This past year has not been a very positive one for the stock market or the economy, resulting in the US entering a recession. These challenging times can often cause investors to examine their investments more closely and want to become more involved in the daily management of their investments. It can also cause investors to examine the relationship they have with their financial advisor and decide to look for someone new, or make the decision to hire a new advisor. What investors have already made changes to their advisor since the start of the recession? Are more investors considering firing their advisor? What is causing investors to consider firing their advisor?

Spectrem Group sought the answers to those questions in our most recent research with wealthy investors. Spectrem found that 11 percent of investors have either fired their advisor or hired a new advisor as a result of the current recession. Some investors are far more likely to have made a change in their advisor than others. Age, wealth and occupation all significantly impact how likely an investor is to have decided to make changes to their financial advisor during this time.

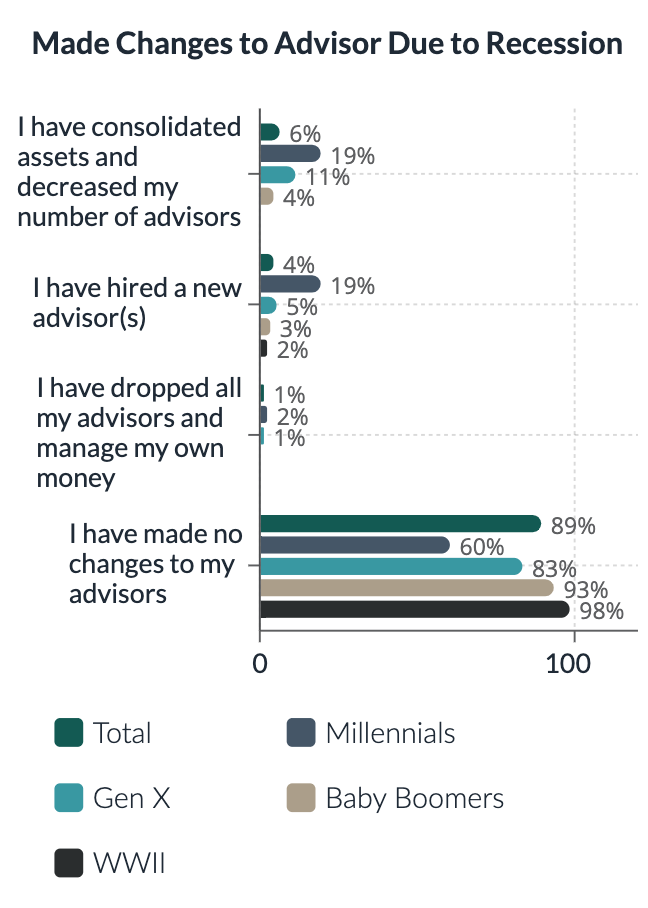

Millennials are the most likely age group to have made changes to their advisor due to the recession, with 40 percent having made some type of change. Eighteen percent of Gen X investors have made changes to their advisor, while in contrast only two percent of WWII and seven percent of Baby Boomers have made changes.

Wealth and occupation also play a role in how likely an investor is to make a change to their advisor. Investors with a net worth between $10 million - $25 million are the most likely to have made a change to their advisor as a result of the recession, with 14 percent decreasing the number of advisors they have, and eight percent hiring a new advisor during this time. Investors in Information Technology, Senior Executives, and Educators are less likely to have made changes to their advisor during this time, while Professionals, Business Owners, and Healthcare Executives are more likely to have made a change.

The investors who have already made the change are those investors who act quickly, while many other investors are still thinking and contemplating what they should do. Among those investors who have not yet made any changes to their advisor, 10 percent are looking to replace their primary financial advisor. A third of Millennials who haven’t changed their advisor yet are looking to replace their primary financial advisor, and 21 percent of investors with a net worth between $10 million - $25 million are looking to do the same.

What is causing investors to want to make these decisions? The most common two reasons are that the advisor contacted the investor less frequently and that the investor’s assets lost more than 10 percent of their value. Some investors feel that their assets losing more than 20 percent of their value is what it took for them to consider firing their advisor. Seven percent of investors feel that their advisor not providing reassurance in the declining stock market environment is what caused them to hurt their relationship with their advisor and is making them consider firing their advisor. Winding up the top five reasons why an investor is considering firing their advisor is that the investor did not receive return emails or phone calls in a timely manner.

This time period will continue to be one of change, both economically and with regards to what professionals’ investors choose to work with. Making changes to advisors can be complicated so investors should make certain that a change is something they need to do before moving forward.

Related: The Connection Between Family Nationality and Financial Matters