Indices, for the most part, closed fractionally higher to end the week. But a new headwind for stocks could be more concerning - rising bond yields.

That correction I’ve been calling for weeks could have potentially started.

While I don’t foresee a crash like we saw last March and feel that the wheels are in motion for a healthy 2021, I still maintain that some correction before the end of Q1 could happen.

Bank of America also echoed this statement and said last week that “We expect a buyable 5-10% Q1 correction as the big ‘unknowns’ coincide with exuberant positioning, record equity supply, and as good as it gets’ earnings revisions.”

But rather than looking at the past, let’s take a look at what’s on tap this week to get you ready for what could potentially be a volatile week ahead.

This coming week, be on the lookout for the January leading indicator index, durable goods orders, and personal income and spending.

On Tuesday, we will also receive the February Consumer Confidence Index; on Wednesday, the Census Bureau will release upcoming home sales. On Friday, the University of Michigan will release its Consumer Sentiment Index.

Of course, as we’ve seen in weeks past, jobless claims from the previous week will be announced on Thursday too. After outperforming the last few weeks, the jobless claims announced last Thursday (Feb. 18) grossly underperformed and reached their worst levels in nearly a month.

Earnings season has been outstanding but is winding down now. Be on the lookout this week for earnings from Royal Caribbean (RCL) on Monday (Feb. 22), Square (SQ) on Tuesday (Feb. 23), Nvidia (NVDA) on Wednesday (Feb. 24), and Virgin Galactic (SPCE) and Moderna (MRNA) on Thursday (Feb. 25).

We have the makings of a volatile week, and as I mentioned before, a possible correction.

Look. Don’t panic. We have a very market-friendly monetary policy, and corrections are more common than most realize. Corrections are also healthy and normal market behavior, and we are long overdue for one. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017), and we haven’t seen one in a year.

While it won’t happen for sure, I feel like it’s inevitable because of how much we have surged over the last few months.

A correction could also be an excellent buying opportunity for what could be a great second half of the year.

My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one to help people who needed help instead of the ultra-high net worth.

With that said, to sum it up:

While there is long-term optimism, there are short-term concerns. A short-term correction between now and the end of Q1 2021 is possible. I don’t think that a decline above ~20%, leading to a bear market, will happen.

Hopefully, you find my insights enlightening. I welcome your thoughts and questions and wish you the best of luck.

Will the Russell 2000 Overheat Again?

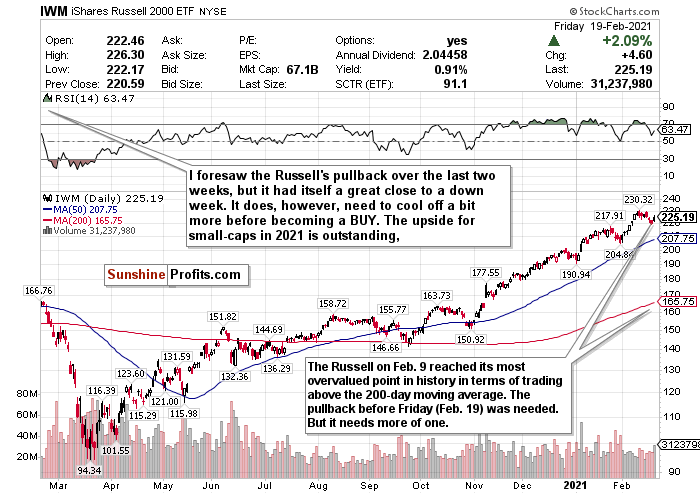

Figure 1- iShares Russell 2000 ETF (IWM)

The Russell 2000 popped on Friday (Feb. 19) after seeing a bit of a pullback since February 9. Between February 9 and the close on February 18, the Russell 2000 lagged behind the other indices after significantly overheating. I switched my call to a SELL then on the 9th, and it promptly declined by 3.40% before Friday’s session.

I foresaw the pullback but cautiously saw a rally and switched to a HOLD call before it popped over 2% on Friday (Feb. 19).

I do love small-caps for 2021, and I liked the decline before Friday. However, I feel like the index needs a minimum decline of 5% from its highs before switching it to a BUY.

As tracked by the iShares Russell 2000 ETF (IWM) , small-cap stocks have been on a rampage since November.

Since the market’s close on October 30, the IWM has gained nearly 47.56% and more than doubled ETFs’ returns tracking the larger indices. If you thought that the Nasdaq was red hot and frothy, you have no idea about the Russell 2000.

Not to mention, year-to-date, it’s already up a staggering 16.38%.

It pains me not to recommend you to BUY the Russell just yet. I love this index’s outlook for 2021. Aggressive stimulus, friendly policies, and a reopening world could bode well for small-caps. Consumer spending, especially for small-caps, could be very pent-up as well.

But we just need to hold on and wait for it to cool down just a little bit more for a better entry point.

HOLD. If and when there is a deeper pullback, BUY for the long-term recovery.

For more of my thoughts on the market, such as the streaky S&P, inflation, and emerging market opportunities, sign up for my premium analysis today.

Related: Is a Market Correction Coming?