Financial providers are constantly working to differentiate themselves from their competition. Consistent evolution of service offerings has become necessary as the financial landscape has changed dramatically over the past several decades. Investors having access to information and DIY options regarding every aspect of their lives, including financial management, has made it even more critical for financial firms to understand what types of services they can offer that provide the added value investors are seeking.

One approach to offering these unique and valued services is through wealth management. Wealth management providers need to understand what types of services investors feel they need included in their wealth management and either develop a solution to those needs, or partner with other providers to provide a solution to all of the various topics that wealthy investors indicate they need as part of their wealth management.

Many firms may be asking themselves; is it worth it to add all of these additional services to our business? Will there be a benefit to our firm if we expand our offerings to include some of the additional topics investors are looking for? The short answer is YES, it is absolutely worth it. Spectrem Group recently researched the topic of wealth management, including examining the benefit to financial providers who are offering wealth management. The benefit is clear and measurable.

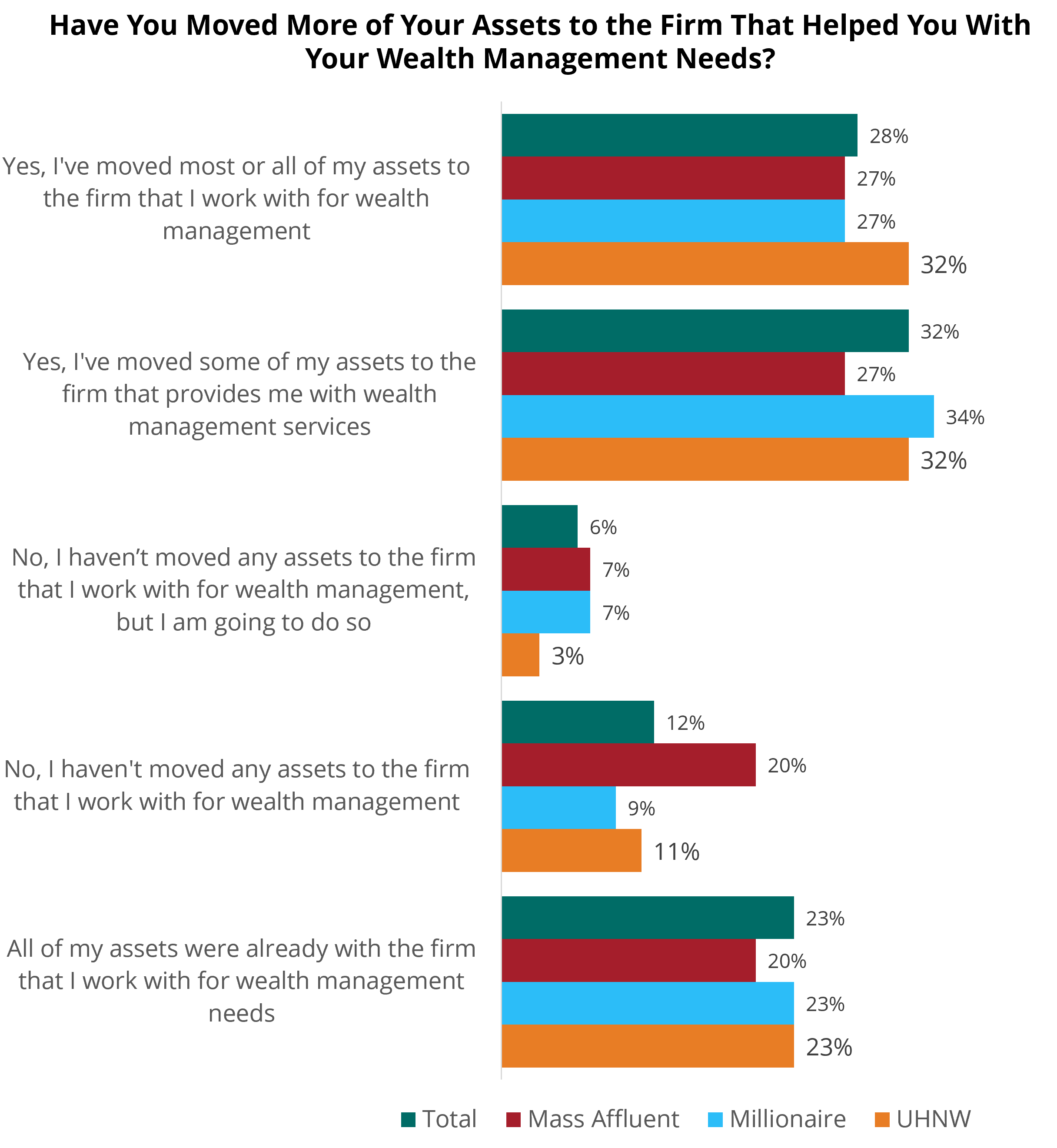

Less than a quarter of investors already had all of their assets with the firm that helped them with wealth management, so that leaves over three-quarters where there is opportunity to increase share of wallet. Twenty-eight percent of investors who receive wealth management services from their provider have moved most or all of their assets to the firm that helped them with their wealth management needs. Nearly a third of investors have moved at least some of their assets to the provider that helped them with wealth management. A small percentage, six percent, have not moved assets to the firm that helped them with wealth management, but they plan to do so. Only 12 percent have not moved assets and do not plan to move assets.

