A client referral is the holy grail of prospects in the financial industry. These referrals often close at a higher rate, and the sales cycle is shorter than that of someone without a referral. Financial advisors are continuously looking for ways to increase referrals from their client base, but perhaps it would benefit them to focus on certain types of clients more than others. Knowing what segment of client refers their financial advisor the most allows advisors to focus on that client segment and ensure the highest levels of satisfaction.

What exactly is a referral? According to recent wealthy investor research conducted by Spectrem Group, nearly two thirds (63 percent) of investors consider a referral to be giving someone their financial advisor’s name and number with a suggestion that they contact the advisor. Twenty-seven percent of wealthy investors believe that a referral is speaking positively about their financial advisor but leaving it up to the person to establish contact. Only twenty percent of investors consider a referral making an introduction directly to their financial advisor. Millennials are the exception to this, with 41 percent defining a referral as a formal introduction to their financial advisor.

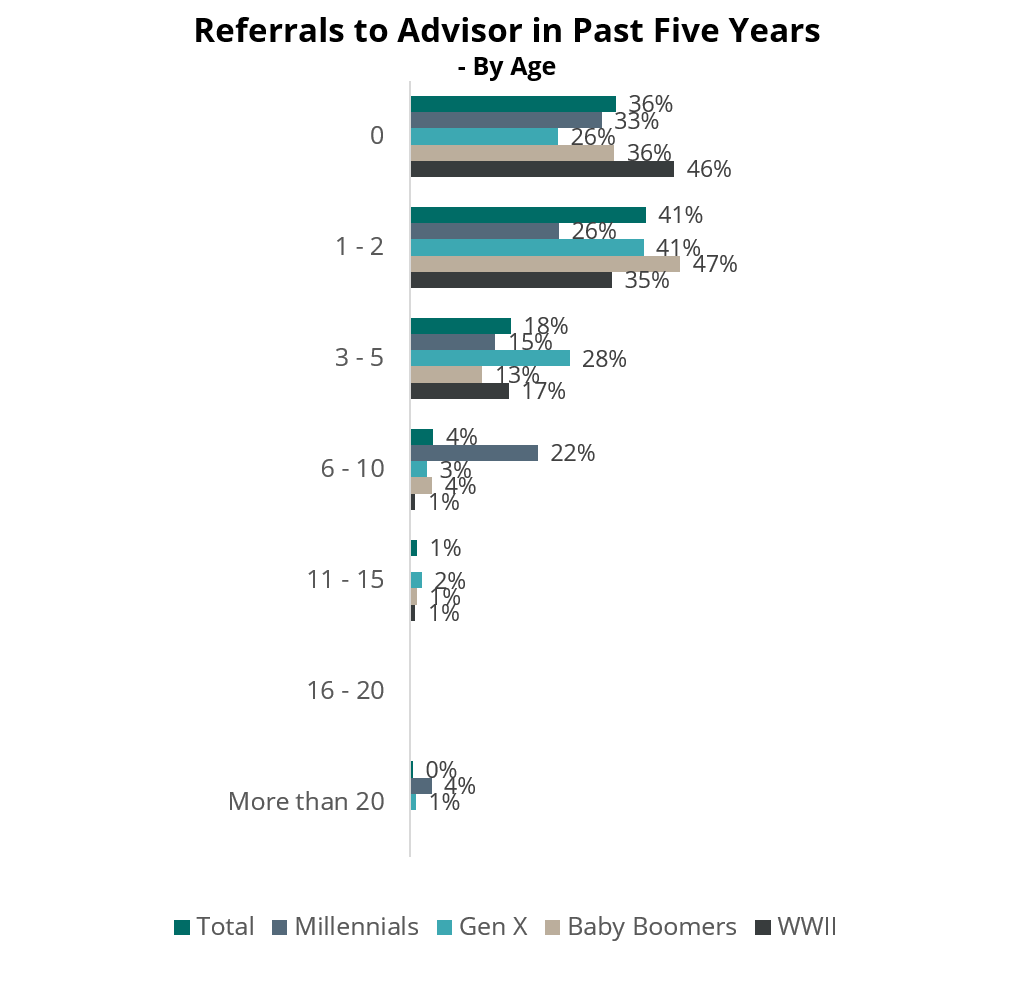

That more engaged, hands-on approach to the referral process is especially beneficial with Millennials, as they are referring their financial advisor more frequently than any other age segment, with 22 percent of Millennials referring to their financial advisor between 6-10 times in the past five years. This is in stark contrast to only four percent of wealthy investors who have referred their advisor that frequently in the past five years. In fact, four percent of Millennials have referred their financial advisor more than 20 times in the past five years.

Investors at the highest levels of wealth are also referring their financial advisor more than other investors. A quarter of investors with a net worth between $15MM-$25MM have provided between 6-10 referrals their advisor in the past five years. At the other end of the wealth spectrum, 45 percent of investors with a net worth between $100K-$499K have not referred their advisor at all in the past five years.

Some clients simply do not refer their financial advisor, and the most common reason for not referring among wealthy investors is that the investor does not feel it is their place to tell other people where to go for those services, with nearly half (46 percent) indicating that is the reason for their lack of referrals. Thirty-six percent of investors do not refer to their financial advisor because they do not discuss those topics with their friends.

Financial advisors that are looking for clients that will help grow their business through referrals should consider focusing on Millennial clients and wealthier clients, as they are more likely to provide those referrals. In the case of Millennials that referral is one that is as direct as possible, providing for the most ideal referral situation.