Written by: Will Casserly

The uncertainty and volatility of the last 2 years has brought a dynamic shift in how accounting and financial services firms do business. From the COVID-19 pandemic and political unrest to market fluctuations and the threat of inflation, it may feel as if there is no light at the end of the tunnel. Many accounting and financial services firms are pulling back, adopting a wait-and-see attitude. But are they missing out on opportunities? Where should firms be focusing their efforts? To thrive in the face of uncertainty it’s critical to understand what is driving buyer behavior. What are buyers’ top challenges and concerns today—and how can we gain real insights into their decision-making process?

One of the best places to get answers to those questions is the just-released edition of our pioneering study of professional services buyers and sellers called Inside the Buyer’s Brain, Fourth Edition: Accounting & Financial Services.

About the Research

At the Hinge Research Institute, we’ve studied more than 40,000 buyers and sellers over the past decade—giving us unparalleled insight into the professional services industry.

Our most recent study of the accounting and financial services industry explores the perspectives of more than 900 buyers and 500 sellers and examines their perspectives across on the following topics:

- How well do accounting and financial services sellers really know their buyers?

- What are buyers’ key business challenges?

- How do clients feel about their service providers?

- How do buyers search for service providers?

- How do buyers evaluate service providers?

- How do buyers make their final selection?

Here are four key insights that came out of our report.

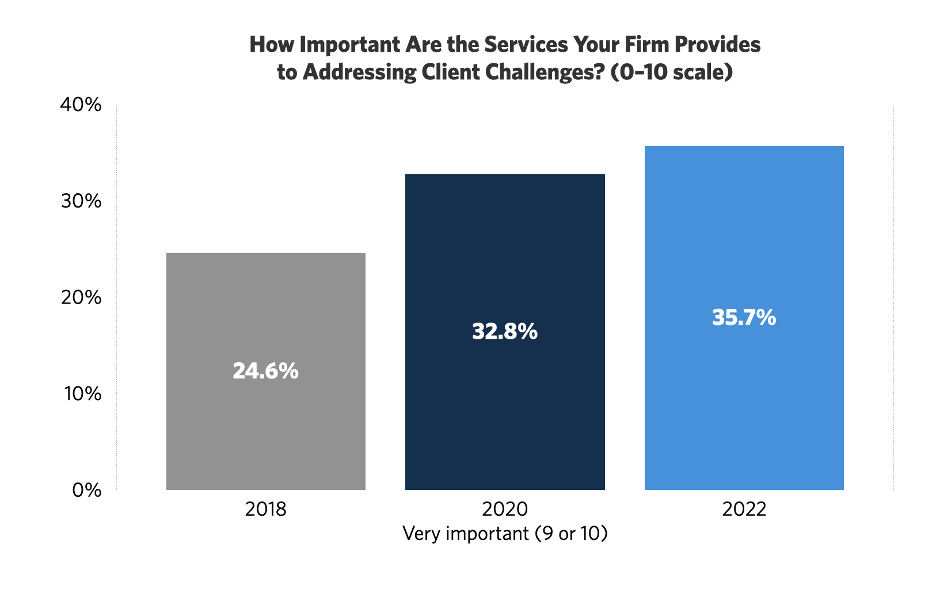

Finding #1: Relevancy ratings have risen to an all-time high—but there is plenty of room to grow

Relevancy for accounting and financial services is at an all-time high. And although that is excellent news, other industries have attained even higher thresholds. This rise may be partially attributed to pandemic-related needs, but now is a great time to lean into that advisory role and clearly communicate your expertise, experience, skills, and services. Don’t assume that your clients understand your full depth of services. Demonstrate ways that you’re more relevant to solving issues, compared to your competitors.

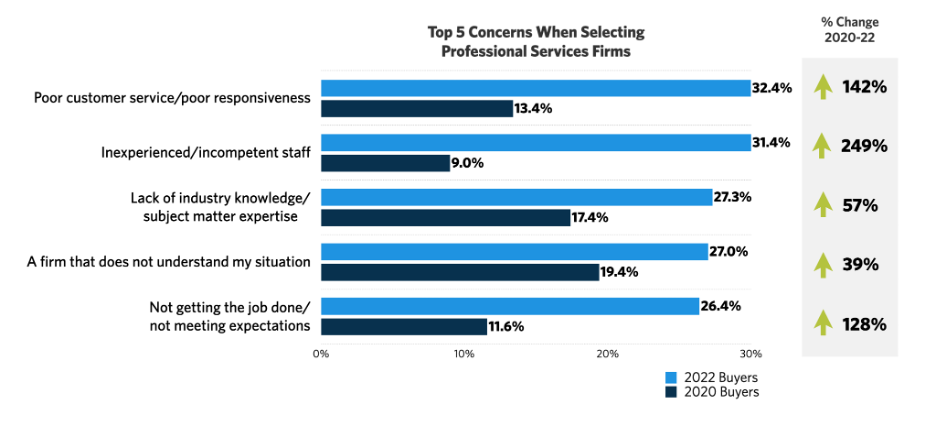

Finding #2: Inexperienced staff and poor customer service have become bigger concerns

Buyers have had some challenging experiences, and the decisions they are making are based not only on what they are looking for, but also what they’re looking to avoid.

We see that sentiment reflected in “poor customer service,” which is up 142% since 2020—and in “inexperienced, incompetent staff,” which has had an even more dramatic increase of 249%. First, look to mitigate those combined issues with better training and development programs for your staff. Equally as important, make sure you’re communicating in ways that let buyers know that you are highly attuned to those specific concerns. Talk openly about how you handle client service, how staff are trained, longevity of your staff – all things that communicate the stability of the client experience and your ability to deliver quality services.

