A fixed indexed annuity is a tax-deferred insurance solution, designed for the long term. It combines the opportunity for a degree of participation in market performance with full protection against market loss.

What are fixed indexed annuities?

A fixed indexed annuity is a tax-deferred insurance solution, designed for the long term. It combines the opportunity for a degree of participation in market performance with full protection against market loss. A fixed indexed annuity can also be fine-tuned to provide lifetime income, though this article will focus on its use during the accumulation phase of preparing for retirement.

A fixed indexed annuity is not an equity investment in any way and should never be represented as an alternative to owning stocks or mutual funds. The issuing insurance company commits to paying the contract owner a return based on the change in level in a particular reference index, such as the S&P 500. However, there are various methods for calculating the interest earned, all of which provide a portion of the potential upside an investor would receive with a direct equity investment.

Why would an investor consider a fixed indexed annuity over other fixed investments?

The appeal of a fixed indexed annuity is that, like a fixed annuity, principal is fully protected. If the reference index goes down in value over an indexed term, an investor will simply earn no interest during that period of time instead of experiencing a loss in their account value.

For those investors comfortable with not knowing exactly what their return will be each year, and with the possibility of occasionally getting no return at all in a given year, a fixed indexed annuity gives them more growth potential than a fixed annuity. It may also offer potentially higher yields compared to bank CDs or government bonds, assuming they are not dependent on a fixed income payment, and are comfortable with a long-term investment with uncertainty of returns from term to term.

How is upside potential achieved?

There are three crediting methods that insurance companies typically use with indexed annuities. Each strategy is based on the level return of a selected reference index over a specified period of time, or indexed term. Let’s take a closer look at some common crediting strategies with an annual indexed term.

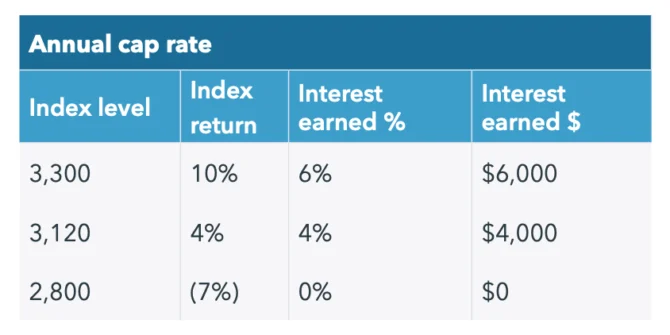

Method #1: Annual cap rate

With an annual cap rate participation crediting strategy, the insurance company looks at the value of the underlying index on each policy anniversary and calculates the change in the level of the index. If the index has increased, the account value is credited interest in the same amount, subject to a max return or cap. If the index has declined, then no interest is paid for that period.

The chart below illustrates how interest is calculated in an upmarket and downmarket if the index had a starting level of 3,000, and an investor bought an annuity with a 6% annual cap rate, with initial premium of $100,000.

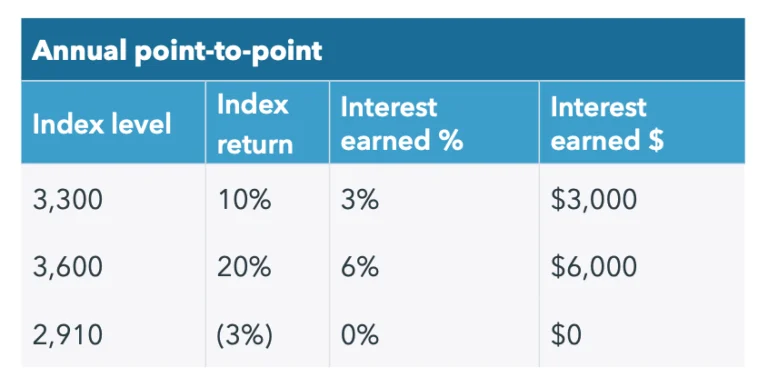

Method #2: Annual point-to-point with a participation rate

With this method, rather than applying a cap rate, the insurance company credits the account value a percentage of the increase in the return in the index. Let’s look at the above example again, but rather than applying a 6% annual cap rate, we will assume an annuity with a 30% participation rate and initial premium of $100,000.

