While wealthier investors are generally more willing to take investment risk than those with less wealth, the current levels of risk that the wealthiest investors are willing to assume may be somewhat dangerous should the economy take a dramatic tumble. Yet the wealthiest investors in 2021 are taking advantage of the historic and robust markets and have shed any concerns about the future of many of their investments.

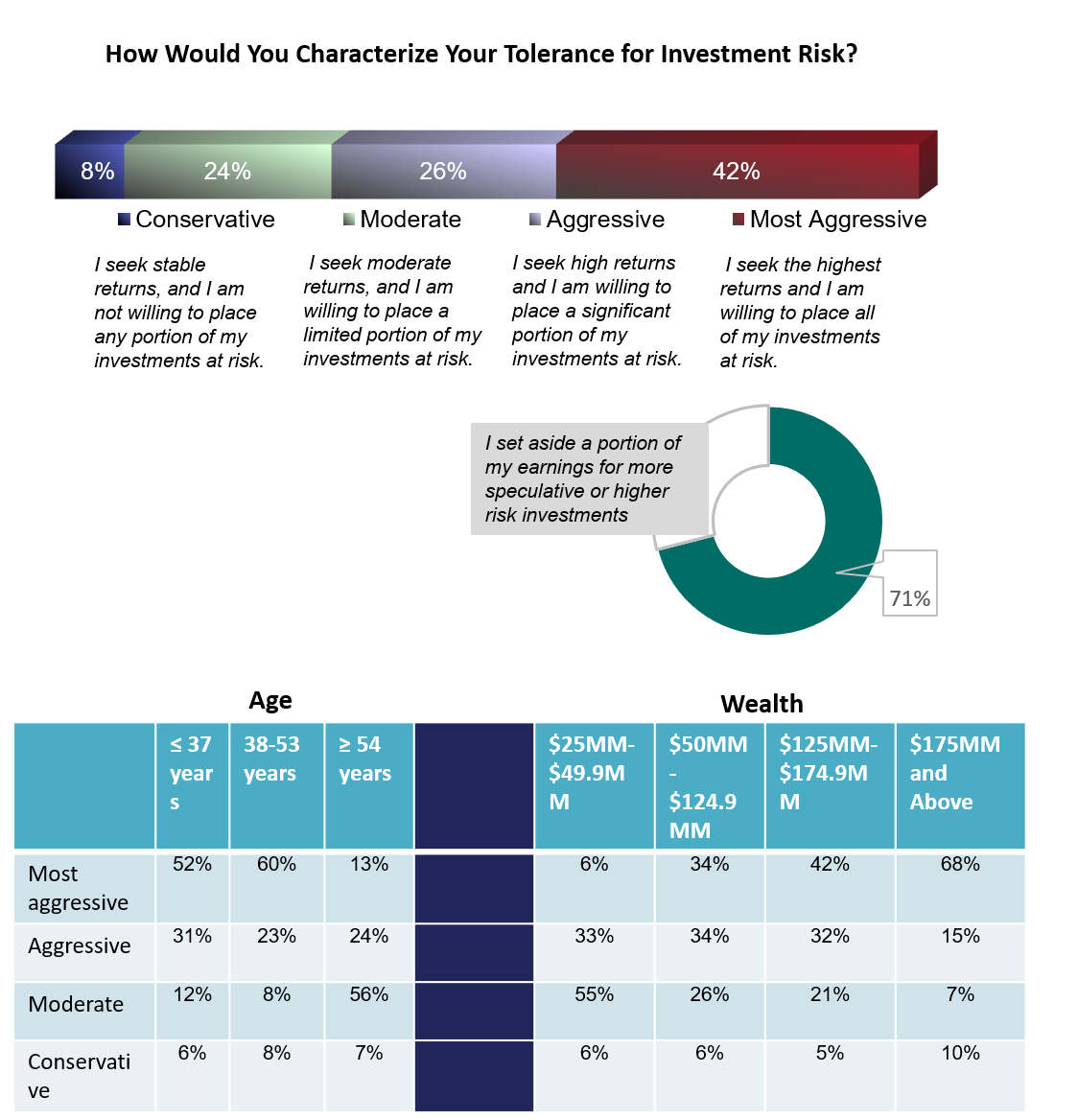

Spectrem Group recently completed research with some of the wealthiest investors (those with $25 Million Plus net worth – not including the value of the primary residence.). These investors were asked to rate their investment risk tolerance. Forty-two percent of investors rated their risk tolerance as “most aggressive” while 26% indicate they are “aggressive investors”. Fewer than a quarter (24%) describe themselves as “moderate” investors and only 8% indicate they are “conservative” investors.

Not surprisingly, older and less wealthy investors are more likely to indicate they are moderate investors while the younger and more wealthy investors are the most aggressive investors.

This aggressive risk tolerance stance can also be seen in their portfolio allocations. At the end of 2020, 26% of the assets of the average $25 Million Plus portfolios were invested in “Alternative Investments” compared to only 13% of similar portfolios as of 2018. Generally, alternative investments are considered to have greater investment risk than the typical equity, bond or cash-based investments which generally make up the largest portion of an investor’s portfolio.

Seventy-one percent of $25 Million plus investors indicate that they “set aside a portion of the earnings for more speculative or higher risk investments”. This highlights the propensity to seek out risky investments. Perhaps cryptocurrencies are some of these investments?

While the markets continue to reach historic highs, the investment risk tolerance levels of these wealthy investors is probably paying off. The trick will be for these individuals to know when to reassess their portfolios and perhaps return to a more moderate risk profile. Financial advisors need to know when to tell their clients to pull back, which may be difficult since the current market environment may not be following historical trends.

Related: More Than Ever Super-Wealthy Are Super-Aggressive Regarding Risk