Estate planning is something that many investors avoid at all costs, after all, who wants to talk about death and dying? Skipping this important step in financial planning can have disastrous consequences for investors, including those investors at the highest levels of wealth. A lack of proper estate planning can result in estates potentially losing millions of dollars or struggling with being able to obtain access to millions.

America’s wealthiest investors, those investors with a net worth of $25 million or more, not including primary residence, should have very comprehensive estate planning completed. However recent Spectrem Group research reveals that this is not the case, and these ultra-wealthy investors are just as reticent to discuss end-of-life topics as their less affluent counterparts.

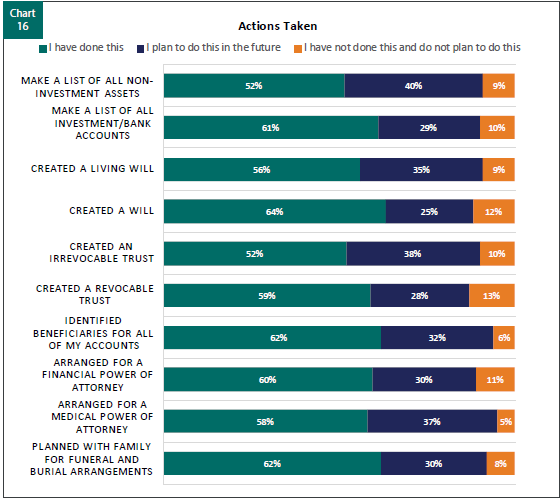

One of the first, and most basic steps in estate planning is creating a list of all investment and banking accounts. According to Spectrem’s research, only 61 percent of $25 million plus investors have made a list of all their investment and banking accounts. This is often a time-consuming endeavor, especially for an investor that has multiple accounts across several providers. It is also often assumed by married couples that both of them are fully aware of all their accounts, however in grief it is easy to overlook investments, so it is always beneficial to have one consolidated place where every account is listed. Twenty-nine percent of $25 million plus investors plan on creating this list in the future, but with the future not promised there is no better time than now to complete that task.

Another simple action investors need to take to protect their assets and allow for a smooth estate distribution is properly identifying beneficiaries for every account. Only 62 percent of $25 million plus investors have completed this task. This extends to insurance coverage as well. It is important for wealthy investors to not only identify primary beneficiaries, but also secondary beneficiaries. Nearly a third, 32 percent, of $25 million plus investors anticipate completing this critical estate planning step in the future.

The creation of a will or trust is often what many investors initially think of regarding estate planning, yet less than two-thirds of America’s wealthiest investors have created a will or a trust. This reveals a significant gap in proper estate planning and can cause significant delays to estate distributions and can also cause unnecessary estate tax liabilities. This step typically requires support from an estate planning attorney or lawyer. If these investors do not have an estate planning attorney or lawyer, they should work with their financial advisor to find one and get these documents in place as quickly as possible.

Some other estate planning tools that are important to have in place are a financial and medical Power of Attorney. No one anticipates being incapacitated and unable to make their own financial or medical decisions, yet that happens to many Americans every day, and illness does not only affect those investors at lower levels of wealth. Having a financial Power of Attorney in place will allow for a smooth transition in the event of the investor no longer being able to make their own financial decisions. A medical Power of Attorney may not impact finances to a significant degree, however having one in place can avoid unnecessary disputes between families.

While no one wants to talk about death, it is one of the few certainties in life, making it critical that investors are prepared for it. Properly preparing for end-of-life allows for the maximum amount of assets to be distributed to the estate’s beneficiaries and prevents unnecessary financial losses and delays.