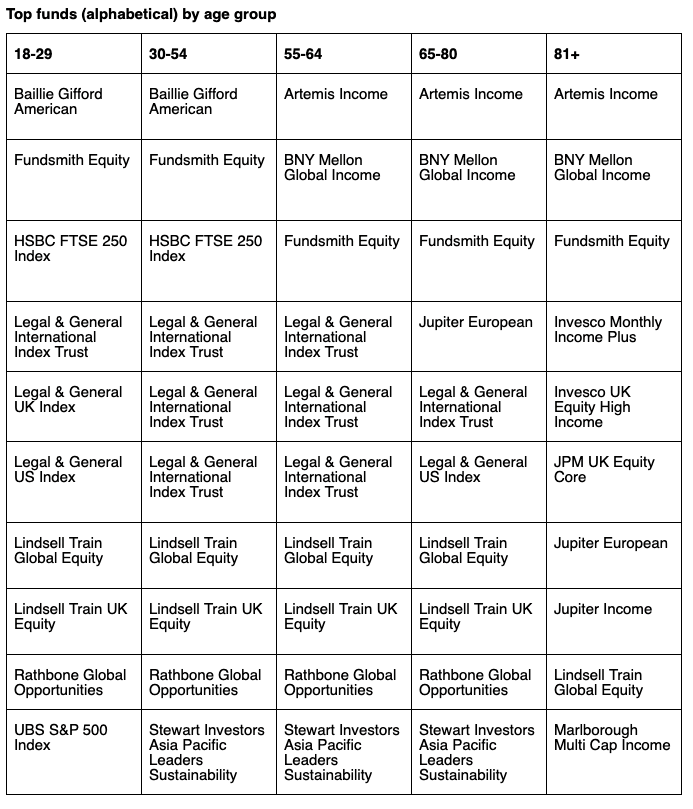

When it comes to selecting funds, there are some themes that appeal across the generations. All have exposure to global funds, and to those that spread the net far and wide.

Younger investors favour tracker funds, which offer exposure to long term growth at a low cost. They also have some smaller company funds in the mix, which reflects the fact that those with a longer time horizon tend to be able to take a little more risk.

While investors of all ages tend to have some exposure to the US, younger people may have more, partly because the market is dominated by some of the technology and growth stocks they favour.

When parents are picking funds for a Junior ISA, they’re aware that with a time horizon of 18 years, they can afford some more adventurous funds. So in among trackers and global funds they have smaller companies and emerging markets.

As we get older, we are marginally more likely to pick a sustainable fund, which makes it to the top ten for those in mid-life. And as your investment needs change, income funds play a more important role.