A good financial advisor can provide financial peace of mind, guidance in decision-making, and critically needed education. One advisory relationship can provide everything an investor needs, while other individuals need multiple advisors in order to meet all their needs. Just how many advisors are enough? Is there an ideal number of advisors?

Over half of wealthy investors use a financial advisor, according to recent research from Spectrem Group. This percentage is lowest among Gen X investors at 43 percent, and highest among WWII investors at 70 percent. This is not surprising as many investors do not seek an advisor until they begin thinking about retirement, which is not something that Millennials have top of mind. As wealth increases, so does the likelihood of using an advisor, with only 32 percent of investors with a net worth between $100,000-$499,999 using an advisor, while three-quarters of investors with a net worth between $10-$25 million use an advisor.

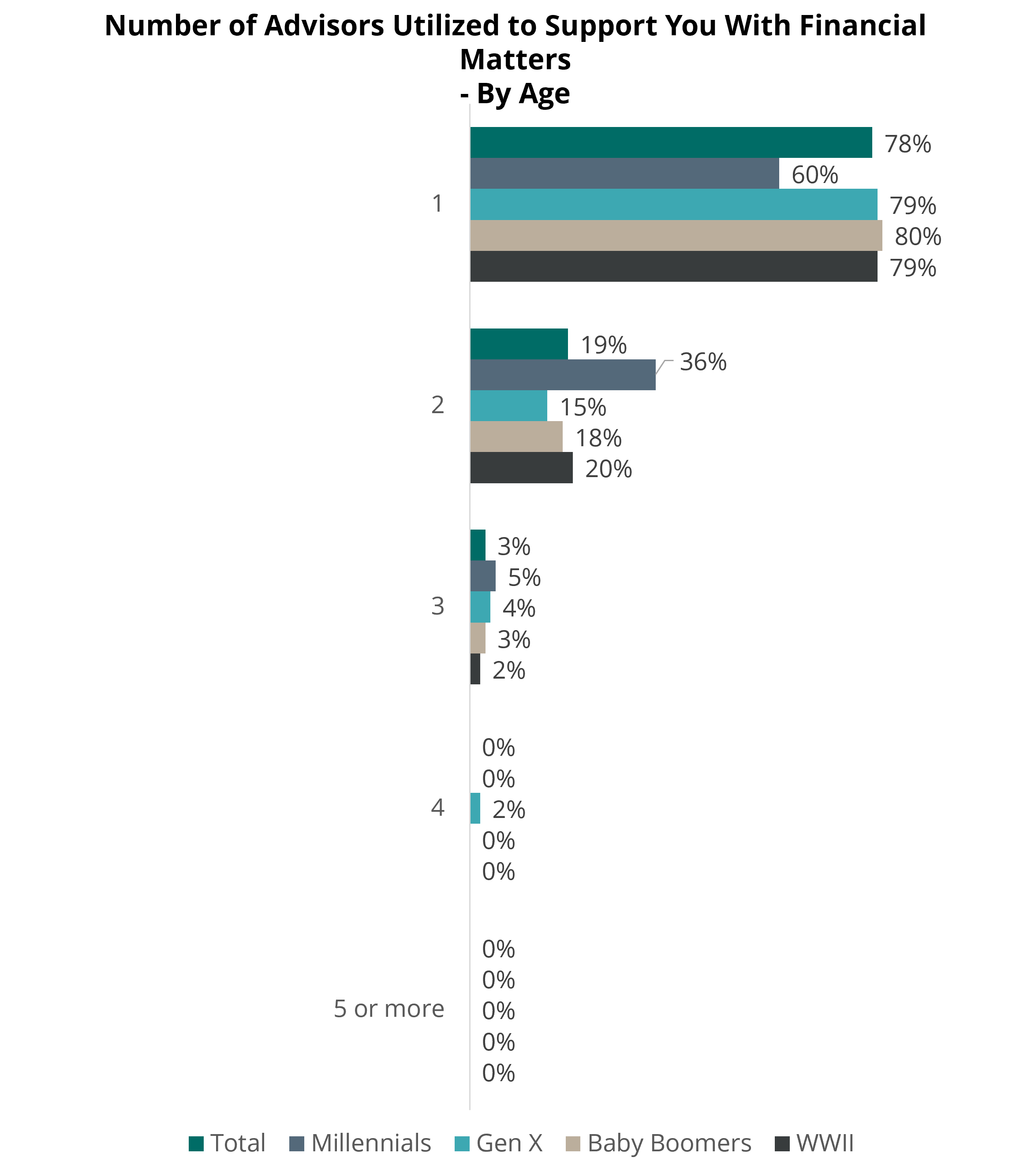

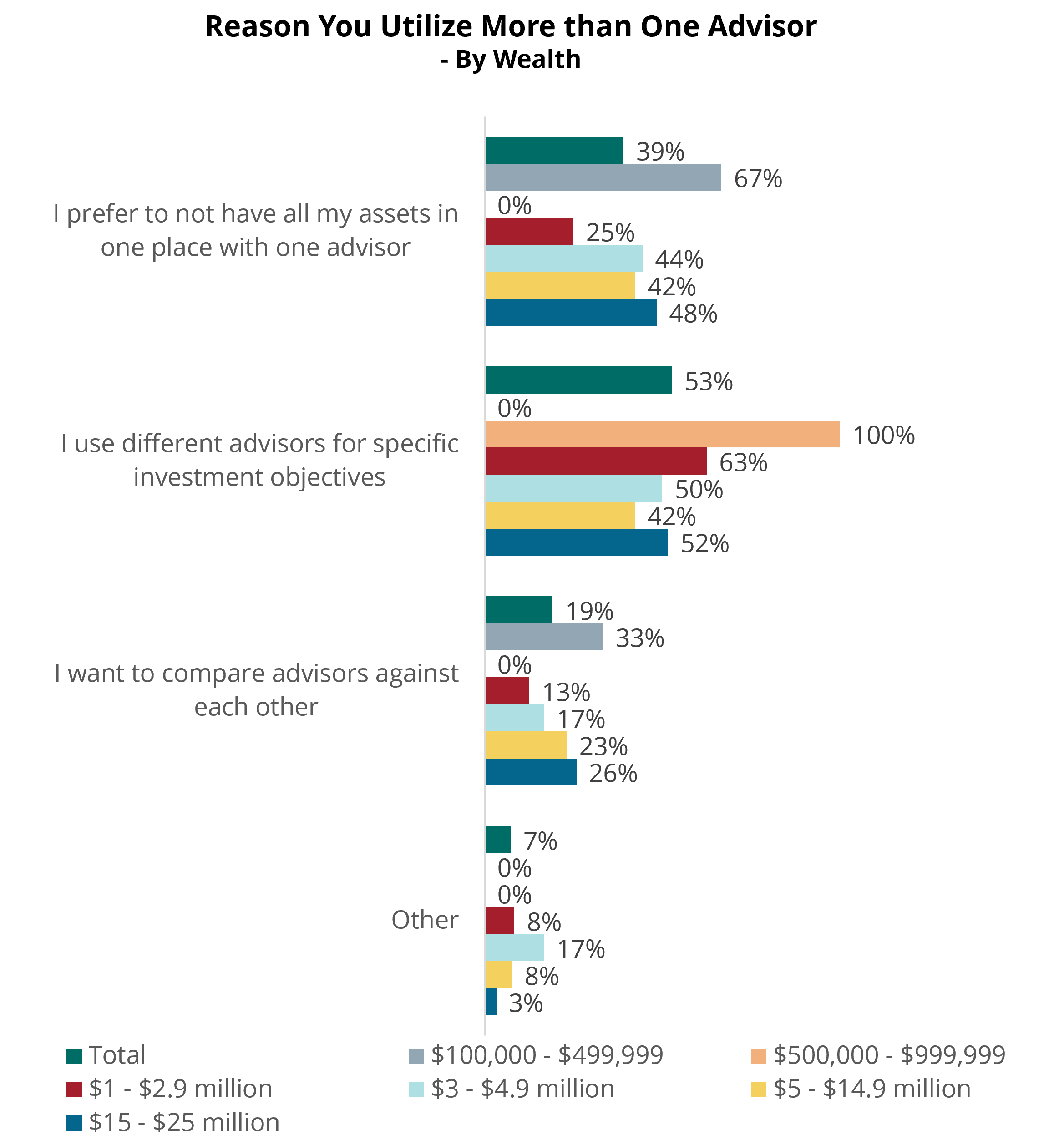

Now just how many investors are needed? Among those investors who use an advisor, 78 percent use just one advisor. Despite being less likely to use an advisor, 40 percent of Millennials use more than one advisor. Millennials are most likely to use multiple advisors because they want different advisors for specific investment objectives. Forty-seven percent of Millennials also prefer to not have all their assets in one place with one advisor.

Wealth also has an impact on how many advisors are utilized. Investors at the highest levels of wealth are more likely to use multiple advisors than those at lower levels of wealth. Eighty-nine percent of investors with a net worth between $100,000-$499,999 use only one advisor, compared to investors with a net worth between $10-$25 million who only 60 percent use one advisor. Those investors at lower levels of net worth are the most likely to use more than one advisor because they prefer to not have all their assets in one place. Investors at higher levels of net worth are more likely to use multiple advisors because they utilize different advisors for specific investment objectives.

The majority of investors clearly feel that one advisor is all they need to properly manage their investments. The primary reasons why investors only have one advisor is that they trust their advisor completely and that they are pleased with the advisor’s performance. This makes it unnecessary in the eyes of the investor to hire a second or third advisor. Investors who do feel the need to use multiple advisors should ensure that they have reviewed their asset allocation with a professional in order to avoid any unnecessary risks.

Related: Do Investors Read Print Media?