Regulation Best Interest (Reg BI) was approved by the SEC in early summer of 2019, and as of summer of 2020 all registered broker-dealers had to comply with what is required in Reg BI. Many investors may have had other topics on their mind in the summer of 2020 (global pandemic) so the communication an investor was aware of as a result of Reg BI and regarding Reg BI had the potential to be impacted by those other events. Spectrem Group conducted research recently with wealthy investors to understand what types of communication the investor recalls receiving from their advisor.

Forty-eight percent of wealthy investors had some type of communication from their primary financial advisor regarding Reg BI, according to Spectrem Group. The communication could contain different types of messaging, depending on the type of advisor the investor worked with. Given that this regulation was created in part to help hold individuals not registered with the SEC to a higher standard, full-service brokers would have the most information to communicate regarding this new regulation. If a Full-Service Broker is not working under the standards of a fiduciary, those advisors can no longer call themselves advisors when communicating with clients or prospects. This regulation also requires communication from a full-service broker to clients, explaining the reasons for choosing specific investments and the belief that the investment recommendations are in the “best interest” of the client.

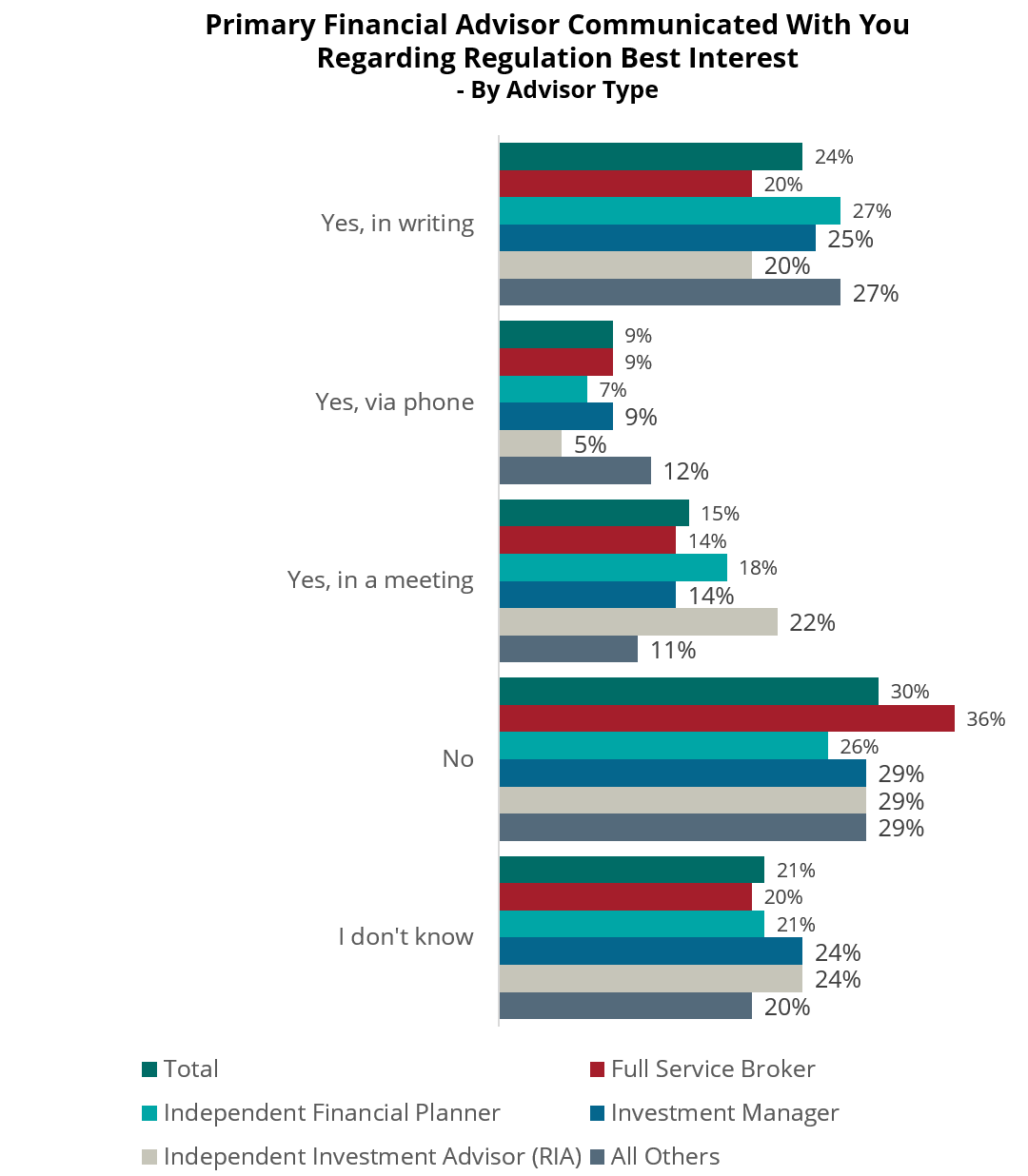

Registered Investment Advisors (RIAs) were not exempt from providing documentation however, as Reg BI required RIAs and Full-Service Brokers to provide a document that details the services provided and all fees and costs. This document also has to clearly identify any potential conflicts of interest and provide information regarding any legal or disciplinary history. The challenge to all of these required disclosures is knowing if the client is aware of receiving them, or if they simply don’t know if they received information regarding Reg BI or not, which is the case for 21 percent of investors. Thirty percent of investors indicated that their advisor did not communicate with them in any way regarding Reg BI.

The percentage of investors who indicate that their advisor did not communicate regarding Reg BI jumps up to 36 percent, among those who work with a Full-Service Broker. Only a quarter of those investors working with an Independent Financial Planner did not receive communication, while 29 percent of those investors working with an Investment Manager or an RIA did not receive communication regarding Reg BI. Given that this regulation requires written disclosures, it is important to know how investors remember receiving this communication.

Twenty-four percent of investors received communication regarding Reg BI in writing. That number drops to 20 percent among those with a Full-Service Broker. Nine percent of investors recall Reg BI being communicated to them over the phone, while 15 percent had Reg BI explained during a meeting. This shows that there is still ground to make up regarding proper communication regarding Reg BI.

It is also possible that the various financial provider types discussed fees without specifically mentioning Reg BI. When asked how easy their fees were to understand 40 percent of investors said their fees were extremely easy to understand. That percentage increases to 46 percent among those investors who have an Investment Manager or RIA as their primary investment professional and drops to 37 percent among those who work with a Full-Service Broker.

These insights reveal that communication needs to continue and be highlighted among investors with many different types of financial professionals. Investment professionals should make a point of communicating again with their clients regarding the fee structure to ensure it is easy to understand and that the client is aware of all the services included in their fee, as well as any conflicts of interest.

Related: How Wealthy Investors Want To Communicate With Their Advisor