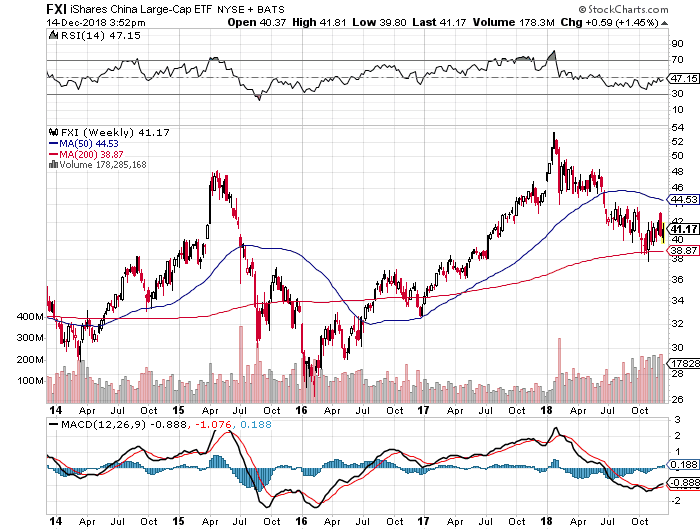

Written By: Leo Kolivakis Fred Imbert, Sam Meredith and Yen Nee Lee of CNBC report, Dow drops 500 points amid rising fears over global growth :"Stocks fell sharply on Friday after weaker-than-expected data in China and Europe exacerbated concerns of a global economic slowdown.""The Dow Jones Industrial Average fell 500 points, led lower by declines in Apple and Johnson & Johnson. The S&P 500 dropped 1.8 percent as the consumer staples and health care sectors lagged. The Nasdaq Composite pulled back 1.8 percent. Friday's losses wiped out the gains for the week.""China reported industrial output and retail sales growth numbers for November that missed expectations. This is the latest sign shown by China that its economy may be slowing down. The data also underscored the rising risks to China's economy as Beijing works to resolve an ongoing trade war with the U.S." "The economic data continues to bear out growth is slowing," said Tom Martin, senior portfolio manager at Globalt. "There is still a lot of positive positioning out there. As the data continues to slow, people are feel less comfortable with that and start to sell." "Where we are is trying to measure how uncomfortable people are with their positioning," Martin said. "There just hasn't been any follow-through in any rally we've seen in the past few weeks. That's very telling of the market." "Industrial production in China grew by 5.4 percent for November on a year-over-year basis, the slowest pace in almost three years. Retail sales, meanwhile, grew at their slowest rate since 2003.""European shares also fell after the release of weaker-than-forecast data. The IHS Markit Flash Eurozone PMI index fell to 51.7 in December, its lowest level in four years . "New business inflows almost stalled, job creation slipped to a two-year low and business optimism deteriorated," IHS Markit said in a release. The Stoxx 600 index, which tracks a broad swath of European stocks, fell 0.3 percent.""Friday's moves come after U.S. equities seesawed in the previous session. The Dow closed slightly higher, while the S&P 500 and Nasdaq Composite fell slightly.""Stocks initially surged last week amid hopes the U.S. and China would be able to strike a permanent deal on trade. On Friday, China said it would suspend an additional tariff on U.S. autos. China also confirmed it would reduce a 40 percent charge on U.S. auto imports to 15 percent for 90 days.""But the uncertainty around the ongoing negotiations has kept investors on edge recently. Data from research service Lipper found that more than $46 billion were pulled out in a week from U.S. stock mutual funds and ETFs, the most ever." "At this point, a lot of investors are very cautious heading into 2019," said Yousef Abbasi, director of U.S. institutional equities at INTL FCStone. "There's a lot of frustration among investors that have been whipsawed by this volatility." "Volatility has picked up this quarter. This is the third decline of more than 500 points for the Dow in December, following two declines of that magnitude or greater in November and three in October.""Shares of Apple fell 2.3 percent after influential analyst Ming-Chi Kuo, of TF International Securities, slashed his iPhone shipment estimates by 20 percent .""Johnson & Johnson, another Dow member, fell more than 9 percent after Reuters reported the company knew about asbestos in its baby powder for decades ."It was another terrible week for stocks, any way you slice it, this market is sick, very sick (and I don't mean that in a good way, like "Sick! Stocks are up again!").Martin Roberge of Canaccord Genuity summarized it well in his weekly Portfolio Incubator: "The stock market seems unable to cure its volatility disease with US indexes incurring unprecedented intra-day swings this week . Uncertainties on US-China trade issues, Brexit, the Fed policy and global growth continue to operate as recycled news narratives. On trade, China cut US auto import tariffs from 40% to 15% and increased soybean purchases. Coincidently, it remains to be seen if President Trump intervened but Huawei’s CFO was granted bail by the Canadian court. On Brexit, the vote in Parliament was delayed to January as it became clear that Theresa May’s plan would not pass. As for the Fed, our note Wednesday pointed to the strong evidence of a “hike-and-pause” next week when the Fed renders its rate decision . The move in the US$ near 52-week highs this week supports a Fed pause. Elsewhere, commodities