“Tariff Man” strikes again.

In a surprise

tweet last Thursday, President Donald Trump announced that, beginning June 10, the U.S. would impose a 5 percent tariff on all goods coming into the U.S. from Mexico “until such time as illegal migrants coming through Mexico, and into our Country, STOP.” The tariff is scheduled to rise incrementally to a hefty 25 percent through October.As I’ve explained

elsewhere, including in an interview this week with Kitco’s

Daniela Cambone, tariffs are essentially taxes that are paid by U.S.-based importing companies, which then pass the extra expenses along to the end consumer. If Trump’s Mexico tariff goes into effect, in fact, it will be the largest tax hike on Americans in approximately 30 years. As such, tariffs are inflationary. Historically, faster inflation has

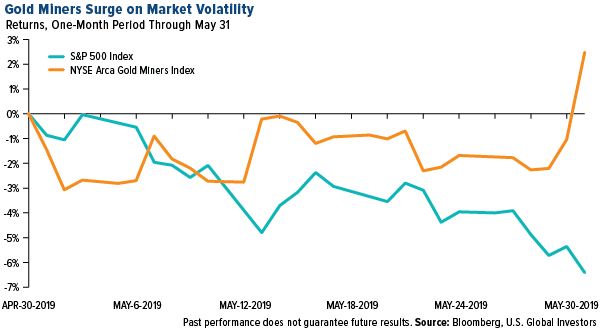

boosted investor demand for gold, and indeed, the price of the yellow metal crossed above $1,320 an ounce on Monday for the first time since late March.Gold miners have also increased sharply. The NYSE Arca Gold Miners Index jumped nearly 4 percent in intraday trading on Friday, the group’s biggest one-day gain in two years. The S&P 500 Index, meanwhile, lost some $1.5 trillion in market cap in the month of May.

click to enlarge

click to enlarge

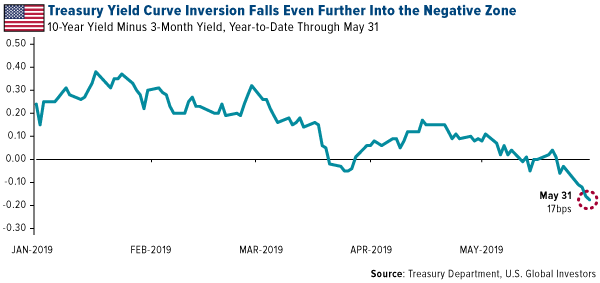

Investors also sought protection in U.S. Treasuries, whose yields fell to a fresh 2019 low. This pushed the already-inverted yield curve between the 10-year and three-month Treasuries deeper into negative territory. On Friday the yield curve sunk to 17 basis points (bps), its lowest level since well before the financial crisis. An

inverted yield curve has preceded every U.S. recession over the last 60 years.

click to enlarge

click to enlarge

Tariffs Against Mexico Will Hit Middle-Class Americans

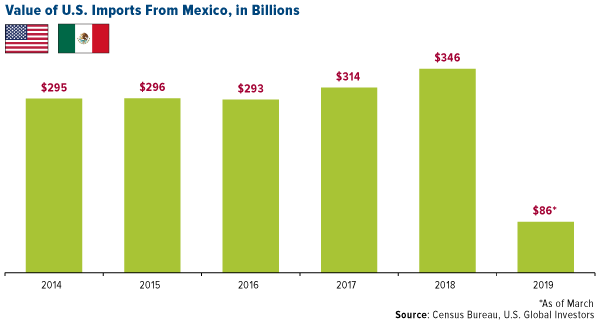

In 2018, the total value of imports from Mexico stood at $346 billion. A 5 percent tariff on this volume amounts to a $17 billion hit on the U.S. economy. At 25 percent, this cost surges to a whopping $87 billion.

click to enlarge

click to enlarge

To be sure, this will have a much more direct inflationary impact on middle-class Americans than tariffs on Chinese goods have had so far. That’s because Mexico—besides being the number one exporter of car parts and vehicles to the U.S.—is also America’s top supplier of agricultural goods, with exports totaling $26 billion in 2018 alone. Fresh fruits and vegetables (valued at a combined $11.7 billion), beer and wine ($3.6 billion), snack foods ($2.2 billion) and more are all set to rise in price at your local grocery store if the 5 percent tariff takes effect as planned.Think I’m exaggerating? On an investor conference call last week, Costco Chief Financial Officer

