Firms have been trying for many years to identify what is a reasonable fee for various types of investors and wealth levels. This dilemma has a significant impact on revenues and profitability, making it a key topic of discussion within financial firms. Do wealthy investors feel their fees are fair? Would they be willing to pay more? Spectrem Group sought out answers to these questions and more in their recent research with wealthy investors regarding the fees they pay to their financial provider.

Just under half (49 percent) of wealthy investors are very clear on what they pay for their financial services, according to Spectrem Group. Another third are somewhat clear on what they pay. Millennials are the least clear on what they pay, with only 31 percent of wealthy Millennials being very clear on what they pay for advisory services. How well the fees have been explained and communicated often impact clarity. Only 28 percent of investors are very satisfied with the explanation and communication of fees from their advisor.

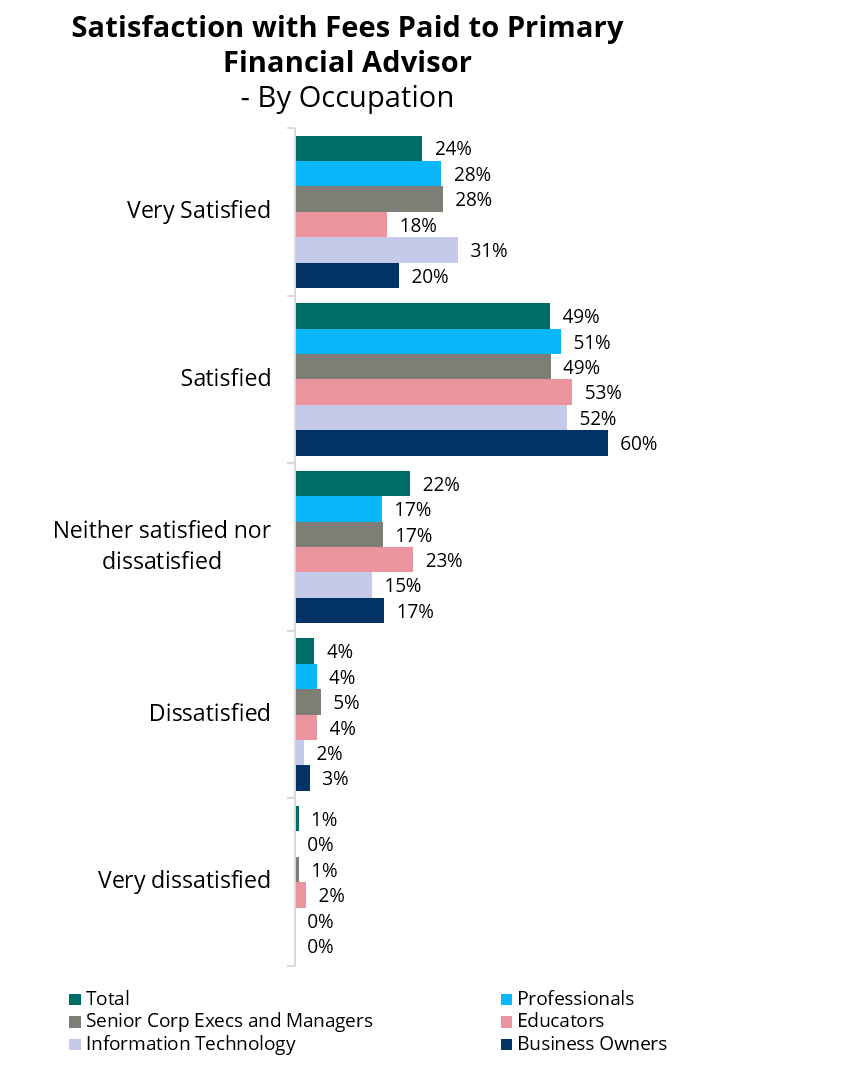

Despite how well or poorly the fees have been explained, or how clear the fees are, satisfaction with the amount of fees that are paid to the advisor is the measure that advisors want to know the most. Just under a quarter (24 percent) of investors are very satisfied with the amount of fees they pay their advisor. Forty-nine percent of wealthy investors are satisfied with the amount of fees. Business Owners and Educators are the least satisfied occupational group. Investors at the highest levels of wealth, those with a net worth between $15 million and $25 million, are the most satisfied with the fees they pay to their advisor. How much are these investors paying on an annual basis that they are satisfied with? Twenty-one percent of investors pay less than .5 percent, while 29 percent pay between .5 percent and .99 percent. Just over a quarter (26 percent) of investors pay between 1 percent and 1.49 percent.

The majority of investors being satisfied or very satisfied with the amount of fees they are being charged brings up the question if they would be willing to pay more. Spectrem asked wealthy investors if they would be willing to pay more for the services of a financial advisor that consistently beat target returns. Forty-eight percent of investors would be willing to pay more if their advisor consistently beats benchmarks. Seventy-one percent of Millennials would be willing to pay more to an advisor that regularly beat benchmarks.

Firms should take care to clarify what they are charging to their clients, especially Millennials and Gen X investors. These investors are more likely to be willing to pay more for an advisor who beats target returns, so establishing target returns with investors is also a beneficial discussion to have with investors.