and bonds remain stable. The next move may well depend on the Fed tone next week. Overall, stocks are closing the week on their lows. Though oversold, it feels like markets need an opposite and positive force to counteract the negative sentiment brought by fears of a nasty global growth slump in 2019 ."My readers need to subscribe to Martin's research to read his reports and notes, and I encourage you to do so.Anyway, why are the markets so sick? That's what I'll attempt to answer this week in my Friday weekly market comment.First, there's no doubt trade tensions are starting to take their toll. On Friday, China reported industrial output and retail sales growth for the month of November that missed expectations .I've been warning my readers all year to pay very close attention to Chinese shares ( FXI ) as well as emerging markets shares ( EEM ) which are a barometer of global growth (click on images):

You'll notice these two charts look similar and that's because China is a major determinant of emerging markets.You'll also notice the downtrend in shares is intact, you had a recent bounce off the 200-week moving average but that's all it is, a bounce.There are two negative factors at work here. One is trade tensions but the other more important factor is higher US interest rates, which have sucked global liquidity out of the system, hitting all risk assets, especially emerging markets.Even emerging markets bonds ( EMB ) have been hammered this year (click on image):

You'll notice these two charts look similar and that's because China is a major determinant of emerging markets.You'll also notice the downtrend in shares is intact, you had a recent bounce off the 200-week moving average but that's all it is, a bounce.There are two negative factors at work here. One is trade tensions but the other more important factor is higher US interest rates, which have sucked global liquidity out of the system, hitting all risk assets, especially emerging markets.Even emerging markets bonds ( EMB ) have been hammered this year (click on image):  The market is telling you something, namely, global growth is slowing and there's a risk the US economy which has hitherto been flying high, is at risk of faltering and joining the rest of world.In fact, have a look at US financial stocks ( XLF ), they are down 20% from their highs and have entered a bear market (click on image):

The market is telling you something, namely, global growth is slowing and there's a risk the US economy which has hitherto been flying high, is at risk of faltering and joining the rest of world.In fact, have a look at US financial stocks ( XLF ), they are down 20% from their highs and have entered a bear market (click on image):  If the US economy is doing so well, why aren't bank stocks surging higher? They're telling you something, the economy is decelerating fast.And the stock market is signaling a slowdown ahead. Randall Forsyth of Barron's recently wrote an article, It's the Stock Market Stupid , where he notes the following:"Beneath the surface of the latest jobs report , however, signs of weakness are appearing. While the headline unemployment rate (dubbed U3 in the Bureau of Labor Statistics release) held at 3.7%, the lowest since 1969, the so-called underemployment rate (U6) ticked up to 7.6% from 7.4% in October, largely the result of people working part time when they wanted full-time gigs.""The number of people working part time for economic reasons rose by 211,000 last month, write Philippa Dunne and Doug Henwood of the Liscio Report. That’s a factor keeping a lid on wage growth, they add, citing the work of David Blanchflower, a Dartmouth College economist." "The real kicker, adds David Rosenberg, chief economist and strategist at Gluskin Sheff, was a 0.2% shrinkage in the average workweek to a 14-month low of 34.4 hours in November from 34.5 hours the previous month. That doesn’t sound like much, but it’s the equivalent of 370,000 people getting laid off, he writes .""The rise of part-timers is paralleled by the upturn in initial unemployment claims, adds Steven Blitz, chief U.S. economist at TS Lombard. Those data don’t jibe with the “universal mind-set of too many job openings and not enough qualified applicants,” he adds in a client note." "The government data are also at odds with the rise in layoff announcements at big companies, highlighted by the planned shuttering of plants by General Motors (ticker: GM), as Danielle DiMartino Booth writes in her Daily Quill report. She was among