Written by: Jordan Jackson

Former Federal Reserve (Fed) Chair Janet Yellen described the first episode of balance sheet drawdown from 2017-2019 to be “like watching paint dry”. This was largely the case until a spike in the overnight reverse repo rate1 in September 2019 by more than 3% above the Federal Reserve’s target range at the time, forced the Fed to intervene and cut administered rates2 and end quantitative tightening (QT).

Since May 2022, the Fed has reduced its balance sheet by almost $2 trillion3, and it’s similarly been “like watching paint dry.” However, the Fed and market participants are sensitive to avoid another liquidity scare. As such, investors are curious; what might lead the Fed to end its current QT program and how soon?

To answer this, it’s useful to assess the liability side of the Fed’s balance sheet to understand where the fresh digitally printed money ends up after buying a U.S. Treasury security. The most notable growth in liabilities under COVID-era quantitative easing (QE) were bank reserves (+$2trn) and the reverse repo facility (RRP) (+$2.3trn). Under the Fed’s current QT program, declines in the RRP have accounted for most of the “money drain” from the system4.

The RRP is perceived as a measure of “excess’ liquidity meaning there are more dollars in short term vehicles—primarily money market funds—than there are supply of Treasury bills in the open market, and thus Treasury collateral is provided at the Fed via the RRP. However, as the Fed’s balance sheet continues to shrink, the RRP is well on its way to zero. Given this, a continuation of QT could last another three months without hiccup; thereafter, most of the decline in liquidity is likely to be seen in falling bank reserves.

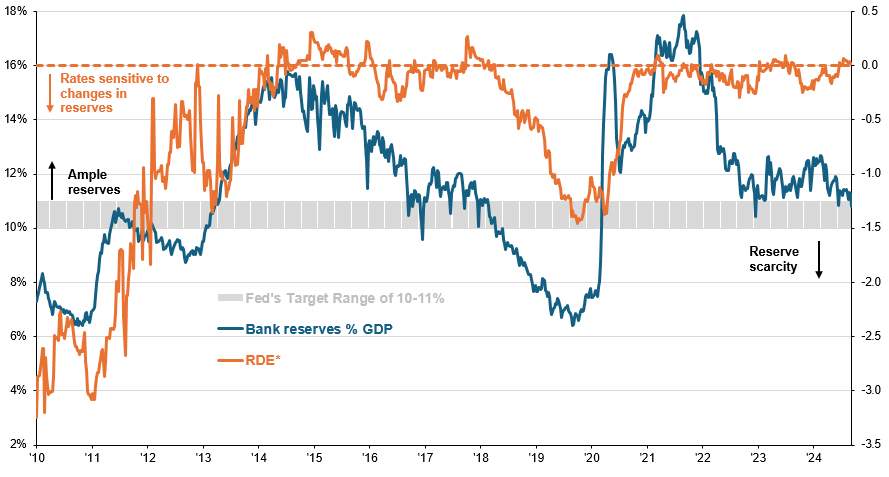

At the beginning of 2019, Fed Governor Waller noted that bank reserves of roughly 10-11% of GDP might be sufficient. Bank reserves as a % of GDP are currently at these levels, suggesting the Fed is poised to end QT sometime in 1H2025 once RRP drainage is complete. Should the level of reserves fall below this threshold, however, its likely to lead to volatility in short term rates. Simply put, when there is enough short-term money/liquidity in the system, short term rates tend to be well behaved; when there isn’t, overnight rates are at risk of spiking.

For investors, the Fed is committed to maintaining an ample reserves regime because it promotes market stability and allows the committee the flexibility to react. Moreover, the balance sheet has increasingly been viewed by Fed members as somewhat independent to the direction of monetary policy. Currently the Fed is cutting rates while continuing QT, so hypothetically they could hike rates with QE if they needed to address market functioning and inflation at the same time. Importantly, regardless of the direction policy needs to go next year, they can only be successful if the market is functioning as intended. Hence, they should learn from their mistakes in 2019 and consider ending QT a bit earlier especially given fiscal policy uncertainty next year.

When bank reserves fall below 10-11% of GDP, liquidity is scarce and cause volatility in short term rates

Bank reserves as % of GDP (LHS), Reserve Demand Elasticity (RDE*, basis points/%, RHS), weekly

The most notable growth in liabilities under COVID-era quantitative easing (QE) were bank reserves (+$2trn) and the reverse repo facility (RRP) (+$2.3trn).

