As we highlighted in our 2Q earnings bulletin, supply chain disruptions coupled with higher input costs have the potential to weigh on profit margins in the medium term. While a variety of different input costs have been rising, a shortage of semiconductors has led to tight supply and demand dynamics around the world. It is unclear how long it will take for the semiconductor shortage to resolve itself, but by our lights, it looks set to remain an issue well into next year.

In normal times, manufacturing a simple semiconductor wafer takes an average of twelve weeks. However, this can take up to twenty weeks for more advanced chips. Additionally, once the chips are manufactured, they must then go through a process known as assembly, test, and packaging (ATP) which can take another six weeks. This means that even with the right processes in place, it can take anywhere from 4-6 months from when an order is placed until the chips are delivered. Furthermore, ramping up production is not as simple as turning a dial – perfecting the fabrication process in order to increase production can take up to twenty-four weeks1.

Looking at recent earnings reports, many of the global semiconductor producers have highlighted plans for modest capacity expansion in 2H21. The recent acceleration in COVID case growth across Asia should not have a material impact on these plans, as companies have been proactive in mitigating outbreaks at factories and in some cases reallocated production capacity to other locations.

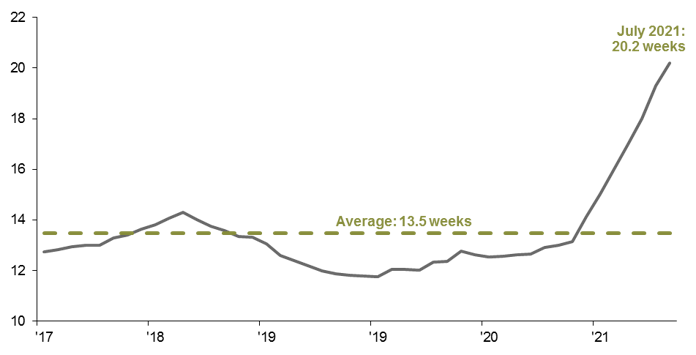

Despite this expected increase in production, semiconductor companies continue to suggest that these tight supply/demand dynamics will extend well into 2022. Demand for chips remains robust across a variety of sectors (auto, industrial, PC, smartphone, etc.) which should support prices as demand stays strong and capacity only increases gradually. Put differently, the environment of elevated orders, lean inventories, extended lead times, and robust pricing power looks set to persist.

Higher input costs, whether they be the price of semiconductors or higher wages, have the potential to support higher rates of inflation and potentially weigh on margins next year. However, higher goods price inflation should moderate over time, and does not represent a structural headwind to profit margins more broadly. On the other hand, rising wages may prove to be less transitory; how this story evolves will be a key determinant of profit growth during the years to come.

Semiconductor lead times reach new all-time high

Time between ordering chip and delivery, weeks

Sources: Susquehanna Financial Group, Bloomberg, J.P. Morgan Asset Management. All data are as of August 9, 2021.

Related: What Should Investors Do After China’s Increase in Regulations?

1 Yinug, Falan. Chipmakers are ramping up production to address semiconductor shortage. Here’s why that takes time. Semiconductor Industry Association. https://www.semiconductors.org/chipmakers-are-ramping-up-production-to-address-semiconductor-shortage-heres-why-that-takes-time/. February 26, 2021.