Generational trends form customer expectations of financial brands

The forces that shape the different generations in America also shape the way Gen Z, Millennials, Gen X and Boomers make, spend, manage and invest money. We’ve pulled out some of the latest highlights below from the Logica® Future of Money Study. Want the full picture? You can access through the Logica® Future of Money Study Insights Kit!

Gen Z Financial Persona

In terms of work, Gen Z is most likely to be switching jobs (compared to other generations) as they begin their careers and navigate their first jobs. For payments, they tend to use debit cards more than credit cards. However, we see them starting to use credit cards more due to inflation, as well as for big purchases. They are proving to be the most driven generation to save for their future and are saving more than other generations due to current market volatility. Gen Z is also very open to all Crypto has to offer. For financial advice, they look to family and friends over a professional financial advisor—and also are looking to YouTube.

Millennial Financial Persona

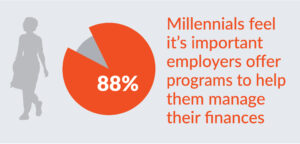

Millennials are in transition in their work, with two-thirds saying they will switch jobs in the next year. At work, they are looking for employers to offer financial management programs and help. On the spending and payments front, this generation also leans toward debit cards over credit cards but will use credit cards for larger purchases—while also still using Buy Now Pay Later. Millennials use more peer-to-peer payment brands than other generations. For money management, they are the most bullish generation on Crypto, while generally being engaged overall in saving and investing. They want professional financial advice but also use DIY apps for more fundamental saving and debt advice.

Gen X Financial Persona

For now, Gen Xers are generally staying put at work. For how they pay: this generation is still big on credit cards for payments, though also as likely as Millennials to use PayPal. Gen X is bearish on savings and investing, unlike the bullish younger generations. And, they want input from professional advisors. They are interested in investing in Crypto but less open than younger generations to other ways to use it.

Boomer Financial Persona

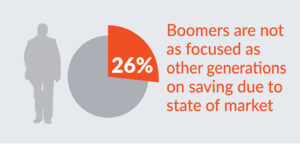

For those Boomers who are working, they are least likely to be switching jobs. If they are working, they are looking to their employers to offer retirement advice. For spending, they continue to rely heavily on credit cards for any purchase price. And like Gen X, they are bearish on saving and investing but have little interest in Crypto. Boomers aren’t looking for a lot of financial advice, but when they do, they prefer to get 1:1 advice in person.

Related: Future of Money Says…Crypto Enthusiasm Will Continue to Grow