Written by: Jennifer DeLong and Heather Balley

While Americans seldom feel certain about retirement, AB’s latest survey, Inside the Minds of Plan Participants, suggests that may be changing. Defined contribution (DC) plan participants are feeling increasingly confident about their retirement prospects—even amid heightened inflation. But there’s still work to do, and rising prices may offer plan sponsors new chances to connect with participants.

What’s Up? Confidence About Retirement

In our survey of more than 1,000 DC plan participants, 35% say they’re confident or very confident about retirement. That’s below the 47% high-water mark registered prior to the pandemic, but it’s still a solid figure when you consider the reemergence of inflation—an issue that had been all but buried for the past three decades. The 35% confidence level also exceeds the longer-term 29% average over nearly two decades of AB surveys (Display).

At first blush, some of our results may seem counterintuitive. For example, you might assume older DC plan participants with more assets would be the most confident about retirement. But in our survey, those closest to retirement—aged 55–64—are the least confident, while savers under 35 express the most confidence. Perhaps younger savers feel that time is on their side, though the responses could also reflect younger savers’ indifference to something that feels very distant from their present lives.

While confidence is up from a historical perspective, that still leaves roughly two-thirds of plan participants feeling unsure about retirement.

Inflation Tops Participants’ Retirement Concerns

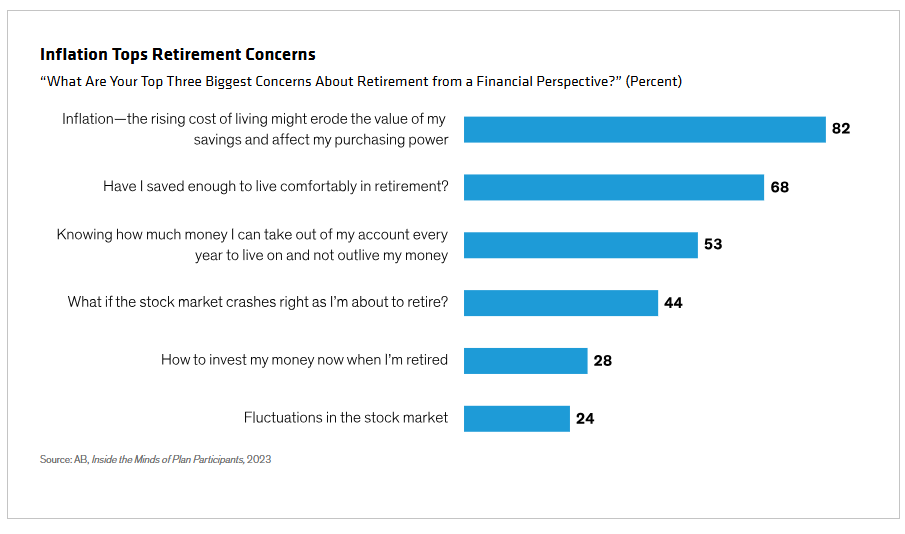

Among those lacking confidence about retirement, 41% cite inflation as a concern—up from 27% in our last survey. And among all participants, including those confident about retirement, inflation leads by a wide margin. A whopping 82% of respondents list it among their top three concerns (Display). They’re also questioning whether they can stockpile enough wealth to live comfortably in retirement (68%) or if they’re at risk of outliving their savings (53%).

Geopolitical crises at home and abroad, with their drumbeat of ominous developments, have taken a toll on Americans’ optimism, as well. Roughly two-thirds of respondents say today’s domestic political environment has eroded their confidence in reaching their retirement goals. To underscore this point, only 5% of respondents believe that the current political backdrop has improved their confidence (Display).

And, of course, market volatility is always top of mind. Nearly three-quarters of respondents view major market volatility as a threat to their retirement goals, while only about one-quarter believe their retirement savings strategy can weather turbulent markets.

We think these concerns create a great opportunity for DC plan sponsors to engage with employees by highlighting tools that can help steer employees in the right direction on their retirement savings journey. Few participants are financial experts, and many could use a helping hand. Plan design is critical, too—we believe that automatic enrollment is a great starting point, as it uses inertia to boost participation and retention rates.

Target-Date Funds: Widely Available, but Are They Used?

Our survey results point to a disconnect between the popularity of target-date funds, which adjust their investment mix as participants move toward and into retirement, and the extent of their actual usage.

The Investment Company Institute estimates that 90% of 401(k) plans offer target-date funds, so nine out of every 10 plans offer them as options. Yet, 60% of our survey respondents either don’t use target-date funds or aren’t sure whether they do. To us, this may indicate that some plans don’t designate target-date funds as the default option for people signing up. Or it may point to an adoption time lag. Longtime employees may have simply continued with whatever investments they started with one, two or even three decades ago.

There’s reason to believe that the latter reason might be the case, given the growing popularity of target-date funds with younger workers. Our survey finds that 45% of respondents under 35 years of age invest in target-date funds—well above the 33% of participants over 55 that do. This growing wave of target-date fans could lead to greater usage in the future. But that most likely would require the help of plan design elements that encourage adoption, such as making automatic enrollment into a target-date fund a plan’s default option.

Demand for Lifetime Income, but Hesitancy Regarding the Means

Across the board, participants also tell us they want guaranteed income in retirement. But there’s resistance to some of the traditional means of getting it. Nearly 40% of respondents cite the effects of inflation as a concern, which likely stems from worries about the declining purchasing power of fixed annuity payments. Participants also resist guaranteed-income products due to a perceived lack of control over assets (21%) and costs (16%).

We think one solution is to add target-date fund solutions with a guaranteed lifetime income component—one that pays heed to participants’ concerns. These funds may help continue the automatic “do it for me” of target-date funds, while still allowing participants control over their assets within an appropriate long-term investment strategy.

This combination appears to have broad support among our respondents who already invest in target-date funds. More than 90% of them find this somewhat appealing, appealing or extremely appealing. And more than two-thirds tell us they’d invest in such a solution if it were available in their plan. Here again, plan sponsors have an opportunity to guide participants and harness inertia: a mere 2% of respondents say they’d opt out if they were automatically enrolled in a lifetime-income target-date fund.

DC plan participants are showing resurgent confidence against an inflationary backdrop, but there are still challenges on the journey to retirement. Solutions will need to come from many different sources. Based on the results of our survey, DC plan providers could be among the most important.

Related: European Industrials: A Prime Growth Opportunity for Equity Investors