Social media can be a great equalizer of wealth. It is challenging to know if the person behind the tweet or LinkedIn profile is wealthy or not. Of course there are indications such as pictures on Facebook of vacations or surroundings that can indicate wealth, but that requires active participation on those platforms. Do the wealthiest American’s have time or interest to be online? What social media platforms are they likely to be currently using?

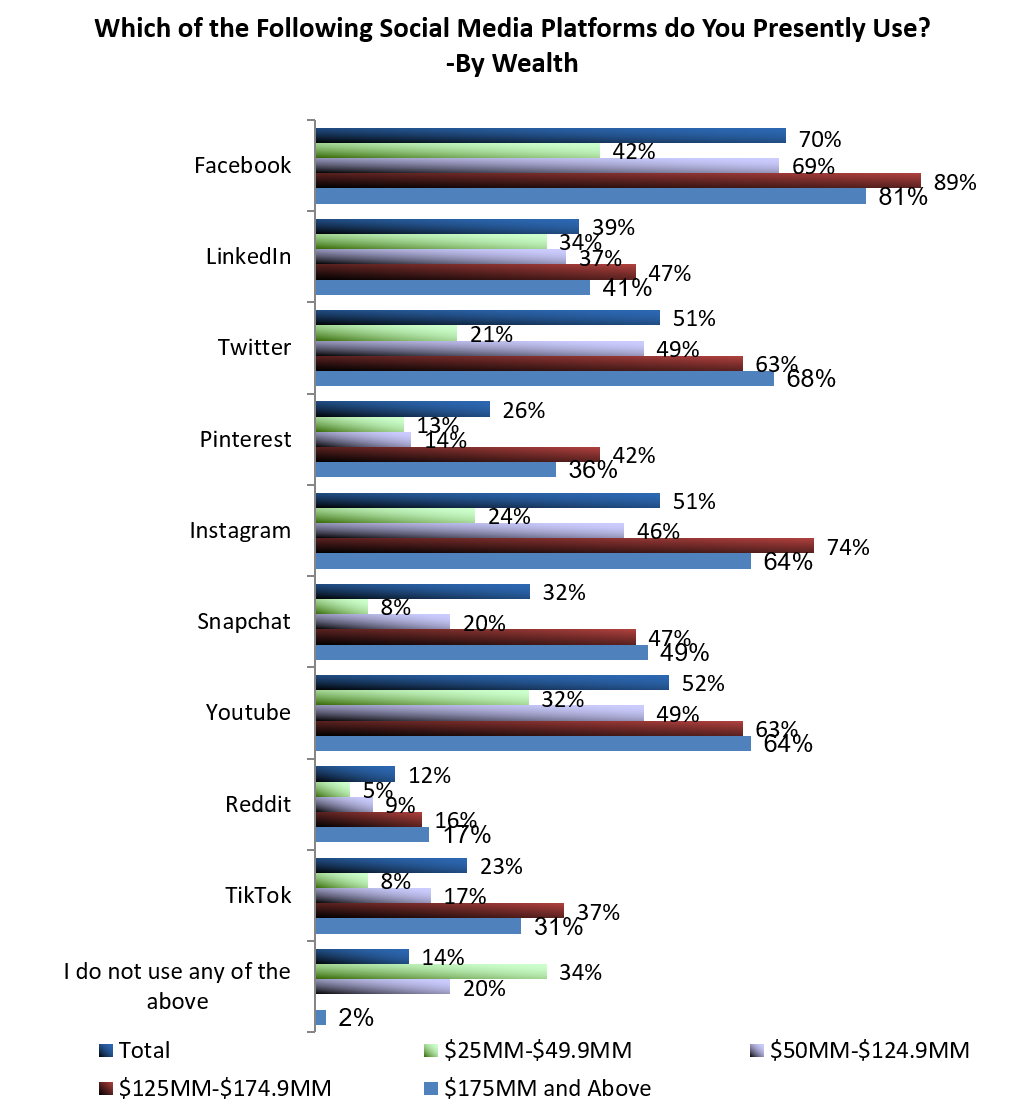

According to recent research conducted by Spectrem Group, Facebook is actively used by 70 percent of investors that have over $25 million in net worth, not including primary residence. YouTube is used by 52 percent of $25 million plus investors and Twitter and Instagram are tied for third with 51 percent using each of those platforms. Thirty-nine percent are using LinkedIn. Interestingly 32 percent use Snapchat, an application that has gained popularity over the past several years and is used for image and video sharing and chat functionality. Another sharing app, TikTok, focuses on video sharing and is used by 23 percent of $25 million plus investors.

Usage of social media varies significantly by age at all levels of wealth, $25 million plus included. Less than 40 percent of investors 54 years old and older are using any social media platform. The most common platform continues to be Facebook, with 39 percent of older investors using that platform. The next most popular platform among $25 million plus investors 54 years and older, with 30 percent using LinkedIn. Younger $25 million plus investors, those between 38-53 years old, most commonly use Facebook and Twitter, 88 percent and 71 percent respectively. For the youngest $25 million plus investors Facebook stays as the most popular with 85 percent using it, while Instagram is the second most popular platform with 71 percent usage among young $25 million plus investors.