That percentage of those investors who have moved most or all of their assets to the firm that they work with for wealth management increases to nearly a third at the highest levels of wealth. The same percentage has also moved at least some of their assets to the firm that provides them with wealth management services, illustrating that nearly two-thirds of investors at the highest levels of wealth that receive wealth management services from their provider will move additional assets to that firm.

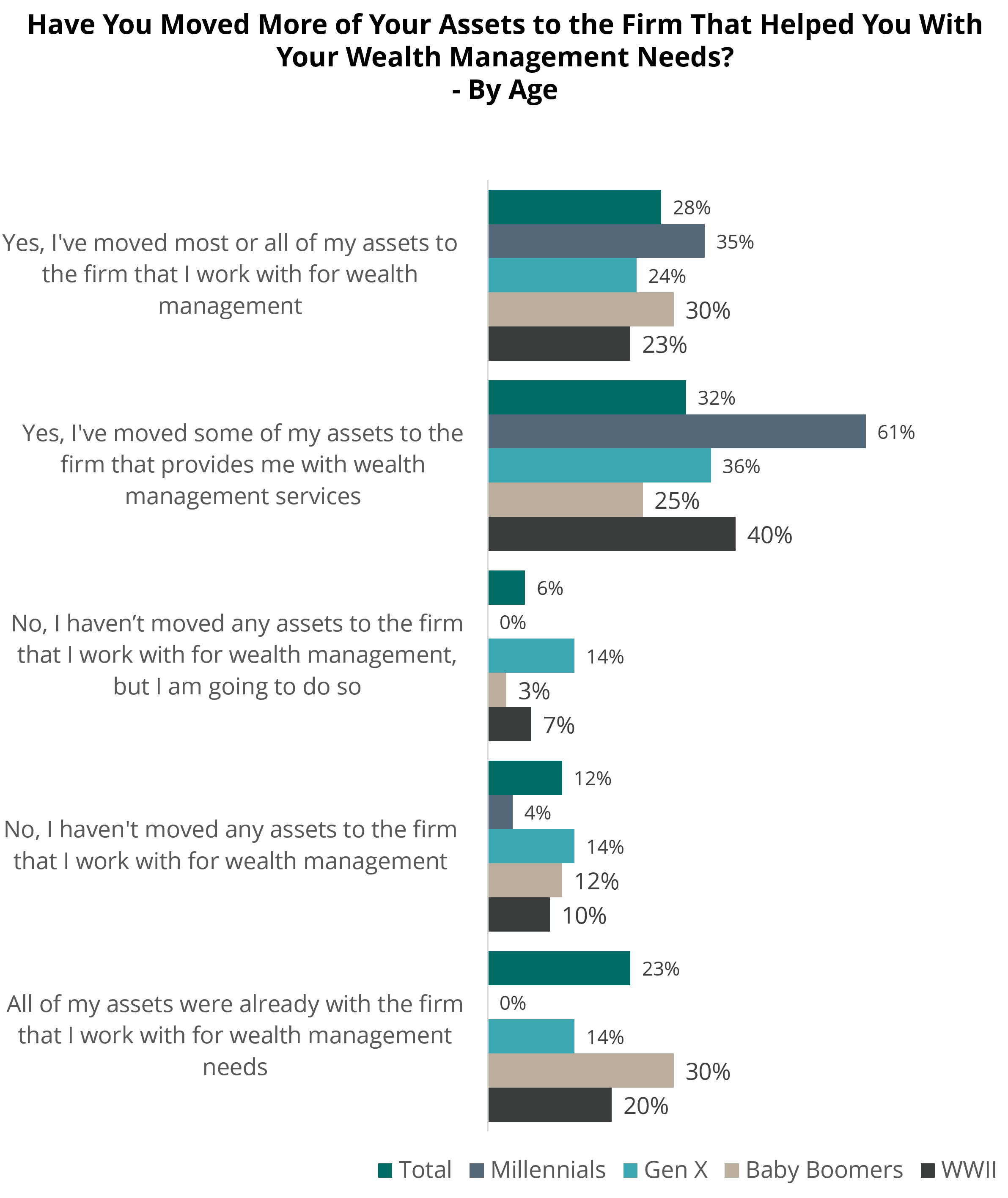

Financial providers who are deciding to work with Millennials will be happy to note that 35 percent of Millennials move most or all of their assets to the firm that helps them with their wealth management needs. Sixty-one percent of Millennials have moved at least some of their assets to the firm that they work with for wealth management. Older age groups are more likely to already have all their assets with the firm that is providing them with wealth management services, however over half of these older investors have moved at least some of their assets to the firm that helps them with their wealth management needs.

This clearly shows that providing wealth management will increases AUM among all investors, but especially among the wealthiest of investors and Millennials. Knowing that providing wealth management services will increase AUM should be enough for financial firms to examine their offerings to ensure they are providing the wealth management services expected from investors. What exactly do investors want from a wealth management provider? Spectrem Group reveals this, and many other insights in our newest report, Redefining Wealth Management, available for purchase now.