The foundation of a great client experience is delivering on the core expectations and preferences of each prospect and client. And while that gets you to satisfaction rather than engagement, it’s clearly a good place to start.

But it’s easy to forget that those core expectations evolve over time. We assume that because clients are satisfied, we’re doing the right things. And while that may be true at a point in time, we need to test those assumptions on a regular basis.

And it starts with four questions:

- Have client needs and expectations changed?

- Is there evidence that those needs and expectations are changing going forward?

- Are needs and expectations changing uniformly across all clients or client segments?

- Am I allowing my own bias to cloud my vision of what clients really need, want and expect?

And the Research Says….

Every year Absolute Engagement conducts one of the largest high-net-worth investor studies, in partnership with the Investments & Wealth Institute. That research highlights changes in core expectations and the changes we can expect. And while ‘the industry’ isn’t necessarily a proxy for your clients, it’s a starting point in analyzing which aspects of your client experience, if any, you may want to evolve.

Frequency of Contact

Clients are generally satisfied with the frequency of contact they receive from their advisor. However, there is evidence that the structure we’ve used for decades may need to change. Many progressive firms are experimenting with different ways of delivering reviews, including:

- A shift from fewer, longer reviews to more frequent, shorter reviews

- A comprehensive annual review with issue-specific, targeted reviews in between

While clients, on average, want two to three meetings, the chart below highlights the fact that averages don’t mean a great deal. Why?

- There is a range of expectations. If I want four reviews a year, I don’t particularly care that your average client wants two.

- Age matters. Younger clients are more likely to want more frequent reviews, noting those reviews can be shorter and delivered virtually.

Going (or Staying) Virtual

We know that COVID created a significant shift toward virtual meetings. After all, we didn’t have a choice. That trend has been tempered but not eliminated. Today, 52% of clients say they prefer something other than in-person reviews.

However, we have to look at this data with caution because two factors are influencing the results. The first is the 'COVID effect' and the second is demographics. Both lead (or led) to a preference for virtual reviews. That means that as your younger clients age, you'll need to deliver more virtual reviews, irrespective of the impact of a global pandemic.

When we break those expectations down by age, the results are more interesting. Older clients are more likely to prefer in-person meetings and younger clients are more likely to prefer virtual meetings. Keep in mind, of course, that ‘more likely’ doesn’t mean everyone in that segment prefers one or the other approach.

TikTok and Snapchat (For Real)

I’m the first one to shake my head as my son is showing me yet another crazy cat video on TikTok. At the same, I fully appreciate that I’m not the target demographic. So while I won’t ask you to start recording TikTok videos just yet, it’s helpful to understand that things are changing. And that means that your client experience will also need to change, like it or not.

