Written by: Brian Clark | Knowledge Leaders Capital

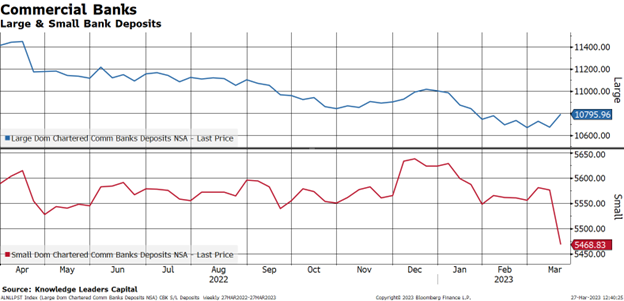

The failures of Silvergate Bank, Silicon Valley Bank, Signature Bank, and the current struggles of First Republic and Pacific West Bank have seen bank deposits flee to the perceived safety of large banks. In the chart below, one can see the flight of deposits from small banks into large.

To make matters worse for banks, rising interest rates and easily accessible higher yielding alternatives exist like money market funds (MMF) or US Treasury ETFs. These alternatives are now a few thumb taps and swipes away from depositors, making the near-zero rate of return on bank deposits much less attractive for many consumers and businesses. In the chart below one can see the drop in bank deposits and increase in MMFs.

Here we can see the significant premium 3-month US Treasury yields command over bank certificates of deposit (CDs).

These issues, plus the new FedNow service which is set to begin trial runs in July, could represent an uphill battle for banks to retain deposits. The Federal Reserve’s new FedNow program will allow bank customers at 10,000 financial institutions to instantaneously transfer funds in and out of bank accounts on a 24/7/365 basis. This is probably the biggest innovation since mobile banking and investment apps and will allow customers greater access to their money than ever before. “We reiterate our view that FedNow will represent a material change in how consumers use electronic money,” said TD Cowen analyst Jaret Seiberg in a recent Marketwatch report. FedNow may accelerate the ability of depositors to remove money from banks accounts and reroute it to higher yield alternatives. With banks under increasing pressure to stem outflows, these trends could add to their troubles, especially if banks are forced to sell even more assets which currently have unrealized losses.

As of 12.31.22, none of the securities mentioned were held in the Knowledge Leaders Strategy.

Related: Biden’s New Banking Reforms Are Badly Focused – Here’s Why