It would be easy to presume that wealthier households need more financial advisors than those with less wealth. Research conducted by Spectrem Group with households with over $25 million of net worth proves that this is not necessarily true. Not only do numerous ultra-wealthy households rely on only one advisor, but the largest percentage of these wealthy investors aren’t also even that reliant upon the advice of their financial professionals.

The research discussed in this study was conducted pre-pandemic. Spectrem is currently fielding up to date information in our $25 Million Plus Investors 2020 study which is available if you click here.

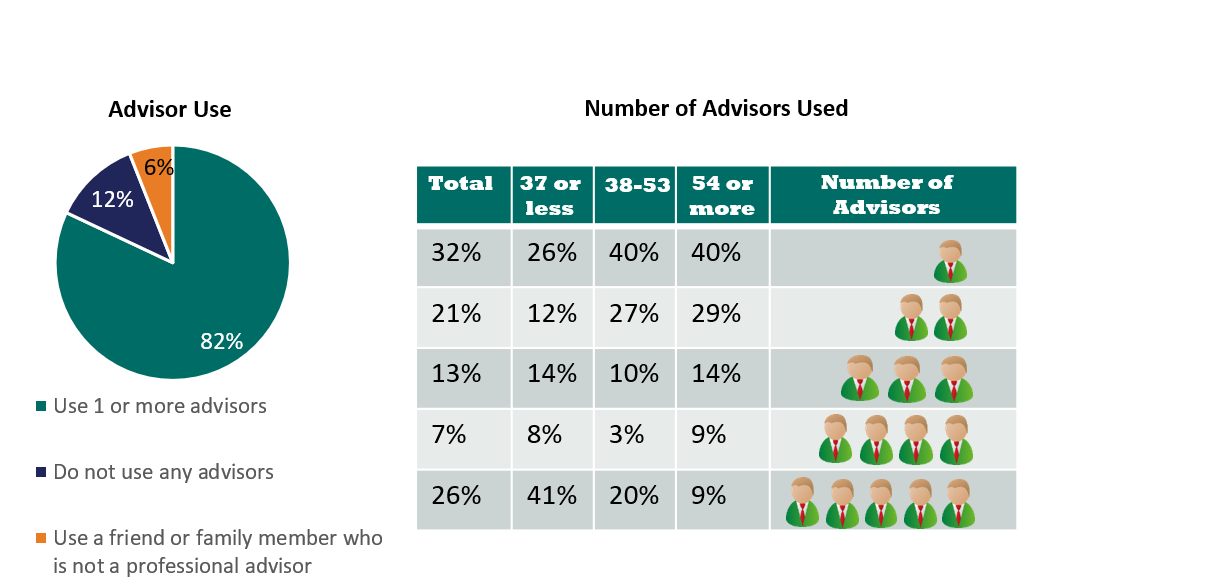

Eighty-two percent of wealthy investors indicated that they use 1 or more financial advisors. This would not include attorneys or accountants just individuals that give advice about investments and financial matters. Twelve percent indicated that they do not use any advisors and 5% rely upon friends and family members.

When those who use an advisor were asked how many advisors they use, 32% indicated that they rely upon one primary advisor. Twenty-one percent had two advisors while 26% indicated that they relied upon 5 or more financial advisors!

It’s interesting to note that the youngest of the wealthy households are the most likely to use multiple advisors while those over age 54 were the most likely to have only one advisor. Why would this be true?

- Younger investors are generally more interested in specialized investments such as hedge funds or other investments that are less common. Specialization may require relationships with more financial advisors.

- Younger investors are more likely to invest in socially responsible and ESG investments and may use advisors that are experts in those fields.

- Younger investors may not have developed deep relationships with a financial advisor and may still be identifying what they expect from an advisor. Older households have generally developed long-term relationships with an advisor.

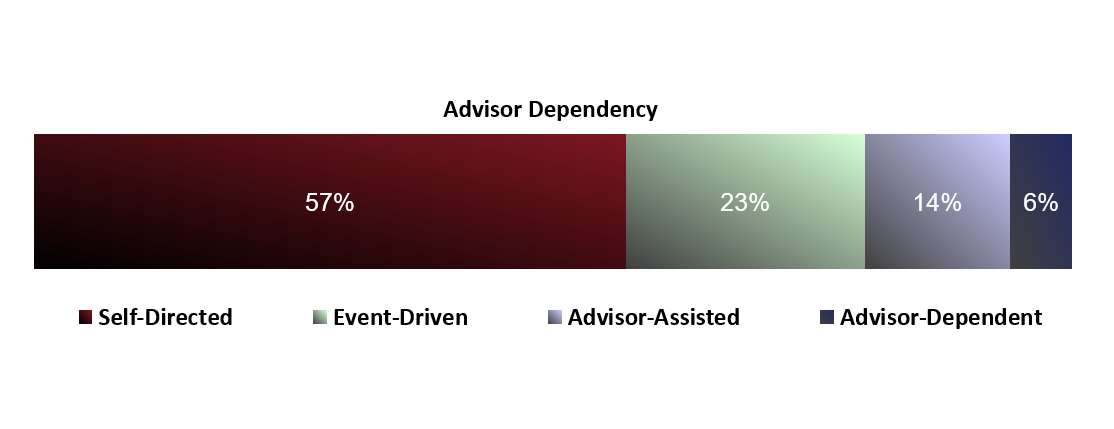

Another reason that younger investors may use multiple advisors is become they often are less reliant upon their financial advisor. As you can see below, 57% of $25 million plus investors identify themselves as “Self-Directed”. That means that they perceive that they make all investment decisions on their own, even if they may be asking a financial advisor for input. Because of this tendency, younger wealthy investors may contact several professionals for opinions and input and therefore identify each of these experts as an advisor. Ultimately, they are confident they can make the final decision themselves.

Financial advisors who are or who seek to work with these investors need to be aware of the predisposition of young wealthy households for multiple opinions. They also need to be prepared to deal with individuals who are somewhat confident in their own knowledge levels regarding investments. Money and ego are sometimes tricky characteristics and require financial advisors to carefully validate the value they add.