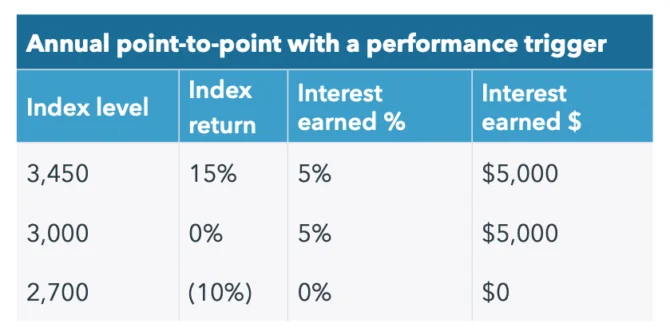

Method #3: Annual point-to-point with a performance trigger

With this method, the insurance company sets a fixed rate they will use to calculate interest on each policy anniversary, so long as the selected reference index is equal to or greater than its level on the previous anniversary.

As an example, if the performance trigger rate is 5% and the reference index must be equal to or greater than 3,000, then a contract owner will earn 5% interest whether the index is up 0%, 5%, 15% or even 40%. Just like the other two methods, an investor will earn no interest in the years where the index declines in value.

The power of the annual reset

A key feature of a fixed indexed annuity is that the index level resets at the end of each crediting period (usually one year). If the index drops in value during a specific crediting period, investors don’t have to wait for the market to recover before they begin to earn interest – returns for each crediting period are calculated based on the index’s level at the start of each crediting period. It also possesses these traits which can provide greater opportunity to earn interest:

- Locking in gains

- No interest deducted due to a negative return in the reference index

- The ability to earn interest in any indexed term regardless of index performance in the previous term

The table below demonstrates this powerful feature by looking at a hypothetical return on a fixed indexed annuity with a reference index that starts at 1,000 on the day the annuity is funded and offers a 6% annual cap rate.

Despite the fact that the index at the end of year 3 is below the value on the day the annuity was purchased (990 vs. 1,000), the account owner would have earned interest in two of the three years because of the reset feature.

Things to consider before buying a fixed indexed annuity

Fixed indexed annuities can be effective long-term planning tools for investors who seek:

- Guaranteed downside protection, no matter how the market fluctuates

- The potential to earn a higher rate of return than other investment options with full principal protection, although the investor must be comfortable with a long-term holding period and uncertainty of returns term to term

- An annual reset feature that provides the opportunity to earn interest in any policy year where the referenced index increases in level

However, the number of options and variations that are available on most fixed indexed annuities can add to the complexity of the product, and there are several important considerations to understand, including:

- Purchasing a fixed indexed annuity is not an alternative to investing in stocks. In order to provide principal protection, there are clearly defined limitations that can restrict how much an investor participates in the growth of the reference index and any dividends of the reference index are not paid to the investor.

- Fixed indexed annuities may credit 0% if the reference index return is negative for the indexed term. Historically, the stock market has gone down once every four years.1 That means if an investor owns a fixed indexed annuity for ten years, interest may not be received in 2–3 of those years based on past market performance. However, past performance is not indicative of future results.

- Early withdrawals that exceed the free annual withdrawal amount during the surrender charge period may trigger surrender charges, fees, and/or tax penalties, and may be subject to negative adjustments, which could be substantial. Early withdrawals that exceed the free annual withdrawal amount may also be subject to a market valuation adjustment, or MVA, which can reduce the account value or the actual withdrawal amount. For this reason, an investor should be prepared and able to hold an annuity through the full length of the surrender charge period which is typically between 5-10 years.

- Withdrawals and distributions of taxable amounts are subject to ordinary income tax and, if made prior to age 591⁄2, may be subject to an additional 10% federal income tax penalty.

- Fixed indexed annuities are not FDIC-insured. All references to guarantees arising under the annuity contract, including optional benefits, are subject to the claims-paying ability of the carrier.

Related: Fixed Income Investments With Principal Protection

Securities products and services may be offered by iCapital Markets LLC, a registered broker/dealer, member FINRA and SIPC, and an affiliate of iCapital. Annuities and insurance services provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Please see the disclaimer at the end of this document for more information.

ENDNOTES

1. Based on the annual performance of the S&P 500 Index from 1957 to 2021