Written by: Meera Pandit

As we approach Election Day, investors look to best position their portfolios for the next administration. However, looking at sector performance after each presidential election since 2000, there is little discernible pattern based on the election outcome.

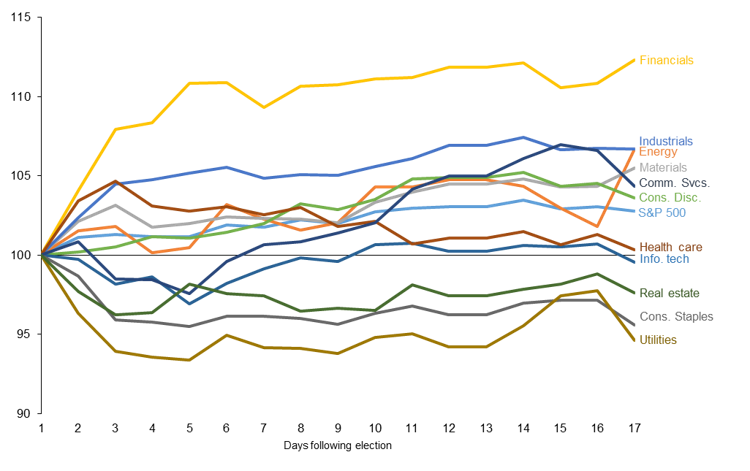

For example, in the weeks following the 2016 election, cyclical sectors like financials, industrials, energy and materials outperformed the broader market. Yet, in 2000, more defensive sectors like consumer staples, health care, and utilities held up better. Both elections resulted in Republican presidents, but markets reacted differently. This is likely because markets do not like uncertainty, and regardless of the outcome, elections always reduce it—except in 2000. This created a more defensive environment compared to 2016, when results were known promptly. Additionally, elections don’t stop prevailing economic conditions from driving markets. Declines across sectors after the 2008 election were likely due to the Financial Crisis, and technology’s sharp underperformance after the 2000 election was attributable to the bursting of the Tech Bubble.

Instead, in the long-run, policy, not politics, should have a more lasting impact on sector returns. Looking at current policy proposals, both parties have sought anti-trust measures for some of the leading technology companies, so any outcome is likely to put pressure on the technology sector. Under a Trump administration, deregulation would likely continue, which has benefited financials and some of the more traditional energy companies. Yet, a multi-trillion dollar clean energy and infrastructure package under Biden could benefit clean or more diversified energy companies, renewables and create differentiation for ESG investors. Both administrations would likely pursue large infrastructure packages, which could lift materials and industrials. Although both candidates have promised to lower drug costs, a weakening of the Affordable Care Act under a Trump re-election could reduce the number of Americans with health care coverage, diminishing health care spending and damaging subsectors within health care.

Ultimately, uncertainty is likely to foment market volatility and impact sector performance in the days and weeks leading up to and following the election, but lasting impacts on specific sectors are likely to come from policy changes over the course of the next four years.

S&P sector performance after the 2016 election

Election Day to Nov. 30, 2016, Election Day = 100

Related: Is the Disconnect Between the Economy and the Stock Market Justified?