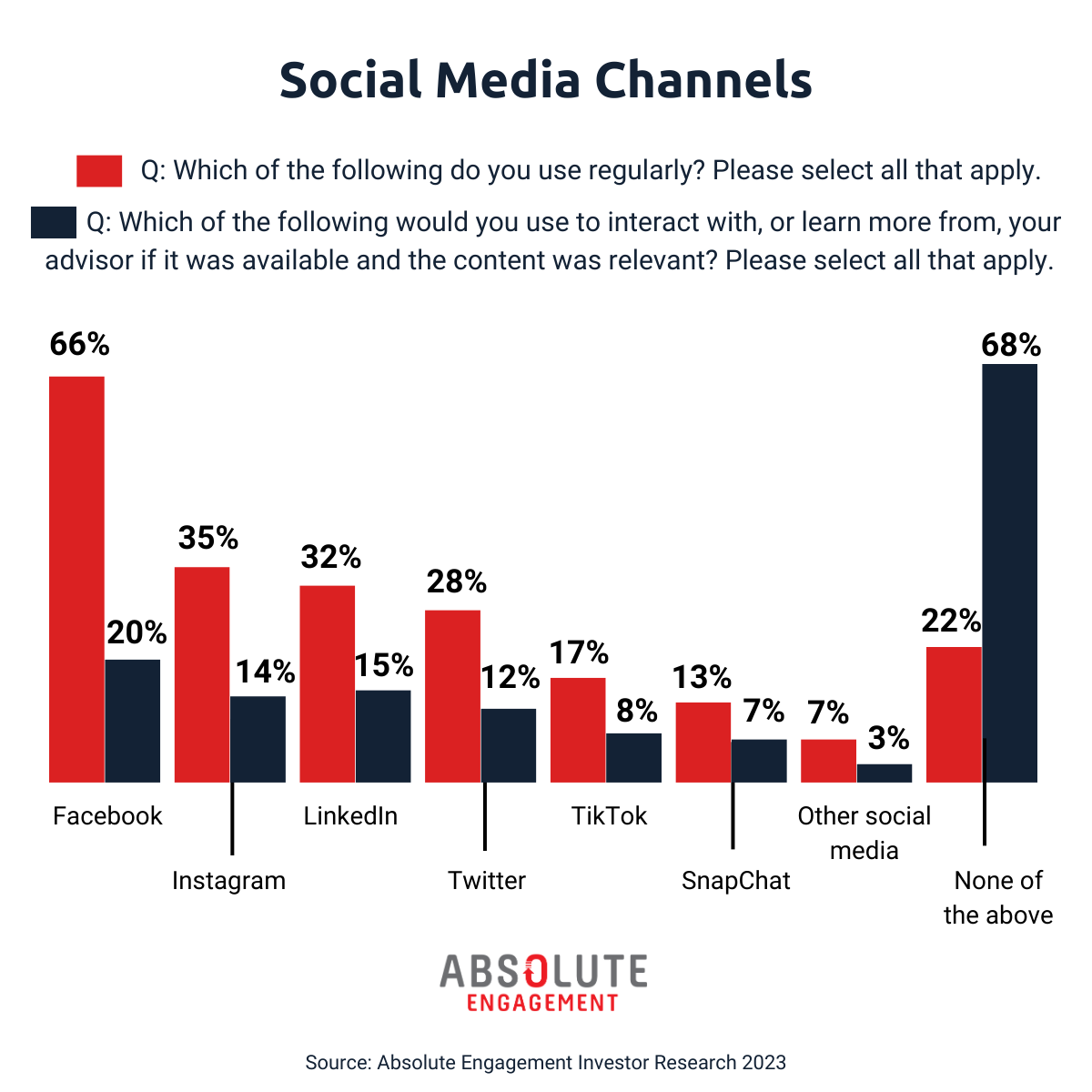

We asked clients to identify the social platforms they use regularly and then, importantly, which they would be interested in using to connect with/learn from their advisor.

You’ll notice that far fewer clients say they do (or would) use social media to connect with their advisors, than use them in their daily lives. That’s to be expected. But the real story is that almost a third of clients would - and that's a significant change. Eighty-seven percent of clients say they use at least one social media channel regularly and 32 percent say they would use social media to interact with, or learn from, their advisor (if the content was relevant).

Once again, age matters. 87 percent of clients between 35 and 44 say they would use some form of social media to interact with/learn from their advisor. That jumps to 95 percent for those under 35.

And while it’s easy to ignore channels like TikTok and Snapchat because so few clients appear to be using them, look at that data by age and you see a very different story. Those channels are being used extensively with younger clients. And based on simple math, those younger clients will become the older clients of your business.

Taking Action

Research is a funny thing. It’s helpful to understand the landscape of client expectations, but it doesn’t tell you if or how your own clients differ. That comes down to having a process in place to capture input from your clients on a regular basis.

This isn’t a post about the specific tactics you should employ to enhance the experience. Instead, the action is to take stock, while letting go of your personal assumptions and biases.

Consider a team exercise. Map out the key components of your client experience today and ask yourself the following questions.

- Does the experience we are delivering reflect the individual expectations of our clients, or are we standardizing around an average client that doesn’t exist?

- Which aspects of the client experience could change in future (whether we want it or not)? Consider frequency, length, format or focus of review meetings or the ways in which you interact with your clients.

Note that if you have this meeting and there are no young people at the table then stop, find some and start again.

Related: Stop Trying to “Fix” Your Clients