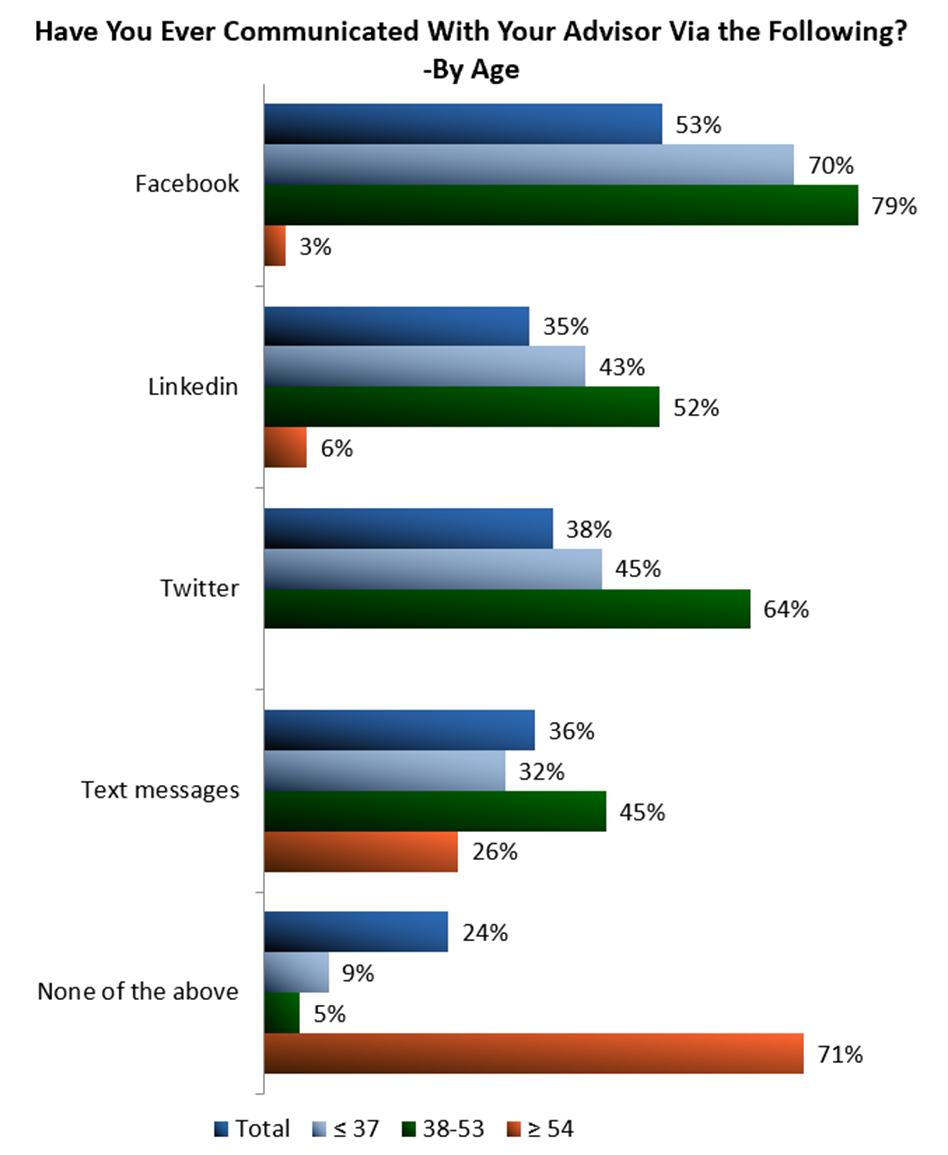

Using social media for personal use is exceedingly common, what about for communication with a financial advisor? Over half of $25 million plus investors have used Facebook to communicate with their financial advisor. Thirty-eight have communicated with their financial advisor through Twitter, and 35 percent through LinkedIn. For comparison purposes, 36 percent have communicated with their financial advisor through text messaging.

Age and wealth again impact the percentages of $25 million plus investors that communicate with their financial advisor through various social media platforms. Seventy-one percent of $25 million plus investors 54 and older have not communicated with their advisor through any social media platform or text messaging. Investors between 38-53 years old are the most likely age segment to have communicated with their financial advisor through social media, with 79 percent having communicated with their advisor through Facebook, 64 percent through Twitter, and 52 percent through LinkedIn. Eighty-two percent of investors with a net worth above $175 million have used Facebook to communicate with their advisor. Over half of those same investors have used Twitter to communicate with their advisor. Lower levels of net worth are less likely to have communicated with their financial advisor through social media.

So regardless of net worth, wealthy investors are using social media, and those investors are also likely to communicate with their financial professional through social media. This indicates that financial professionals need to find ways within compliance constraints to interface with clients on these platforms as it is not likely social media will cease to be a key component in the lives of most wealthy investors.