the first to point out the rise in jobless claims, whose four-week moving average is the highest since mid-April (though still a low 231,000)." "Meanwhile, layoff notices, as compiled by Challenger Gray & Christmas, total 495,000 so far this year, up 28% from the comparable period a year earlier, and the highest 11-month total since 2015, when there were 475,000 job cuts. Challenger’s data show that corporate cost-cutting spiked to a 12-month high, which is de facto deflationary, Booth contends .""All of which bolsters the likelihood that the Fed will go slow on rate hikes in the new year. “One and done” has become the new mantra in the markets . That was reflected in massive short-covering in the Eurodollar futures market on Thursday, as indicated by a huge decline in open interest (the number of open contracts, according to a note to clients from Chicago futures brokers R.J. O’Brien). In other words, futures traders were closing out bets for more rate hikes in 2019."It remains to be seen if "one and done" is the Fed's new mantra but if you ask me, the damage is already done.Related: This Is the End of Trump’s Economic Sugar High Importantly, forget the circus show in Washington, Brexit, Frexit, trade tensions, the cumulative effect of soon to be nine rate hikes are starting to bite the economy. You see it in housing, the auto sector and other interest rate sensitive sectors.From a macro perspective, even if the Fed pauses here, the damage is done. The US economy is slowing, the US dollar will stop surging higher in Q1 of next year, and the big wild card is what happens in the rest of the world.If the Fed pauses, you would expect emerging markets to take off, global growth to pick up, oil and commodity prices to start bolstering and heading higher. This will benefit commodity currencies like the Aussie, loonie and kiwi.But if global growth doesn't pick up, then 2019 will be the year of a synchronized global downturn, risk assets will languish, and US bonds will outperform all other major asset classes (click on image):

If the US economy is doing so well, why aren't bank stocks surging higher? They're telling you something, the economy is decelerating fast.And the stock market is signaling a slowdown ahead. Randall Forsyth of Barron's recently wrote an article, It's the Stock Market Stupid , where he notes the following:"Beneath the surface of the latest jobs report , however, signs of weakness are appearing. While the headline unemployment rate (dubbed U3 in the Bureau of Labor Statistics release) held at 3.7%, the lowest since 1969, the so-called underemployment rate (U6) ticked up to 7.6% from 7.4% in October, largely the result of people working part time when they wanted full-time gigs.""The number of people working part time for economic reasons rose by 211,000 last month, write Philippa Dunne and Doug Henwood of the Liscio Report. That’s a factor keeping a lid on wage growth, they add, citing the work of David Blanchflower, a Dartmouth College economist." "The real kicker, adds David Rosenberg, chief economist and strategist at Gluskin Sheff, was a 0.2% shrinkage in the average workweek to a 14-month low of 34.4 hours in November from 34.5 hours the previous month. That doesn’t sound like much, but it’s the equivalent of 370,000 people getting laid off, he writes .""The rise of part-timers is paralleled by the upturn in initial unemployment claims, adds Steven Blitz, chief U.S. economist at TS Lombard. Those data don’t jibe with the “universal mind-set of too many job openings and not enough qualified applicants,” he adds in a client note." "The government data are also at odds with the rise in layoff announcements at big companies, highlighted by the planned shuttering of plants by General Motors (ticker: GM), as Danielle DiMartino Booth writes in her Daily Quill report. She was among the first to point out the rise in jobless claims, whose four-week moving average is the highest since mid-April (though still a low 231,000)." "Meanwhile, layoff notices, as compiled by Challenger Gray & Christmas, total 495,000 so far this year, up 28% from the comparable period a year earlier, and the highest 11-month total since 2015, when there were 475,000 job cuts. Challenger’s data show that corporate cost-cutting spiked to a 12-month high, which is de facto deflationary, Booth contends .""All of which bolsters the likelihood that the Fed will go slow on rate hikes in the new year. “One and done” has become the new mantra in the markets . That was reflected in