As a business owner I have always had the feeling that I make decisions differently than other investors. Running a company requires a mindset that never forgets people, sales, expenses, or the bottom line. That type of thinking permeates into every aspect of my life, as I am sure it does for many other occupations. I have friends and family that run the gamut of occupations, from senior level executives, to teachers, managers, doctors, and individuals in information technology. They all operate in their lives and make decisions differently than I do, which may be a result of their occupation, or they chose the occupation they are in because it was uniquely suited to who they are and how they make decisions.

Regardless of which came first, different occupations impact decision making and priorities. How exactly do those different occupations impact the selecting of a financial advisor? What types of differences in priorities can be seen when examining investors from different lines of work? Spectrem reveals these differences in our ongoing research on a variety of topics, but I wanted to know more about the advisor selection process. How does occupation impact the importance of various traits when hiring a new financial advisor?

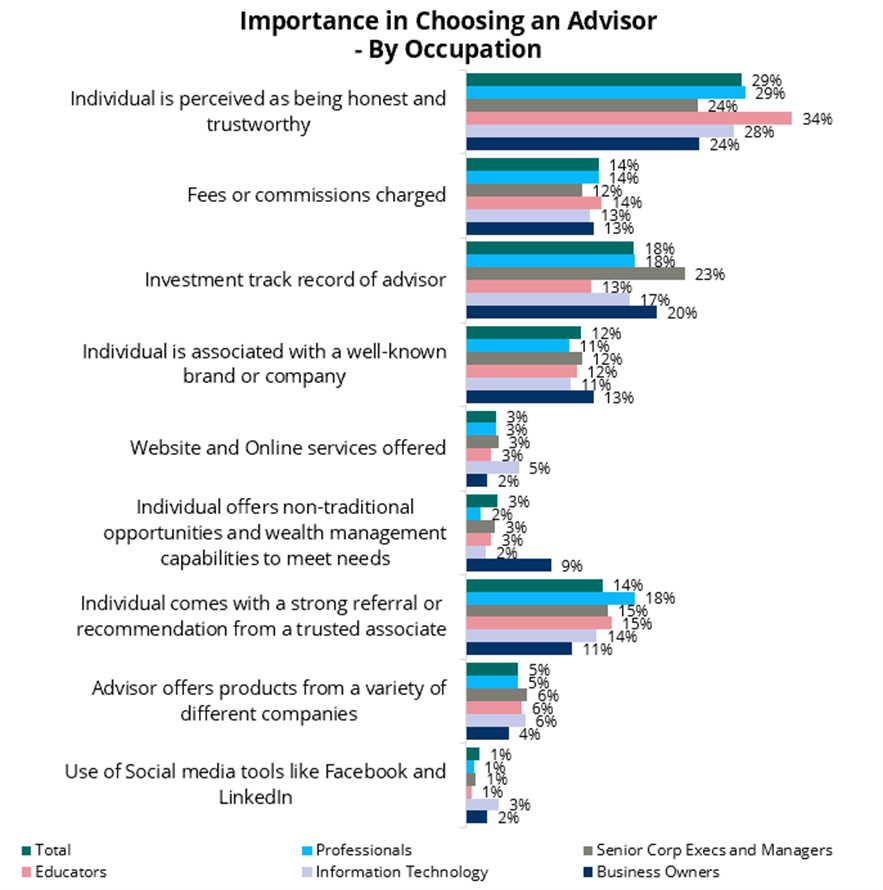

Some traits and characteristics of an advisor are important to all investors, regardless of occupation, as is the case with desiring an advisor who is honest and trustworthy. That trait is the most commonly identified characteristic by investors from every occupational segment, however the percentage within each occupation does vary. This pursuit of an advisor who is honest and trustworthy is the most important trait to 34 percent of educators surveyed, while less than a quarter of senior corporate executives & managers, and business owners feel similarly.

Since everyone agrees on what is most important, you would think there would be agreement on the second most important trait, but that is not the case. Professionals have a tie for the second most important trait between the advisor’s investment track record, and that the advisor needs to come with a strong referral or recommendation from someone they trust. Senior corporate executives & managers agree with professionals somewhat, as their second most important trait is the advisor’s investment track record. Educators value the advisor coming with a strong referral as their second most important trait. Investors in information technology and business owners both value the investment track record of an advisor they are considering hiring.

Investors also tend to agree on what is least important, as less than five percent of investors care about an advisor using social media tools or if the advisor offers non-traditional opportunities and wealth management capabilities, regardless of occupation. Not surprising, investors in information technology are slightly more likely to care about the website or online services offered by an advisor when considering hiring them.

While it’s clear that occupation impacts decision making somewhat, it is also apparent that there are several similarities that exist across all career fields. It is nice to know that while age, wealth levels and retirement status can have a significant impact on advisor selection, occupation creates common ground in the pursuit of an advisor who is honest and trustworthy, from a strong referral source with a solid investment track record.

Related: Advisor Satisfaction By Generation