Written by: Jordan Jackson

As the U.S. economy enters the fourth quarter, economists will begin penning their outlooks and suggested portfolio allocations for 2024. It appears there are still two consensus projections for economic growth next year: soft landing or recession. To be clear, we are biased to the former over the latter, but remain close to strategic portfolio allocations and well-diversified across geographies and risk given the amount of uncertainty.

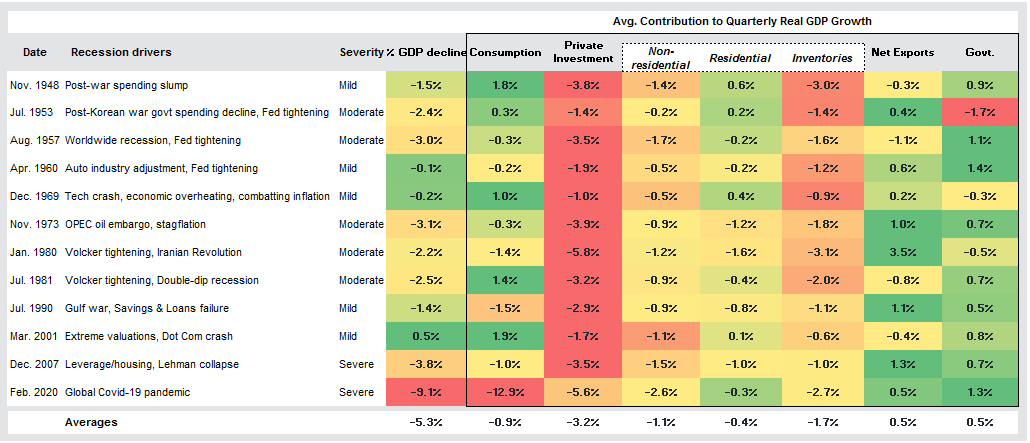

While no two recessions are the same, looking at previous recessions could help inform growth forecasts. Per the recession heatmap, there are several interesting takeaways:

- Consumption: While consumption accounts for roughly two-thirds of economic activity and typically contracts during recessions, investors may be surprised to see that there have been mild to moderate recessions where consumption remained positive.

- Private Investment: Capital spending tends to correct materially during recessions likely driven by the very cyclical nature of inventories and business fixed investment. Housing, on the other hand, tends to be stable with the sector showing modest declines on average.

- Net exports: The change in the U.S. trade balance has historically been a positive to growth during recessions. Exports outpacing imports could be a sign that foreign economies are stronger than the domestic economy increasing the demand for U.S. goods. However, the U.S. trade deficit tends to worsen when the economy is growing strongly and therefore the more likely reason may be the decline in domestic demand curtails imports to a greater degree than exports.

- Government spending: Fiscal support and thereby deficits tend to increase during recessions to offset a weakening economy.

Looking ahead to 2024, we are cautious on consumption given higher interest rates, depleted savings, higher credit card balances, softening labor markets impacting incomes and potentially higher gasoline prices souring consumer confidence. That said, consumers have been resilient all year and given consumer balance sheets have been largely catered to low interest rates, absent a significant rise in unemployment, consumption could slow but remain positive.

Within private fixed investment, subsidies and grants via the Inflation Reduction Act and CHIPS and Science Act and enthusiasm around generative AI could keep capital spending on equipment and structures and intellectual property rights on solid footing, even under higher interest rates. Residential housing may finally stabilize at 7% mortgage rates given a chronic shortage of inventory incentivizing a modest uptick in construction activity. Inventories remain a wild card, but we don’t see signs of an excessive buildup—or “boom”—in inventories through year-end that would cause a recessionary “bust” next year.

We suspect net exports won’t materially impact the growth outlook next year but could be net positive for exporters if the dollar declines as the rest of the world recovers while growth in the U.S. slows. Should Congress successfully approve FY 2024 appropriation bills, government spending is likely to continue its trend as a “boost” to GDP given deficits are expected to rise in the years ahead.

In general, there are several offsetting factors that will impact the economy next year. Suffice it to say, it is still a close call on whether the economy will enter a recession or not, but we do believe slow growth is the most likely outcome, while risks for a mild recession remain.

Source: BEA, FactSet, J.P. Morgan Asset Management. Data are as of September 30, 2023.

Related: What Are the Investment Implications of the September FOMC Meeting?