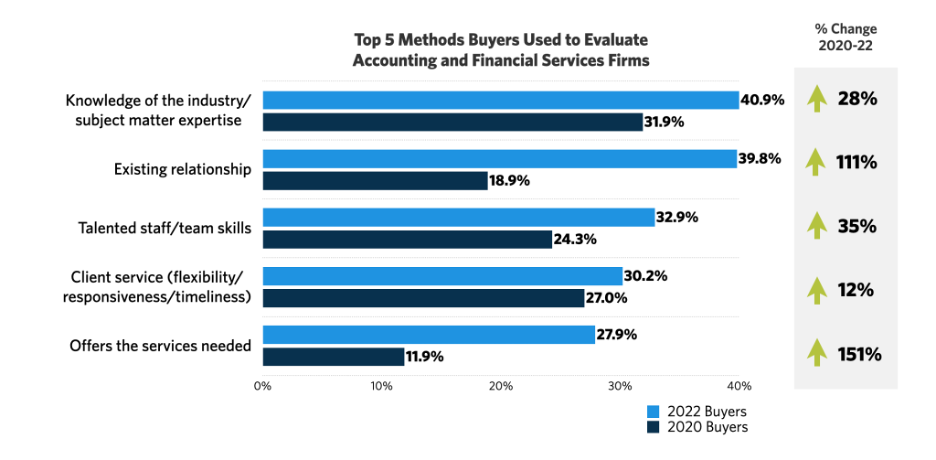

Finding #3: Existing relationships have become substantially more important for buyers

Moving forward in the buyer journey and looking at the top selection criteria for buyers, there are two evaluation criteria that really stand out. First, the importance of an “existing relationship” is up 111%. While this trend had been in decline for a number of years, it has suddenly reversed. In times of uncertainty like these, clients are looking to reduce risk. They want to work with partners they already know. This is a key finding to understand.

Another takeaway is the importance of industry knowledge. During the business development process, be sure to talk about your team’s relevant expertise and support it with freely available thought leadership that you make available online.

All of these metrics relate back to a desire to reduce risk. Buyers are asking: Do you get me? Do you understand my needs? Are you going to get the job done? Do you have the people in place? Are staff going to be there when I need them?

Combine the desire to work with an existing partner with “offers the services needed,” which is up 151%. Considering those criteria together would suggest you may want to review your business development process. Talk about increasing the frequency of conversations with existing clients to uncover new opportunities. Conduct research to uncover their specific needs and raise the overall quality of your thought leadership to include very detailed industry insights.

Chances are, there is a lot of fruit still on the vine with your existing client base. In times of uncertainty, clients can be averse to change—and they would rather work with a firm they know and trust. An added benefit for you is that it’s a lot less expensive to build new opportunities with existing clients than to develop new relationships.

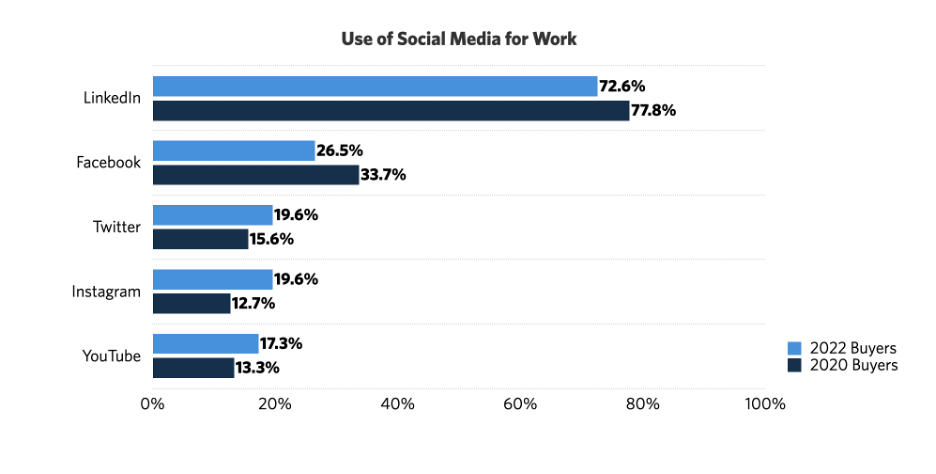

Finding #4: LinkedIn dominates, but other social media platforms are increasingly being used for business purposes

This chart looks very different for accounting and financial services compared to other professional services industries. LinkedIn is the dominant social media platform everywhere, but in most other industries the competing social channels are in decline. In the case of accounting and financial services, there’s been a dip in the use of Facebook, which likely reflects a trend where social media channels are being used for specific purposes for specific audiences. Interestingly, we see an uptick in Twitter, Instagram, and YouTube. Unfortunately, the data doesn’t fully reveal why their use is on the rise in one industry but not the others. One explanation could relate in part to job seekers and recruiting efforts across various social media platforms.

A Few Final Thoughts

Since our last study two years ago, it may come as no surprise that accounting and financial services buyer behavior has changed. Prolonged uncertainty and regulatory changes are fueling buyers’ needs for advice and services—and that same uncertainty is also influencing buyers’ decision-making and a desire to reduce risk.

In this changing landscape, the best way for your firm to stay relevant is by researching your target audiences to understand their specific challenges and needs—as well as where they look for information and how they evaluate service providers. This type of research will validate—or challenge—your assumptions and decisions.

Related: Top 21 Examples of Differentiators for Advisory Firms