massive short-covering in the Eurodollar futures market on Thursday, as indicated by a huge decline in open interest (the number of open contracts, according to a note to clients from Chicago futures brokers R.J. O’Brien). In other words, futures traders were closing out bets for more rate hikes in 2019."It remains to be seen if "one and done" is the Fed's new mantra but if you ask me, the damage is already done.Related: This Is the End of Trump’s Economic Sugar High Importantly, forget the circus show in Washington, Brexit, Frexit, trade tensions, the cumulative effect of soon to be nine rate hikes are starting to bite the economy. You see it in housing, the auto sector and other interest rate sensitive sectors.From a macro perspective, even if the Fed pauses here, the damage is done. The US economy is slowing, the US dollar will stop surging higher in Q1 of next year, and the big wild card is what happens in the rest of the world.If the Fed pauses, you would expect emerging markets to take off, global growth to pick up, oil and commodity prices to start bolstering and heading higher. This will benefit commodity currencies like the Aussie, loonie and kiwi.But if global growth doesn't pick up, then 2019 will be the year of a synchronized global downturn, risk assets will languish, and US bonds will outperform all other major asset classes (click on image):  You'll notice that US long bonds ( ( TLT[NSD] - $119.17 Trade ) ) are doing well recently which is exactly what you'd expect when the market is selling off.It's too soon to tell whether or not this trend continues into the new year. There are a lot of moving parts to the market and economy, a lot of risks in the background.And they're not all financial risks. What if Trump is impeached next year? You will see the US dollar and stock market sell off hard and bonds take off.Right now, all this uncertainty over the Fed, China, Brexit, Trump, is causing many investors to back off, stop buying the dips and start selling the rips to raise cash.In fact, Zero Hedge had a comment that one theory behind who's behind the "sell the rip" in the market is global pension funds are selling stocks to invest in bonds and raise cash.But I can tell you from the senior pension execs in Canada that I've spoken with, they feel much more comfortable buying the dips now that valuations have come down than at the beginning of the year.And Suzanne Bishopric just sent me an article stating pension funds bought emerging markets as they tumbled (remember, a lot of them need to make their actuarial target rate of return).Another theory is that CTAs and hedge funds reeling from steep losses are the ones behind all the selling. They're cutting risk all around, cutting headcount too, and selling their winners and losers to just end what's been another horrible year.I was telling a friend of mine earlier that I don't like these markets at all. Drip, drip, drip lower, then a rip here and there and right back down, drip, drip, drip lower, making new lows.If you've been around long enough and traded in all sorts of markets, you know these markets and they don't give you that warm fuzzy feeling inside. Quite the opposite, it's what I call the Chinese water torture markets.For all effective purposes, the year is over. We shall see what the Fed does next week and whether investors will react positively or sell the rip again but either way, I don't expect it will make a difference in terms of annual stock returns.All I can tell you the contrarian trade next year will be to buy/ overweight cyclical shares like emerging markets ( ( EEM[ARCA] - $39.46 ) ), financials ( ( XLF[ARCA] - $24.00 ) ), industrials ( ( XLI[ARCA] - $65.95 ) ), energy ( ( XLE[ARCA] - $60.96 ) ) and metal and mining shares ( ( XME[ARCA] - $27.12 ) ) and sell/ underweight stable sectors like healthcare ( ( XLV[ARCA] - $87.19 ) ), utilities ( ( XLU[ARCA] - $54.99 ) ), consumer staples ( ( XLP[ARCA] - $53.24 ) ), REITs ( ( IYR[ARCA] - $76.91 ) ) and telecoms ( ( IYZ[BATS] - $26.81 Trade ) ).But being a contrarian often lands you in deep trouble, especially in these flash crash markets dominated by high-frequency algos.I leave you on another note. Earlier this week, I wrote about why CPPIB is shorting small and mid-cap European shares . Jeffrey Snider of Alhambra Investments just wrote a comment, The End of QE Will Always Devolve Into This Sort of Incoherent Mess . Take the time to read it here , he raises many excellent points.Problems are piling up all over the world, and I haven't