How someone makes a decision is as unique as a fingerprint. Each person weighs different priorities to come to a conclusion they are comfortable with. Selecting a financial advisor is no different. Investors must determine what traits are most important to them in an advisor, and what they are looking for from that relationship. Investors may value the advisor having a positive track record, while others may want an advisor who has very friendly staff members.

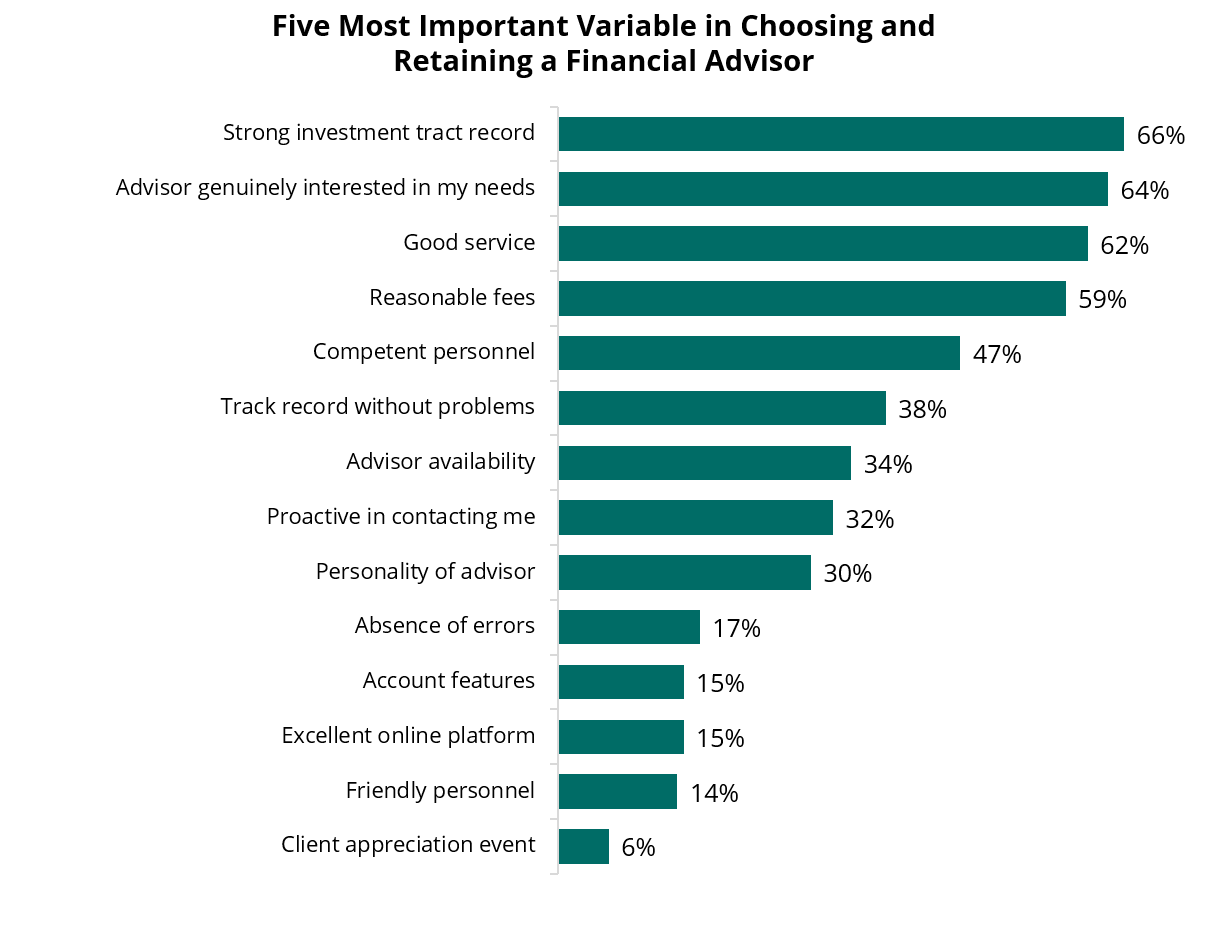

Knowing what variables are the most important to investors will allow financial providers to ensure they have those variables and highlight them when interacting with prospective clients. Spectrem Group uncovered these insights with their recent research with wealthy investors regarding their relationship with financial advisors. Two-thirds of investors identify a strong investment track record as one of the five most important variables when choosing or retaining a financial advisor. Very close behind with 64 percent of investors selecting the advisor being genuinely interested in the investor’s needs. Good service is identified by 62 percent of investors as one of the five most important variables when selecting and keeping a financial advisor. Just behind that with 59 percent of investors identifying it is reasonable fees. The fifth most selected variable that is the most important to investors is the advisor having competent personnel, which was identified in the top five variables by 47 percent of investors.

There are a few traits that less than twenty percent of investors would place in the top five most important. Client appreciation events are not an important variable in selecting or retaining a financial advisor. Having an advisor that does not have any errors is also not a key variable. Investors are more concerned with the advisor being able to communicate well and provide good service than the advisor being perfect. While having personnel that is friendly, and an excellent online platform is very beneficial, neither one is identified by more than 15 percent of investors as being among the top five variables when selecting and retaining a financial advisor.

Female investors are more likely to value a strong investment track record and the advisor being available, while male investors are more likely to value the advisor having friendly personnel and the advisor having a personality they like. Gen X investors are far more likely to have reasonable fees be among their top five variables when selecting or retaining a financial advisor, while Millennials are more likely to be focused on the advisor’s availability. Baby Boomers and WWII investors are both more likely to value the advisor being genuinely interested in their needs than the other age segments.

Financial advisors who would like to increase their likelihood of closing more prospects could focus on providing a strong investment track record, while being genuinely interested in the prospect or client needs, all through a comprehensive service model that charges reasonable fees. Having those components, along with a very competent staff will showcase that the advisor provides the top five variables that wealthy investors consider when selecting or retaining a financial advisor.