Written by: Jordan Jackson and Samrawit Soquar

The rally in corporate credit may have caught some investors by surprise given the consensus that a recession would materialize this year, a historically bad environment for credit spreads. The bullish macro view argues that robust labor markets, declining inflation and rebounding consumer confidence have pushed the recession further out or perhaps could prevent a recession altogether. On the other hand, tight monetary policy should contribute to a slowdown in growth and, in turn, wider spreads. Given the wide range of views on the direction of the economy, credit investors should consider why spreads have tightened year-to-date, the potential timing and magnitude of spread widening, and sectoral trends that suggest an active approach going forward.

Importantly, there have been both technical and fundamental dynamics that have supported IG credit this year.

- Fundamentals: While 2Q23 revenue growth and EBITDA[1] estimates suggest profits will be materially down from there mid-2021 peaks, debt levels are manageable potentially leading to further improvement in credit metrics. The trailing 12-month total debt/EBITDA1 ratio for the US IG universe has been stable at 2.5x for the past four consecutive quarters, down from a peak of 3.3x in 2Q20 and lower than the pre-pandemic 2.8x in 4Q19. Moreover, ~8% of IG debt was upgraded in 1H23, almost 4.5x the amount of debt downgraded.

- Technicals: Corporate bond issuance has been generally on par with issuance trends over the past two years, but notably, demand has remained strong across institutional and foreign investors. Indeed, while spreads are tight—spreads account for ~25% of the yield on IG bonds—the overall yield of ~5.5% remains attractive to pension funds and foreigners given the perceived low risk of default.

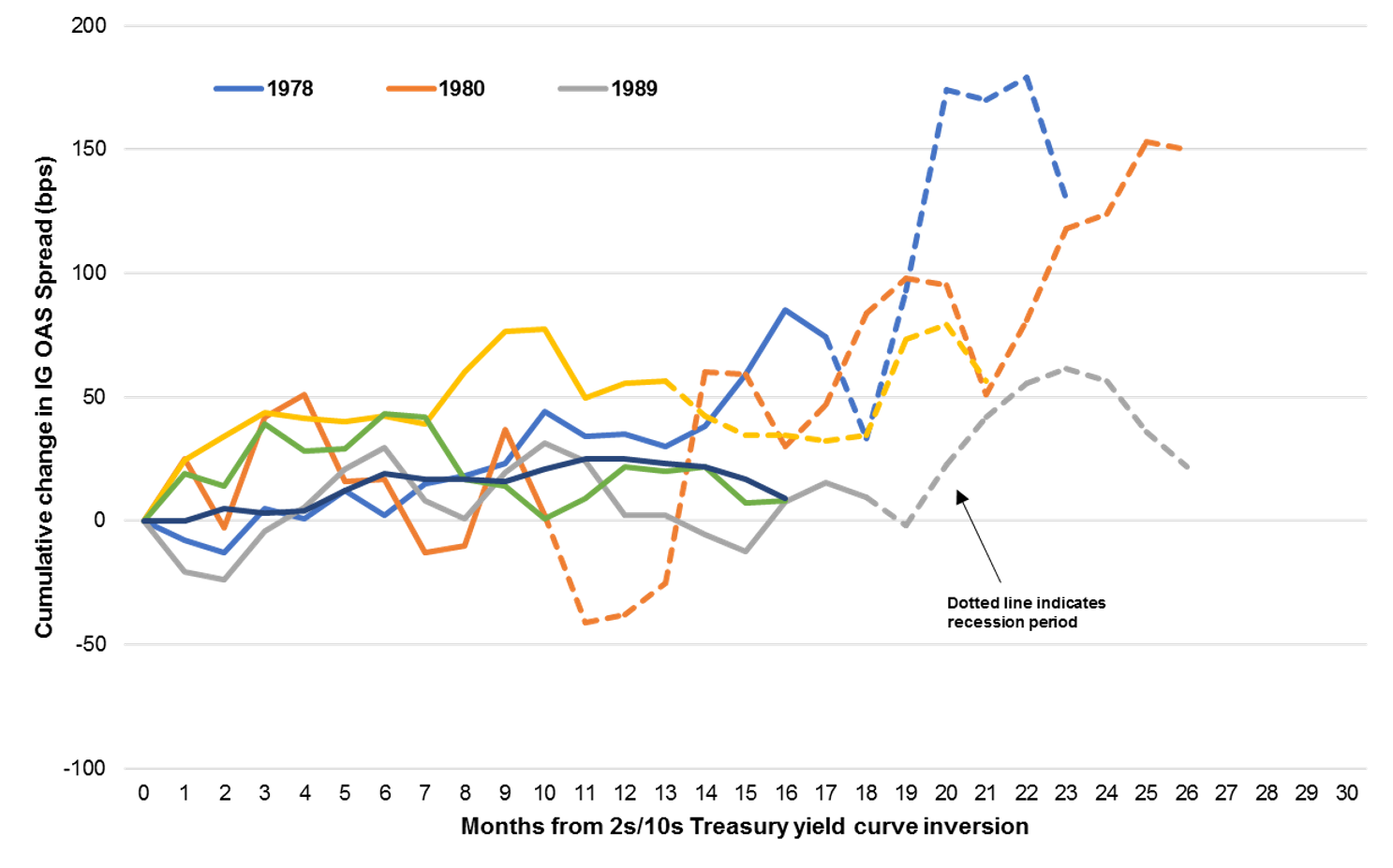

We anticipate these trends should support credit spreads in the near term. However, we are cognizant of the risk a growth slowdown could have on credit spreads. For this reason, we remain cautious and up-in quality within our credit exposure. That said, history suggests, and as shown, spreads don’t widen until much later in the business cycle and in some cases, not until the recession arrives.

It would be a fool’s errand to try and predict the peak in spreads, but certain sectors within investment grade like finance companies, REITs, and banks have meaningfully wider spreads than the broad market presenting opportunities in our view. Conversely, spreads in transportation, capital goods, and consumer sectors are only marginally wider than their 2021 tights, suggesting more downside risk when the economy comes under pressure.

In summary, we remain selective in IG credit in portfolios with sectoral tilts based on valuations. Going forward, investors should monitor credit metrics and embrace active management in the space.

1Earnings before interest, tax, depreciation, and amortization

Spreads dont tend to widen until much later in the business cycle

Monthly, basis points, IG OAS spreads are indexed to 0 at the month the 2s/10s Treasury curve inverts in prior cycles

Source: Bloomberg, Barclay's, J.P. Morgan Asset Management. Spreads are based on the US IG Barclays Index from 1997 to present. Pre-1997, Moody's BBB US IG Corporate index are used as a proxy for IG credit spreads. *The 2s10s Treasury curve hit 7bps (never inverted) in December 1994 and was not followed by a recession. Data are as of August 6, 2023.

Related: Is It True That When the U.S. Sneezes the Rest of the World Catches a Cold?