Former Federal Reserve (Fed) Chair Janet Yellen described the first episode of balance sheet drawdown from 2017-2019 to be “like watching paint dry”. This was largely the case until a spike in the overnight reverse repo rate1 in September 2019 by more than 3% above the Federal Reserve’s target range at the time, forced the Fed to intervene and cut administered rates2 and end quantitative tightening (QT).

Since May 2022, the Fed has reduced its balance sheet by almost $2 trillion3, and it’s similarly been “like watching paint dry.” However, the Fed and market participants are sensitive to avoid another liquidity scare. As such, investors are curious; what might lead the Fed to end its current QT program and how soon?

To answer this, it’s useful to assess the liability side of the Fed’s balance sheet to understand where the fresh digitally printed money ends up after buying a U.S. Treasury security. The most notable growth in liabilities under COVID-era quantitative easing (QE) were bank reserves (+$2trn) and the reverse repo facility (RRP) (+$2.3trn). Under the Fed’s current QT program, declines in the RRP have accounted for most of the “money drain” from the system4.

The RRP is perceived as a measure of “excess’ liquidity meaning there are more dollars in short term vehicles—primarily money market funds—than there are supply of Treasury bills in the open market, and thus Treasury collateral is provided at the Fed via the RRP. However, as the Fed’s balance sheet continues to shrink, the RRP is well on its way to zero. Given this, a continuation of QT could last another three months without hiccup; thereafter, most of the decline in liquidity is likely to be seen in falling bank reserves.

At the beginning of 2019, Fed Governor Waller noted that bank reserves of roughly 10-11% of GDP might be sufficient. Bank reserves as a % of GDP are currently at these levels, suggesting the Fed is poised to end QT sometime in 1H2025 once RRP drainage is complete. Should the level of reserves fall below this threshold, however, its likely to lead to volatility in short term rates. Simply put, when there is enough short-term money/liquidity in the system, short term rates tend to be well behaved; when there isn’t, overnight rates are at risk of spiking.

For investors, the Fed is committed to maintaining an ample reserves regime because it promotes market stability and allows the committee the flexibility to react. Moreover, the balance sheet has increasingly been viewed by Fed members as somewhat independent to the direction of monetary policy. Currently the Fed is cutting rates while continuing QT, so hypothetically they could hike rates with QE if they needed to address market functioning and inflation at the same time. Importantly, regardless of the direction policy needs to go next year, they can only be successful if the market is functioning as intended. Hence, they should learn from their mistakes in 2019 and consider ending QT a bit earlier especially given fiscal policy uncertainty next year.

When bank reserves fall below 10-11% of GDP, liquidity is scarce and cause volatility in short term rates

Bank reserves as % of GDP (LHS), Reserve Demand Elasticity (RDE*, basis points/%, RHS), weekly

Source: BEA, Federal Reserve, Haver Analytics, J.P. Morgan Asset Management. *Reserve Demand Elasticity (RDE) shows by how many basis points the spread between the federal funds rate and the interest on reserve balances (IORB) would move for an increase in aggregate reserves equal to 1 percent of banks’ total assets.Reserves are ample when the supply of reserves is sufficiently large that the federal funds rate is not materially sensitive to everyday changes in aggregate reserves; that is, the elasticity of the federal funds rate to reserve shocks is small, so that active management of the supply of reserves by the Federal Reserve is not necessary. When the RDE is statistically indistinguishable from zero, the estimate suggests that reserves are abundant. Data are as of November 21, 2024.

Related: Who Stands to Profit from Corporate Tax Cuts?

1 The Fed's reverse repo rate is the interest rate paid to market participants who lend cash to the Fed in exchange for Treasury collateral. In a reverse repo, the Fed sells a security to a counterparty and agrees to buy it back at a specified price and time in the future.

2 On September 19, the day after the FOMC meeting, the Fed implemented a 5-basis-point technical adjustment to the two administered rates: the interest rate on excess reserves (IOER) was lowered to 20 basis points below the top of the target range and the ON RRP rate was lowered to 5 basis points below the bottom of the target range. By moving IOER lower in the target range, the Fed reduced the risk of EFFR moving above the top of the range.

3 As of November 14, 2024.

4 Bank reserves have been stable at roughly $3.2 trillion while the RRP is currently at ~$200bn as of November 14, 2024.