even talked about credit markets where investors are now very concerned about leveraged loans .Being a contrarian in this environment is a leap of faith, it might very well pan out but my advice is stay safe, focus on stable sectors like healthcare (XLV), utilities (XLU), consumer staples (XLP), REITs (IYR) and telecoms (IYZ) and always hedge your equity risk with US long bonds (TLT). DISCLOSURE : The views and opinions expressed in this article are those of the authors, and do not represent the views of equities.com . Readers should not consider statements made by the author as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please go to: http://www.equities.com/disclaimer

You'll notice that US long bonds ( ( TLT[NSD] - $119.17 Trade ) ) are doing well recently which is exactly what you'd expect when the market is selling off.It's too soon to tell whether or not this trend continues into the new year. There are a lot of moving parts to the market and economy, a lot of risks in the background.And they're not all financial risks. What if Trump is impeached next year? You will see the US dollar and stock market sell off hard and bonds take off.Right now, all this uncertainty over the Fed, China, Brexit, Trump, is causing many investors to back off, stop buying the dips and start selling the rips to raise cash.In fact, Zero Hedge had a comment that one theory behind who's behind the "sell the rip" in the market is global pension funds are selling stocks to invest in bonds and raise cash.But I can tell you from the senior pension execs in Canada that I've spoken with, they feel much more comfortable buying the dips now that valuations have come down than at the beginning of the year.And Suzanne Bishopric just sent me an article stating pension funds bought emerging markets as they tumbled (remember, a lot of them need to make their actuarial target rate of return).Another theory is that CTAs and hedge funds reeling from steep losses are the ones behind all the selling. They're cutting risk all around, cutting headcount too, and selling their winners and losers to just end what's been another horrible year.I was telling a friend of mine earlier that I don't like these markets at all. Drip, drip, drip lower, then a rip here and there and right back down, drip, drip, drip lower, making new lows.If you've been around long enough and traded in all sorts of markets, you know these markets and they don't give you that warm fuzzy feeling inside. Quite the opposite, it's what I call the Chinese water torture markets.For all effective purposes, the year is over. We shall see what the Fed does next week and whether investors will react positively or sell the rip again but either way, I don't expect it will make a difference in terms of annual stock returns.All I can tell you the contrarian trade next year will be to buy/ overweight cyclical shares like emerging markets ( ( EEM[ARCA] - $39.46 ) ), financials ( ( XLF[ARCA] - $24.00 ) ), industrials ( ( XLI[ARCA] - $65.95 ) ), energy ( ( XLE[ARCA] - $60.96 ) ) and metal and mining shares ( ( XME[ARCA] - $27.12 ) ) and sell/ underweight stable sectors like healthcare ( ( XLV[ARCA] - $87.19 ) ), utilities ( ( XLU[ARCA] - $54.99 ) ), consumer staples ( ( XLP[ARCA] - $53.24 ) ), REITs ( ( IYR[ARCA] - $76.91 ) ) and telecoms ( ( IYZ[BATS] - $26.81 Trade ) ).But being a contrarian often lands you in deep trouble, especially in these flash crash markets dominated by high-frequency algos.I leave you on another note. Earlier this week, I wrote about why CPPIB is shorting small and mid-cap European shares . Jeffrey Snider of Alhambra Investments just wrote a comment, The End of QE Will Always Devolve Into This Sort of Incoherent Mess . Take the time to read it here , he raises many excellent points.Problems are piling up all over the world, and I haven't even talked about credit markets where investors are now very concerned about leveraged loans .Being a contrarian in this environment is a leap of faith, it might very well pan out but my advice is stay safe, focus on stable sectors like healthcare (XLV), utilities (XLU), consumer staples (XLP), REITs (IYR) and telecoms (IYZ) and always hedge your equity risk with US long bonds (TLT). DISCLOSURE : The views and opinions expressed in this article are those of the authors, and do not represent the views of equities.com . Readers should not consider statements made by the author as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please go to: http://www.equities.com/disclaimer