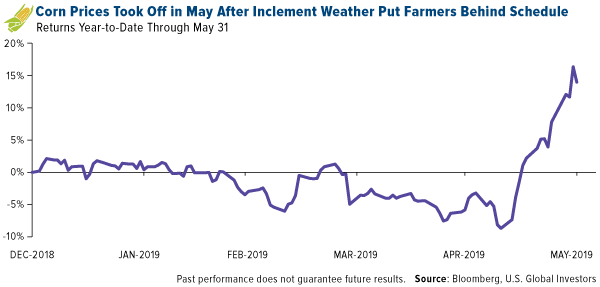

Richard Galanti said, “At the end of the day, prices will go up on things” due to tariffs on Chinese and now Mexican-made goods.For some idea of what might happen with food prices, take a look at what corn has done in the past month alone. Granted, this price jump is due to inclement weather, which put U.S. famers behind in their planting schedule. But imagine all of your tomatoes, avocados, cucumbers, onions, strawberries and other produce from Mexico making similar moves. This would have a serious multiplying effect on the U.S. economy.

click to enlarge

click to enlarge

Vehicle prices are also likely to climb. In a

press release dated May 31, Matt Blunt, president of the American Automotive Policy Council (AAPC), wrote that tariffs against Mexico will undermine the United States Mexico Canada Agreement (USMCA)—the not-yet-ratified replacement for NAFTA—and “would impose significant cost on the U.S. auto industry.”Speaking specifically of General Motors (GM), Citi analyst Itay Michaeli said that the 5 percent tax could result in a significant “several-hundred-million-dollar” impact to the carmaker’s annual earnings. Shares of GM, Ford and Fiat Chrysler were all down significantly in Friday trading.Related:

Gold Is Being Manipulated. But to What Extent? Could Trump Be Ambushing His Own 2020 Reelection Bid?

Taken as a whole, the Mexican tariffs could very well end up being the one policy that costs Trump many die-hard supporters who have stuck with him up until now.On Thursday, the U.S. Chamber of Commerce—the staunchly Republican business lobbyist group—

condemned the president’s plan, writing that “tariffs on goods from Mexico is exactly the wrong move. These tariffs will be paid by American families and businesses without doing a thing to solve the very real problems at the border.”High-ranking Republican Senator Chuck Grassley of Iowa, who has also safely been in Trump’s corner on most policies, came close to suggesting the imposition of tariffs was an abuse of power. “Trade policy and border security are separate issues,” Grassley said. “This is a misuse of presidential tariff authority and counter to congressional intent.”Further, Grassley commented that the tariffs could risk the ratification of the USMCA, one of the president’s greatest achievements in his two-and-a-half-year-old administration.Further still, the tariffs could sabotage any chance of a trade resolution with China. In a note to investors, Raymond James public policy analyst

Ed Mills wrote that he views the president’s actions as “further deteriorating the U.S.-China trade fight. Chinese officials have stated their concern about the reliability of President Trump as a trading partner. These tariffs were announced the same day as significant advancement of the USMCA. If China does not believe a deal will stick, why negotiate?”While I’m on the subject of China, the number of Chinese tourists to the U.S.

fell 5.7 percent in 2018 from the previous year, the first time that’s happened since 2003. Trade tensions between the two economic superpowers appear to be a huge contributing factor. Hopefully this isn’t the start of a trend, as Chinese tourists top the list of the world’s biggest spenders.

Is Gold the Solution?

All of this is ample reason to ensure that you have some gold in your portfolio. I always advocate the

10 percent Golden Rule. That means I think you should have half of that 10 percent in gold coins, bars and 24-karat jewelry. The other half should be in high-quality gold mining stocks and funds. Make sure you rebalance at least once a year.One of the biggest proponents of gold is the Austrian

school of economics, which emphasizes self-reliance and individualism. Because fiat currencies are solely based on the faith and credit of the economy, they have no intrinsic value and are prone to huge swings, according to Austrian economic thought.Gold, on the other hand, is nobody’s liability. As destructive as socialist policies can be to business and capital, they can’t reduce the value of your gold. In fact, the inverse is true. Historically, the more debt that the government accrues, and the higher inflation gets, the more valuable the yellow metal has become.